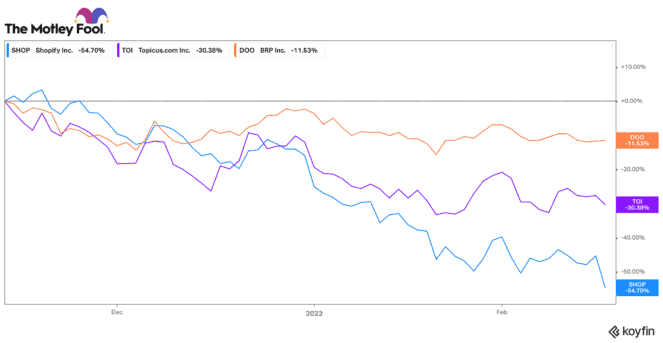

Just this week, Shopify (TSX:SHOP)(NYSE:SHOP) once again experienced another crushing drawdown of about 20%. It has been a tough go for Shopify shareholders as of late. Its stock is down 47% this year. It is down 56% since the middle of November 2021. Unfortunately, it appears that the curse of the highest valued company in Canada (that is not a bank) has come back to haunt Shopify.

Bank stocks have replaced Shopify as Canada’s most valuable businesses

Royal Bank of Canada and Toronto-Dominion Bank have once again retaken their long-term thrones at the top of the TSX Index. Certainly, recent stock market reactions have been drastic and blunt. Steam has been leaking out of many of the world’s highest-growth, highest-valued stocks. Even after its rapid decline, Shopify still trades at 25 times sales and 163 times forward earnings. Certainly, it is still not cheap.

Strong 2022 results for Shopify

Despite the decline, Shopify delivered stellar fourth-quarter and year-end results. Revenues in the quarter increased 41% to $1.38 billion. That largely beat analysts’ expectations. For the year, the company grew revenues 57%, and net income rose 10 times above the prior year. It was an exceptional year! Yet investors were disappointed by a tempered outlook for 2022.

Frankly, that shouldn’t be a surprise. The pandemic was a major tailwind for e-commerce platforms like Shopify. A more normal retail environment will likely taper e-commerce demand to some extent. Yet that really doesn’t take away the quality of Shopify’s platform and its long-term growth potential. Chances are good Shopify stock is reverting to its mean trajectory, which is probably healthy.

Two stocks I’d buy over Shopify stock

While I really like Shopify’s business, I will probably continue to watch it. The TSX remains volatile, and Shopify stock still has an elevated valuation. A better entry could still be forthcoming. In the meantime, two growth stocks I am picking up right now are Topicus.com (TSXV:TOI) and BRP (TSX:DOO)(NASDAQ:DOOO).

Topicus.com

Topicus.com is a new entrant to the TSX Venture Exchange. It was spun out of Constellation Software early last year. Unlike Shopify, Topicus.com focuses on acquiring a wide array of vertical market software businesses in Europe. Like Shopify, this stock it has been growing revenues quickly. Last year, it grew revenues by 50%. It grew revenues organically by 8%.

In 2021, it acquired €338 million worth of niche software enterprises. Considering tech valuations have declined in 2022, it could be set to acquire even more businesses this year. The company had a lot of accounting noise this quarter, but I expect its earnings and cash flow picture should clear up nicely as 2022 progresses. For a smaller company replicating Constellation Software’s model, this is a great stock to own.

BRP

BRP is not a software “technology” stock. However, technology is a vital part of its product portfolio. It is one of the world’s leading manufacturers of snowmobiles, all-terrain vehicles, and watercraft in the world. Like Shopify, BRP’s stock has delivered strong returns for investors. Over the past five years, this stock has delivered a compounded annual return of 30%.

This stock has pulled back recently over supply chain worries. Yet, BRP has been investing in further manufacturing capacity for 2022. Likewise, it expects to introduce a huge selection of new products this year. Lastly, this stock is ultra-cheap. Despite very strong growth ahead, it only trades for 9.5 times earnings. On a growth-to-value basis, this is a top stock, and that’s why I’m buying it over Shopify today.