Canada has some great blue-chip stocks trading in our market. These large-cap companies have excellent fundamentals, with strong business models, a long history of share price appreciation, solid dividend growth, and good competitive advantages.

Canadian investors should strongly consider making these blue-chip stocks the backbone of the Canadian equity portion of their portfolio. However, choosing which one to buy and hold can be tricky. Keeping up with the news, re-balancing, and staying on top of earnings reports can be tiring.

Fortunately, there are a variety of exchange-traded funds (ETFs) out there that take the hassle out of stock picking. For a very low fee and zero effort, you can own an ETF that holds 60 of Canada’s largest, most traded stocks.

The best Canadian ETF

You might not know, but the first ETF actually originated in Canada. In 1990, BlackRock launched the first version of the iShares S&P/TSX 60 Index ETF (TSX:XIU). Since then, it has grown to become the largest and most liquid ETF in Canada, with assets under management of $11 billion.

XIU works as an accurate barometre of the Canadian stock market’s performance, because it tracks the S&P/TSX 60 Index, net of expenses. This is a market cap weighted index of the 60-largest stocks trading on the Toronto Stock Exchange (TSX).

The top 10 holdings of XIU contain many solid companies that should be held by Canadian investors for the long term. They include Royal Bank of Canada, Toronto-Dominion Bank, Shopify, Bank of Nova Scotia, Enbridge, Brookfield Asset Management, Canadian National Railway, Bank of Montreal, Canadian Pacific Railway, and Canadian Natural Resources.

What the numbers say

Holding XIU will cost you a management expense ratio (MER) of 0.18% per year. That means you’ll pay $18 a year if you own $10,000 worth of XIU. That is an absolute steal, especially compared to mutual funds that have an average MER 10 times that at over 1.8%!

XIU also pays a respectable dividend, thanks to its many underlying Dividend Aristocrat stocks. Currently, the 12-month trailing yield stands at 2.41%, and is paid quarterly. Reinvesting this dividend can significantly boost your returns.

Finally, the share price of XIU can be attractive for investors with a smaller account. Imagine trying to buy one share of each of the 60 companies in the S&P/TSX 60 Index. You would need to spend a lot! Fortunately, XIU trades for just $32, giving investors affordable exposure to every stock without the need for fractional shares.

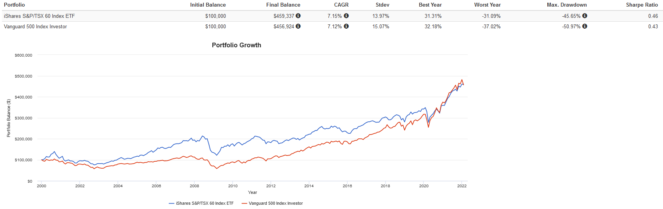

XIU has done very well over its lifetime. Below is a backtest from 2000 to present with all dividends reinvested versus the venerable U.S. S&P 500 Index. They’re both neck and neck in terms of risk and return. Notice that most of the outperformance of the S&P 500 came in recent years, with XIU doing better in the years prior.

The Foolish takeaway

If you want an absolutely hands-off approach for your Canadian equity portfolio, XIU is the way to go. For a small annual fee, you get the performance of the top 60 stocks in the Canadian market.

You’ll never have to worry about rebalancing or monitoring the holdings, trying to figure out which stock will do well or poorly. Set the dividends on to be auto-reinvested, and enjoy watching your gains compound!