The Registered Retirement Savings Plan (RRSP) is a great tool to help Canadians save for retirement. It has many advantages. The biggest one is its ability to shelter savings from taxes. As the RRSP deadline approaches, how can you start saving? How much should you set aside? And what should you invest in? The answers to these questions are simple: Start saving by taking a percentage off each paycheck. Set aside as much as you can spare. And invest in top dividend stocks like Fortis (TSX:FTS)(NYSE:FTS) and Enbridge (TSX:ENB)(NYSE:ENB) stocks.

Without further ado, here are the top dividend stocks for your RRSP.

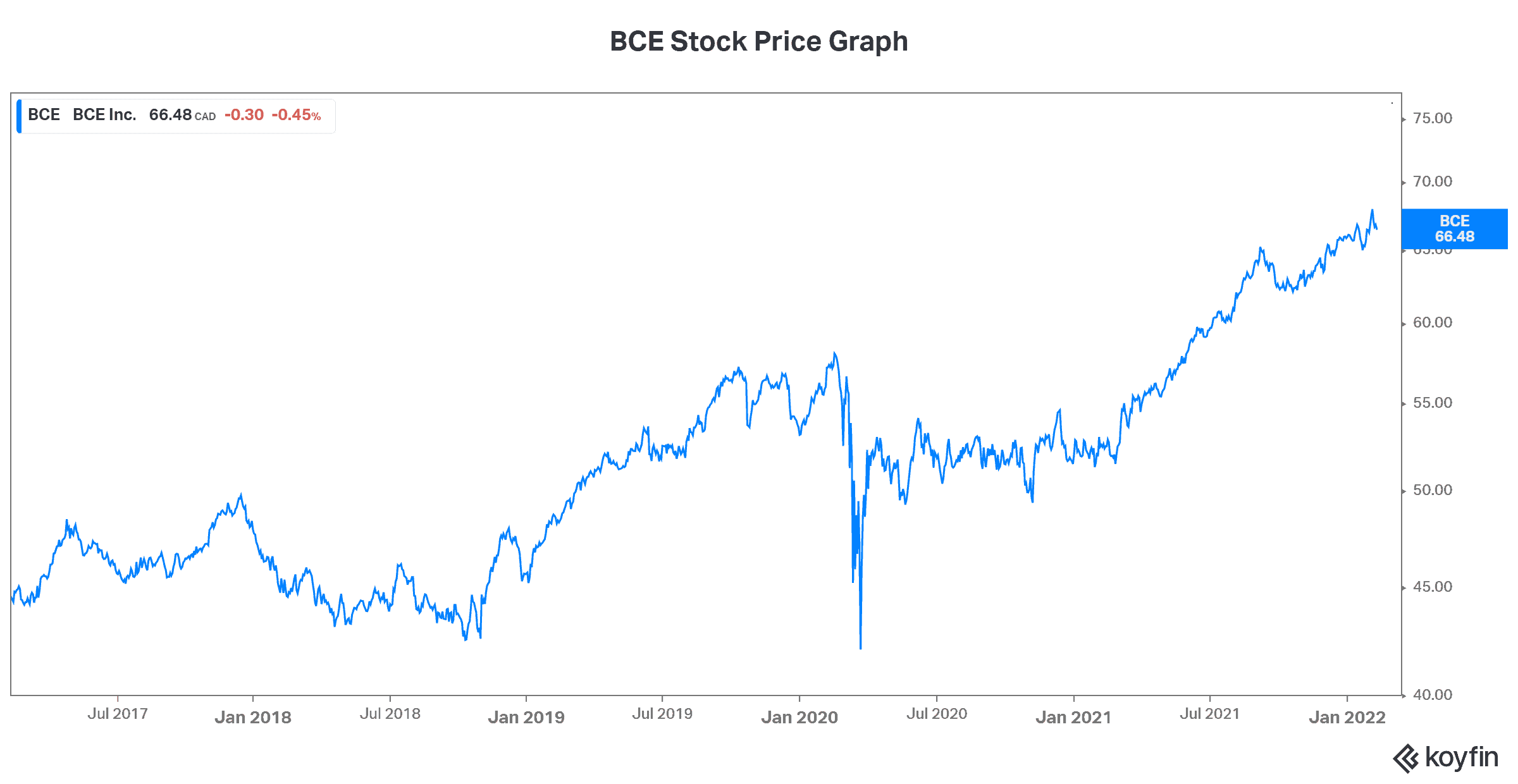

RRSP stock #1: BCE has the advantage of stability and sustainability

$60 billion BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom company. It extensive reach and dominance is part of this company’s competitive advantage. BCE’s world-class wireless and fibre networks are leading Canada into the next generation of connection. Its financial strength and generous dividend yield of 5.5% is what solidifies it as a top dividend stock for your RRSP.

In fact, looking at BCE’s dividend history, its value as a stock to buy with your next RRSP contribution becomes even clearer. After a really strong 2021, BCE increased its dividend again. It was the 14th consecutive year of a 5% or higher dividend increase. In fact, its stable and defensive business and numerous growth opportunities point to more good times ahead for BCE.

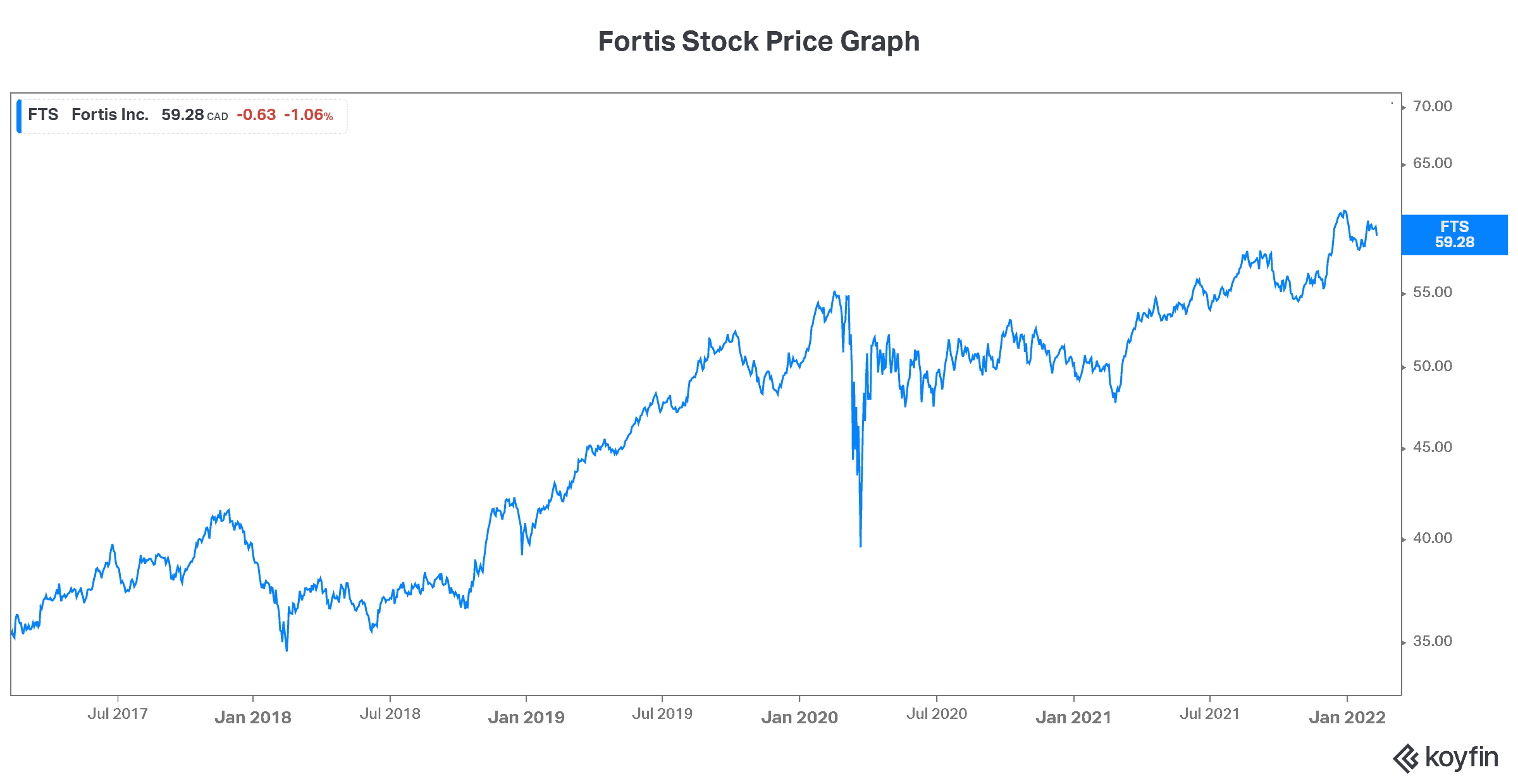

RRSP stock #2: Fortis stock is powering our lives as well as shareholders’ pocketbooks

Fortis stock is another top dividend stock to buy, as the RRSP contribution deadline approaches. Certainly, this stock can safely help investors reach their retirement goals. Fortis is a regulated gas and electric utility company, and this defensive business breeds safety and predictability. But it’s also grown quite nicely.

This is reflected in Fortis’s dividend. In fact, Fortis’s dividend has given its shareholders passive income that has consistently grown for 48 years. Fortis stock’s dividend income has not only combatted inflation, but it’s also provided more than acceptable returns on investment. Fortis stock currently has a very generous dividend yield of 3.6%.

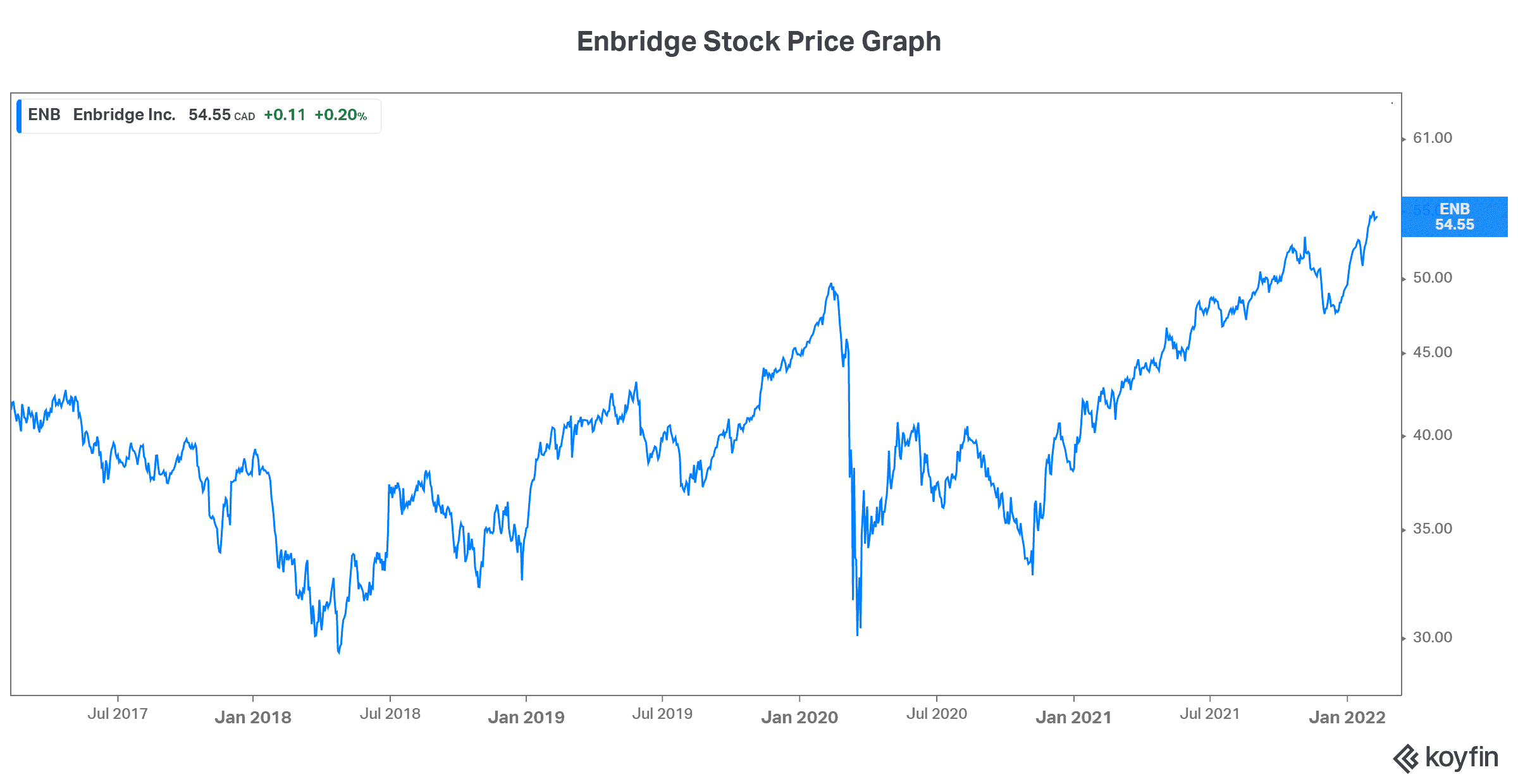

RRSP stock #3: Enbridge stock is the one with the most attractive dividend/security combination

Lastly, we have Enbridge stock. This stock/company has been plagued by trouble for years. But here’s the kicker: Enbridge is actually more undervalued and profitable today than ever. The noise that’s been driving Enbridge stock down is political and idealistic. It has nothing to do with the actual realities of Enbridge’s business.

Yes, we all want to clean up the environment. It’s definitely a tragedy when we hurt wildlife and the very ecosystem that gives us life. And yes, we want to move to a future that lives in better harmony with nature. So, the transition is underway. In the meantime, we still need tremendous amounts of energy to survive and thrive. This means that Enbridge will have a place for the foreseeable future. I like the fact that the company recognizes its place but also invests in cleaning up and in renewable projects.

Today, Enbridge is yielding a lucrative 6.32%. It has a place in every investor’s RRSP portfolio, because of its rich history of dividend stability and growth. Also because of its promising future as part of the energy transition.

Motley Fool: The bottom line

The RRSP contribution deadline will soon be upon us. In preparation, please take a look at and consider the top dividend stocks mentioned in this article. The goal is steady and reliable retirement income and growth. These stocks have all that and more.