Canadian technology stocks like Shopify (TSX:SHOP) and Constellation Software (TSX:CSU) have both enjoyed a remarkable bull run over the last five years, with gains of over 1,982% and 264% respectively. Both companies have great business models, ample cash runways, and ever increasing market dominance.

The downside is that all of this growth has caused both stocks to become very expensive, and not just from a fundamentals-based valuation perspective. To buy just one share of each company at their current stock price, you would need a total of $3,563.12.

Unless you’re buying fractional shares (or have a decently large account), such a sum could deter new investors. Fortunately, there is a solution. By using an exchange-traded fund (ETF) such as iShares S&P/TSX Capped Information Technology Index ETF (TSX:XIT), you can gain exposure for under $50.

The right ETF for the job

As an ETF, XIT holds an underlying “basket” of stocks. When you buy a share of XIT, you’re buying an equivalent percentage stake in each underlying stock, based on the proportion held in the ETF. Shares of XIT trade on the stock exchange and can be bought and sold like any other stock.

Currently, XIT holds a total of 24 stocks from Canada’s info tech sector. The two largest holdings are SHOP at 27.21%, and CSU at 23.90%. Other companies like Open Text, CGI, Nuvei, Lightspeed Commerce, Descartes Systems Group, an BlackBerry are also held in smaller portions.

XIT has a management expense ratio (MER) of 0.61%, which is more expensive than an index fund but typical for a thematic sector fund. The ETF currently trades at a price of around $46 per share, making it an affordable way to gain exposure to some otherwise expensive Canadian technology stocks.

How has it performed?

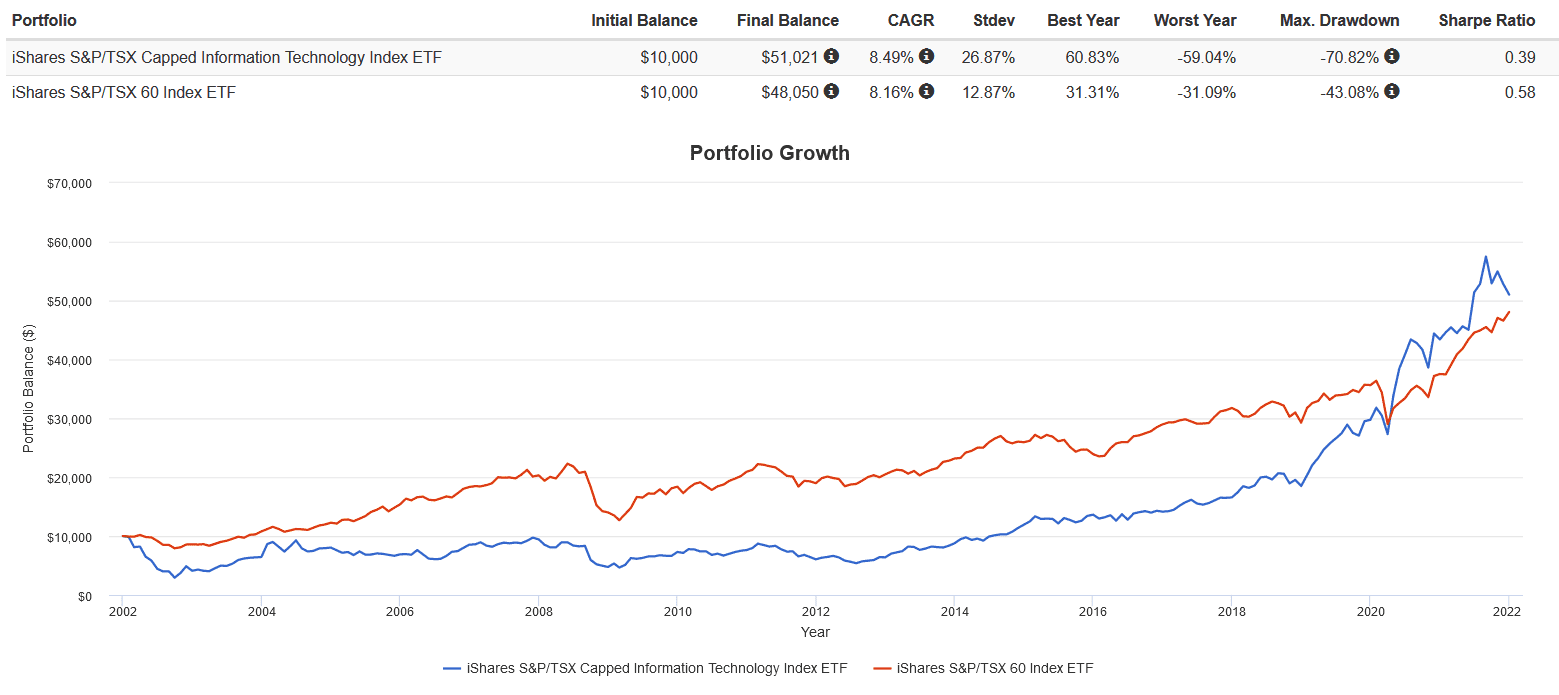

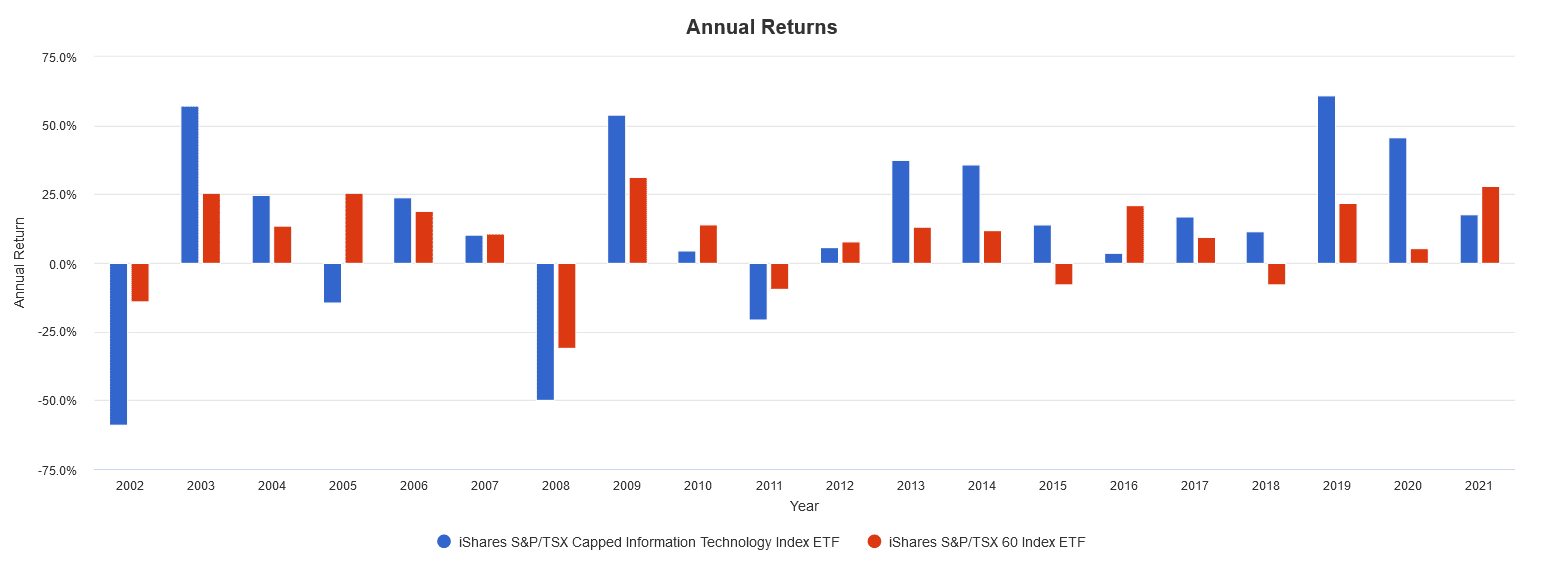

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

The results are disappointing. Since inception, XIT has barely outperformed the S&P/TSX 60 Index, with nearly all of its outperformance coming in 2013-2014 and 2019-2020. Moreover, XIT had higher volatility and worse drawdowns than the broad market index. Few investors can stomach these bouts of underperformance and turmoil.

The Foolish takeaway

In my opinion, XIT is best used as a SHOP and CSU stock surrogate if you lack the capital to buy shares without either of them dominating your portfolio. You also get 22 other tech companies to diversify your holdings a bit. Regardless, by buying XIT you’re making a concentrated bet on the tech sector’s continued outperformance.

Investors looking to buy now should be wary of performance chasing and recency bias. XIT is highly concentrated, and is likely to underperform the broad market index on a risk-adjusted basis in the long term. 2022 might also be a year where high-valuation growth stocks face strong headwinds from inflation and rising interest rates.