There have been some tough months for growth stocks in Canada and the United States. While indices are not down significantly, some high-valuation growth stocks are down more than 50%. A perfect example is the ARK Innovation ETF. It is both acclaimed and disdained for its specific focus on high-growth, high-opportunity stocks.

Growth stocks are getting cheaper

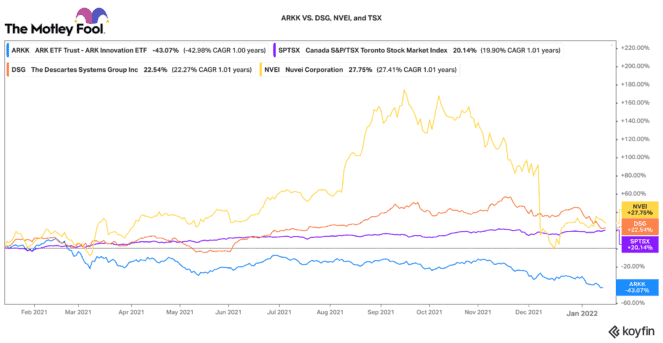

Many of these stocks are not profitable and trade with price-to-sales multiples that are many times higher than the benchmark index. This ETF has been punished over the past year. It is down 43% in that time. While I don’t recommend going and buying any of Cathy Woods funds, I think there are opportunities starting to shine in some individual growth stocks. Many growth stocks are now trading at their lowest valuation multiple since the pandemic began.

Certainly, many software names benefitted from the pandemic and forward results may slow. Yet many of these businesses now have stronger customer penetration, better balance sheets, and broader total addressable markets (TAMs) than they had before. Consequently, the recent fire sale in growth stocks is a great opportunity for investors who want to acquire high-quality stocks at a bargain price.

Nuvei: A top high-growth stock

One TSX technology stock that looks interesting is Nuvei (TSX:NVEI)(NASDAQ:NVEI). Payments stocks have taken a serious hit in the past few months, and Nuvei is no exception. It doesn’t help that the stock was targeted by a short report late last year. The stock is down 52% since October 2021.

At 10 times sales, I would still not exactly call this stock cheap. However, when looking at its enterprise value-to-EBITDA ratio it only trades for 25 times. Nuvei grew revenues by 53% in 2020 and is expected to grow by over 90% for 2021. EBITDA is expected to grow by the same clip as revenues. Going forward, revenue and EBITDA growth will likely taper to the +30% range. Yet for a company that is still rapidly growing both revenues and earnings, it is not an unthinkable valuation to own the stock.

Nuvei has a great payments platform that helps deal with the complexity of currency, geography, and even alternative payments (i.e., crypto). It just signed an interesting deal with Wix.com that will enable it to facilitate payments for the website builder’s platform. These kinds of deals demonstrate Nuvei’s relevance to top e-commerce and merchant platforms. This stock has been volatile, so average into the holding and hold it in a “higher-risk” allocation in your portfolio.

Descartes Systems: A portfolio anchor

One interesting growth stock that not many people talk about is Descartes Systems (TSX:DSG)(NASDAQ:DSGX). It provides integral cloud-based software solutions for the logistics, shipping, and freight industry. Supply chains have been heavily disrupted by the pandemic. Fortunately, this has been a major tailwind for Descartes. Despite that, the stock is down 22% since November.

Descartes is a great portfolio anchor for a growth stock. Descartes’s software solutions capture a high rate of reoccurring revenues. It also earns very attractive +40% EBITDA margins on these revenues. Consequently, it generates a lot of free cash flow. Today, the company has $171 million of net cash.

With tech stock valuations recently declining, Descartes is in a great position to deploy that cash into attractive market-expanding acquisitions. Descartes is not a cheap stock by any means (it trades for 12 times price-to-sales and 34 times earnings). However, given its high-quality business platform, it is a great one to buy, tuck away, and hold for many years to come.