It has been a pretty rough time for TSX technology stock investors over the past three months. The contemplation about rising interest rates, rising inflation, and challenging year-over-year comparisons is putting pressure on some of Canada’s fastest-growing stocks.

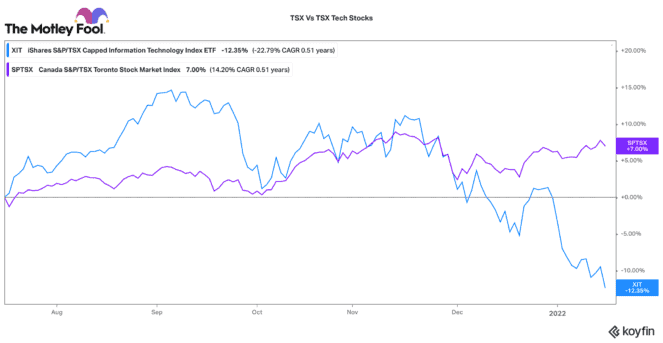

The TSX Index is beating tech stocks over the past six months

Over the past six months, the S&P/TSX Capped Information Technology Index is down over 12%. Many Canadian technology leaders are down by more than 20%. In comparison, the S&P/TSX Composite Index is down only 7% in that time frame.

Certainly, the decline is worrisome. Valuations for technology stocks got stretched, as ample liquidity and endless demand skyrocketed these stocks. Many stocks simply overreached their valuation threshold and got too expensive. Fortunately, many TSX tech stocks trade at a decent discount to their American peers, so the decline has not been as precipitous.

A great opportunity for investors that can think long term

These declines could also be a great opportunity. Many of these TSX tech stocks have long-term tailwinds supporting growth for years, perhaps even decades. Choose high-quality companies that have strong balance sheets, smart managers, and products/services that streamline efficiencies throughout society.

You may not get the valuation 100% correct. However, having a long investment horizon (five years or more) helps offset any short-term volatility. Fundamentals always catch up to stocks, so buying when there is a valuation mismatch is a great way to boost long-term returns. Here are two reasonably cheap tech stocks I’d be looking to buy on the recent market dip:

- Nuvei (TSX:NVEI)(NASDAQ:NVEI)

- TELUS International (TSX:TIXT)(NYSE:TIXT)

A top TSX payments stock

Nuvei stock has fallen over 50% since October 2021. Consequently, a lot of froth has come out of this name. Its valuation is starting to look reasonable. At $78 per share, it trades at 10.5 times revenues (still pricey), but an enterprise value-to-EBITDA (EV/EBITDA) ratio of 25 times (not unreasonable).

Right now, Nuvei is expected to grow around 90% in 2021. Over the mid-term, it targets around 30% average annual growth going forward. Nuvei is expanding both by geography and in payments solution verticals. It earns attractive +40% EBITDA margins and generates a decent amount of free cash flow.

Payments streamlining through technology is a trend that won’t stop just because inflation and interest rates are on the rise. Consequently, Nuvei is well positioned to help merchants across the globe adapt and manage various payment methods and currencies (including crypto). For a TSX stock that is quickly growing and also profitable, Nuvei presents an attractive value today.

A leading digital services provider

Telus International is a new stock to the TSX market. It completed its initial public offering (IPO) in early 2021. It is down 29% since November 2021. Year to date, it is down 14%. In fact, at $35.70, the stock now trades below its IPO first day trading range.

TI helps some of the world’s largest corporations streamline their customer interactions by using artificial intelligence, data annotation, and content management. The company expects to grow revenues and EBITDA by over 30% in 2021. Despite that, it only trades with an EV/EBITDA ratio of 14 (that is far cheaper than when it IPO’d) and a price-to-earnings ratio of 26.

While this TSX stock may have some short-term pressures from rising inflationary costs, the digitization of society supports a long-term, double-digit-growth trajectory. Like Nuvei, it has a nice combination of growth and profitability. At its current price, TI should present attractive value for long-thinking shareholders.