As the market selloff continues, there’s nervous tension in the air. We know that major selloffs are historically great opportunities. But we’re nervous. When will the carnage stop? When should we think about stepping in and buying? What should we buy? Well, the simple answer is that we need to look for the companies with profitable businesses and healthy cash flows. At this time, energy growth stocks such as Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ) fit the bill.

In fact, energy stocks are the real growth stocks these days. Strong oil and gas prices have made it so. Without further ado, here are the three growth stocks to buy as the market sells off.

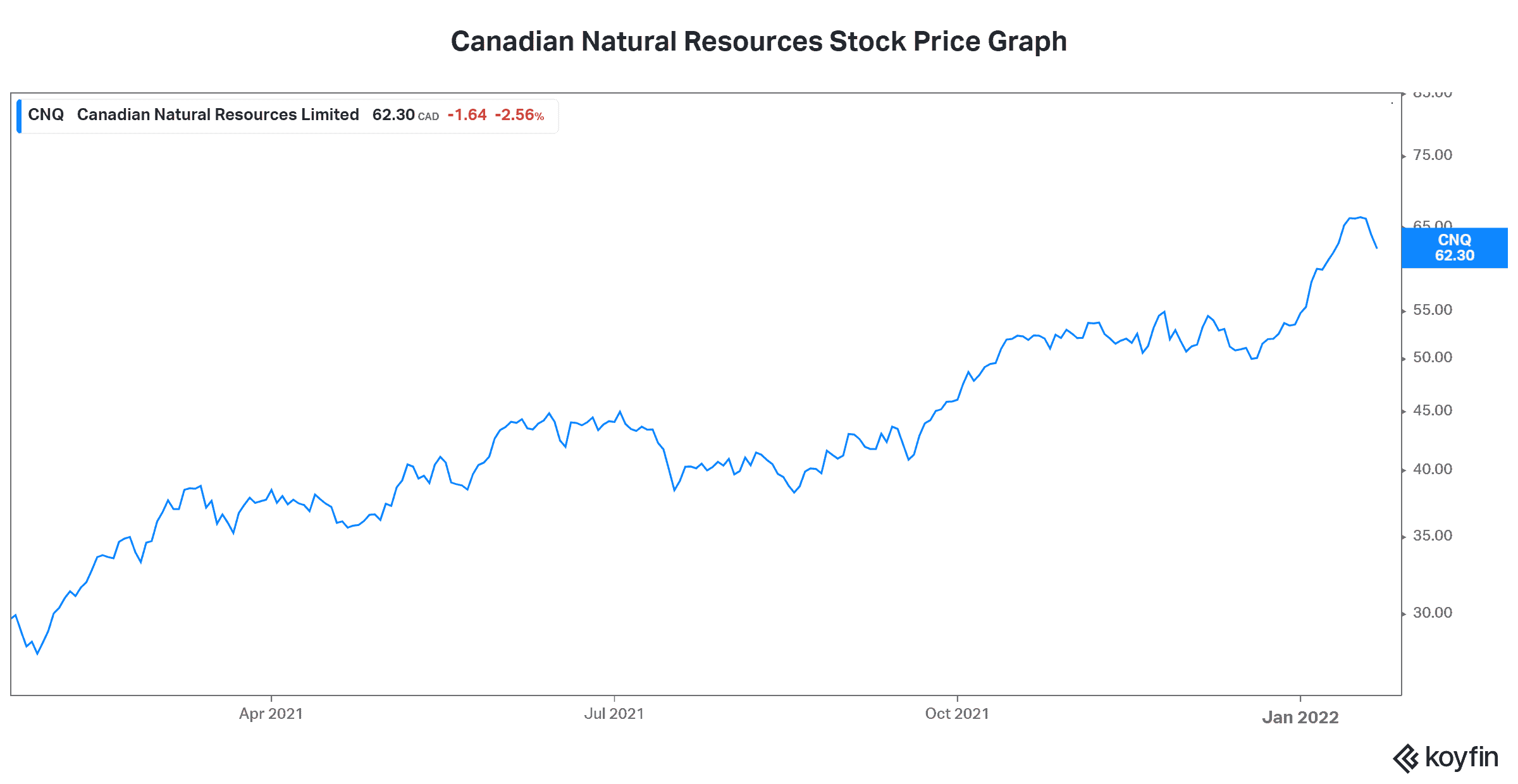

Canadian Natural Resources stock: This best-in-class stock is a strong buy in this market selloff

Oil prices are up 58% from where they were a year ago today. Natural gas prices are up 55%. Not surprisingly, Canadian Natural Resources stock has doubled as a result. Canadian Natural Resources’s cash flows were up almost 200% in the first nine months of 2021.

Last, but not least, CNQ stock’s dividend increased 25% in 2021. This increase represents the 22nd year of consecutive increases. It’s also the largest one yet. Clearly, management believes that this dividend level can be maintained. I tend to agree. This is due to the very nature of Canadian Natural’s assets. These long-life, low-decline assets have highly stable and predictable cash flows associated with them.

You can see that Canadian Natural stock has all the hallmarks of a growth stock. Today, CNQ stock is yielding a generous 3.8%. The stock is selling off along with the market. This might be a stock to scoop up as it drifts lower.

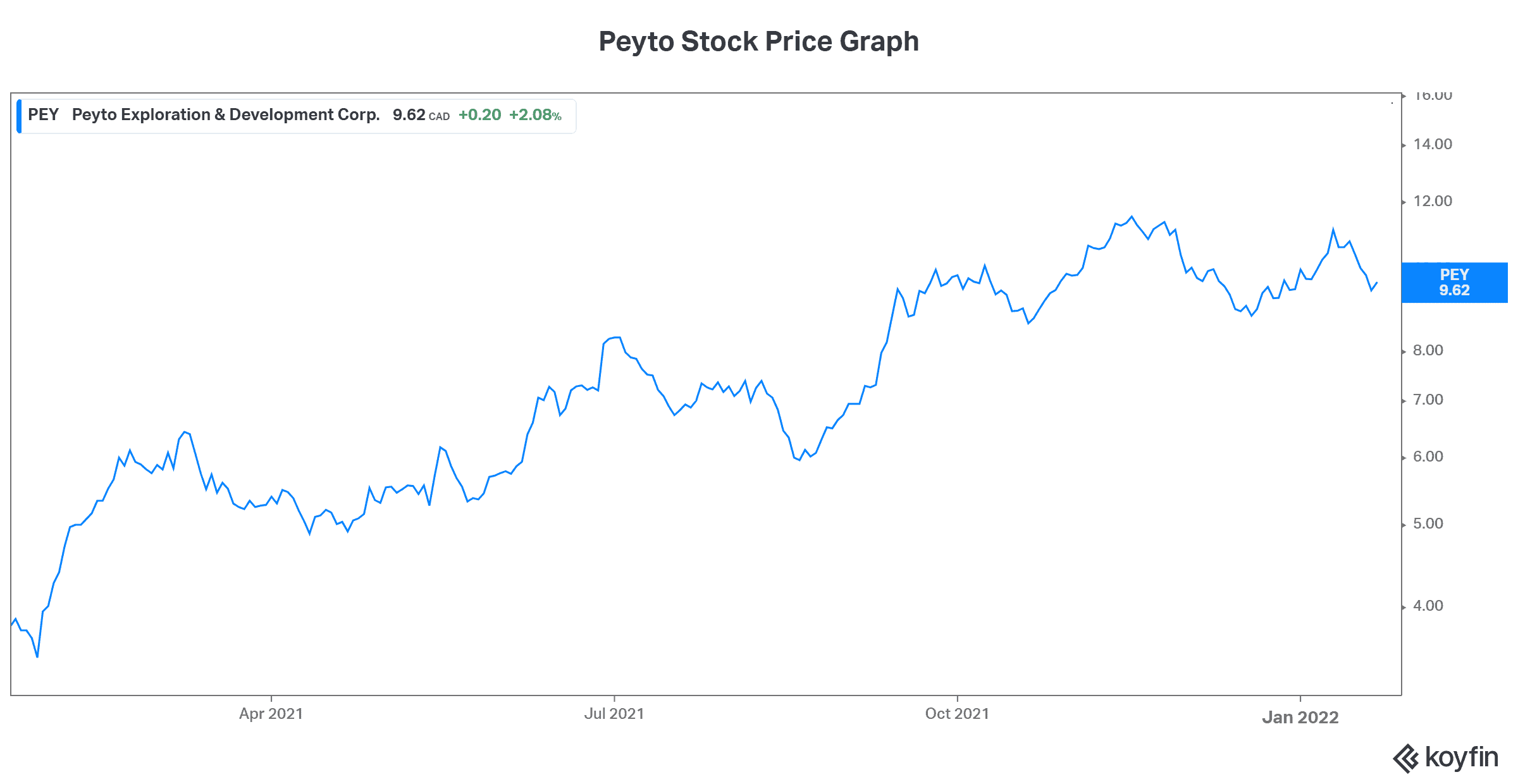

Peyto stock: Laughing at this market selloff

Who says that a growth stock can’t also be a high-yielding stock? In Peyto Exploration and Development (TSX:PEY) we have a stock that’s both a growth stock and a high-yielding stock. It’s quite unusual, yet it’s an attractive situation that investors can take advantage of. So, Peyto is an energy stock with a natural gas focus. It is, in fact, one of Canada’s lowest-cost natural gas producers.

Over the last year, Peyto stock has soared 150%. This makes sense. I mean, in the first nine months of 2021, Peyto’s cash flows have increased 110%. This kind of growth is huge. And it’s fueling dividend increases and an accelerated return of capital to shareholders. In fact, Peyto’s dividend yield is currently a very generous 6.2%. More recently, Peyto has been selling off, as the general market selloff continues.

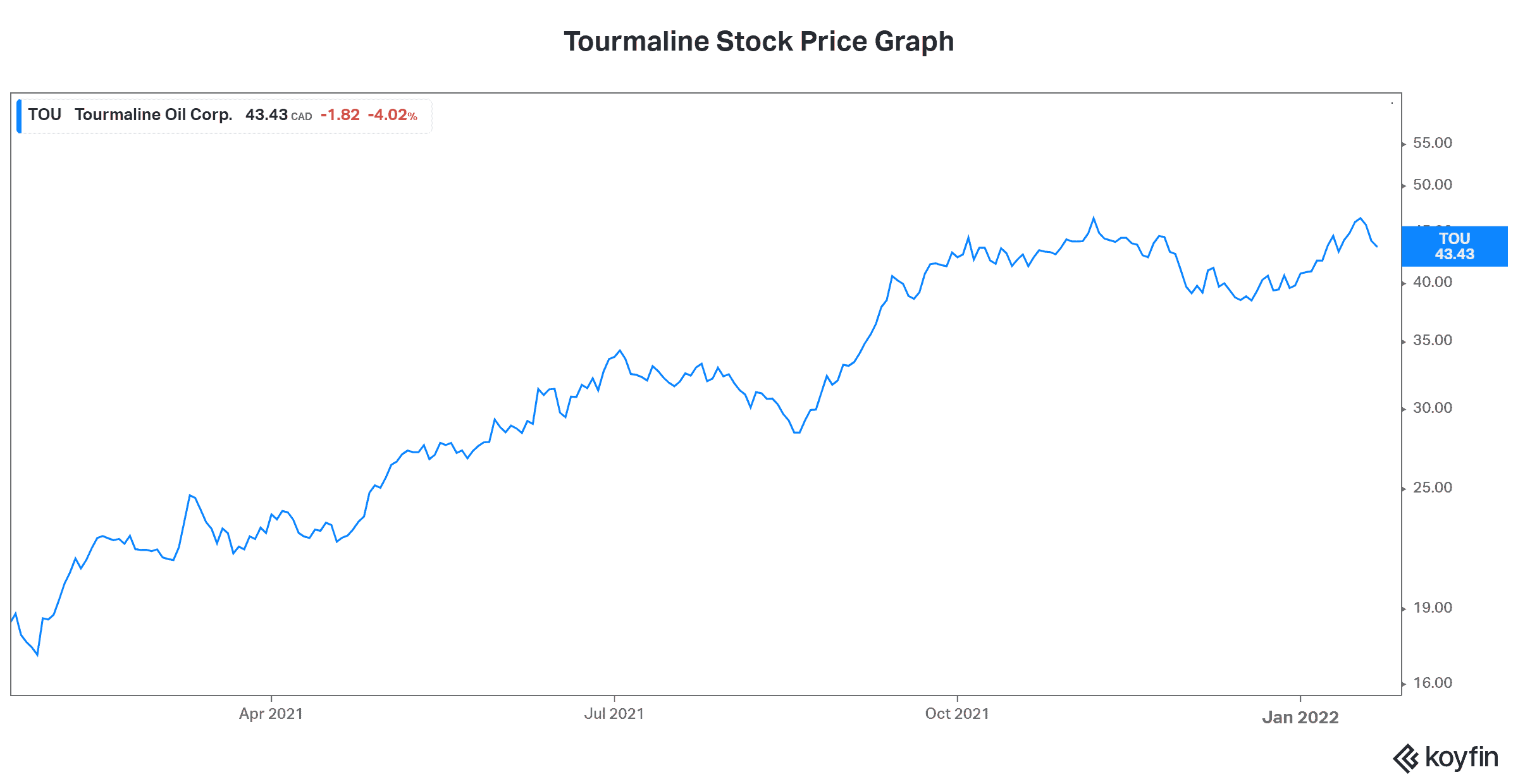

Tourmaline stock: A natural gas growth stock to buy on weakness

Natural gas stocks are certainly one of the hottest growth stocks around today. As I’ve pointed out, natural gas prices have soared in the last year. They’re up 55%. But there’s more. Natural gas is believed to be a very important “transition” fuel. This is because it’s a relatively cleaner fuel when compared to coal and oil. So, it has its place for years to come, as societies make that shift to clean energy.

Tourmaline Oil (TSX:TOU) is a mid-tier natural gas weighted producer that’s looking good today. It’s heavily weighted toward natural gas production (almost 90%). As a result, Tourmaline’s cash flows are soaring. In the first nine months of 2021, Tourmaline posted a 150% increase in cash flows. It’s these strong fundamentals that have sheltered Tourmaline stock somewhat from the market selloff.

Like Peyto, Tourmaline is also returning cash to its shareholders at a feverish pace. Last week, the company announced an 11% dividend increase and another special dividend. This special dividend was $1.25 per share, and it follows the $0.75 per share special dividend announced late last year.

Motley Fool: The bottom line

The three growth stocks to buy are not your typical growth stocks. They’re admittedly very cyclical. And they pay an unusually high amount in dividends. In short, they represent a very attractive risk/reward proposition today. So, if you’re looking for stocks to buy as the market sells off, consider them.