CGI (TSX:GIB.A)(NYSE:GIB) is $23 billion IT and business consulting services firm that helps businesses and governments with their digital transformations. It’s one of the largest and most successful tech companies in Canada. Similarly, CGI stock is one of the best value stocks in Canada. It is with this backdrop that I would like to take you through CGI’s most recent results in the first quarter fiscal 2022. As the results show, the momentum is building.

Without further ado, here are three very bullish numbers from CGI’s results that could send this value stock soaring permanently higher.

CGI stock: A value stock like no other

CGI has grown to what it is today from nothing in 1976. It’s well known for its cutting-edge products and services. Also, it’s trusted for its expertise. This has resulted in the company securing countless clients from all areas and industries of the world. In short, CGI is helping to digitize the world. Governments, banks, and corporations are jumping on the bandwagon. This is a trend that’s here to stay, and CGI has a prime position.

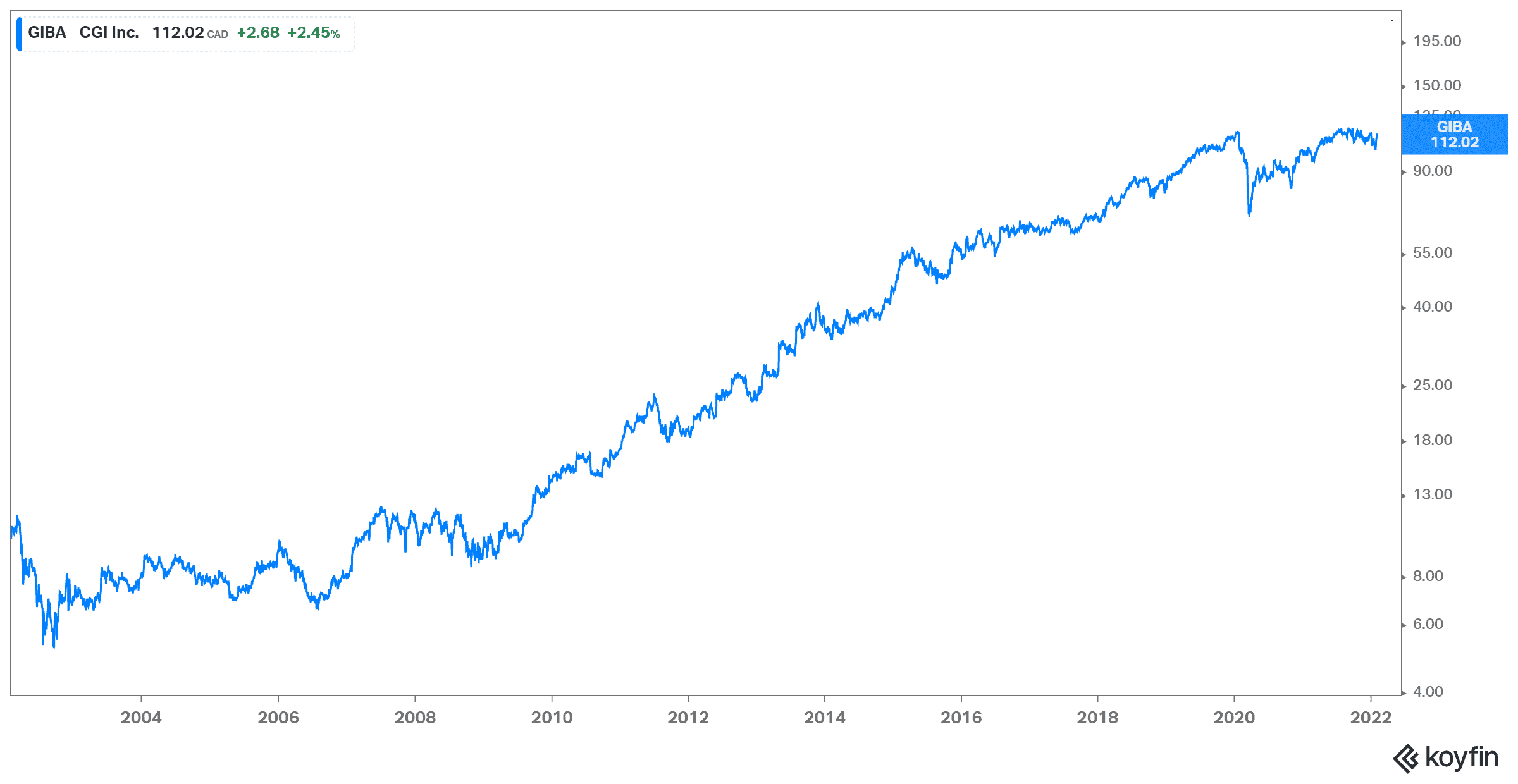

CGI doesn’t pay dividends, but its healthy returns on capital indicate that for now, this is the right choice. The IT services market remains highly fragmented. CGI continues to consolidate it, driving earnings and shareholder returns higher. The following stock price graph for CGI stock (GIB) speaks volumes.

Revenue is up almost 20% in some geographic regions

Total revenue increased 6.8% in its latest quarter. This growth rate has accelerated significantly versus a few years ago. Back then, investors were understandably concerned with CGI’s stagnant revenue. Today, the script has turned and all the talk is about the company’s impressive results. I mean, revenue growth in certain geographies look more like growth rates of “growth” stocks. And CGI has certainly not been known as a growth stock. It’s stable, but consistent growth and lower valuation has put it firmly in the “value” stock category.

This gives us all the more reason to get excited about CGI stock. It has “value”-type valuations, and now, it’s starting to have some “growth,” like revenue-growth rates. For example, in Asia Pacific, revenue rose almost 20%, and in Western Europe it rose 15%.

Backlog of $23.6 billion signals good times ahead for CGI stock

CGI’s backlog of almost $24 billion is a nice increase versus last year. In fact, it’s up almost 4% amid rapidly rising bookings. Bookings, which are new orders in the period, soared in many geographic areas, as the race to digitize has intensified. For example, in Scandinavia, bookings rose 117%, and in the U.K. and Australia they soared 122%.

Client demand for end-to-end digitization remains the key driver for growth for CGI. Management is very bullish on its future, forecasting double digit EPS growth for fiscal 2022.

GIB stock: Return on invested capital hits 15.3% as margins reach new highs

If you’ve been following CGI’s stock (GIB) as long as I have, you might remember a time when the company was struggling with anemic margins of well under 9%. This was concerning for such a value-adding company in the tech sector. But this provides us with a lesson in patience and conviction. Those of you that stuck with CGI have seen a big payoff. Today, this payoff is obviously far from over.

EBIT margins of 17% in the quarter are a reflection of just how far CGI has come. And, by all accounts, these increasing returns are nowhere near over. CGI’s market remains highly fragmented, and the company is ready to acquire when the opportunity arises. The company has earmarked $1 billion for acquisitions this year. Needless to say, CGI’s growth is also far from over.

Motley Fool: The bottom line

CGI stock remains one of Canada’s best tech stocks today for growth, value, and stability. The company is still creating tonnes of value capitalizing on the many opportunities available in its fast-growing industry. Therefore, there are no dividends to speak of. But, hopefully, you’re investing for the long term (as we at Motley Fool are). In this case, I think you’ll be happy, as this tech stock is well on its way to eventually join the ranks of top dividend stocks.