The TSX energy sector is cyclical, with bouts of underperformance and outperformance versus the S&P/TSX Composite Index. Factors like political roadblocks, commodity prices, and supply chain disruption make it rather volatile.

Today, with inflation at all-time highs and the threat of multiple rate hikes on the horizon, these energy stocks are again poised to outperform in 2022, after posting amazing returns in 2021.

Investors seeking to gain exposure can either choose to buy individual energy stocks, or buy a sector exchange-traded fund (ETF) that holds them all. Let’s look at the pros and cons of each approach.

The ETF method

There is an easy way to own the TSX energy sector with one ticker — iShares S&P/TSX Capped Energy Index ETF (TSX:XEG). XEG holds 22 energy stocks in a “basket” of sorts. When you purchase a share of the ETF, you are getting a slice of this basket, with proportionate exposure to all of its underlying stocks.

XEG is advantageous in that it is completely hands off – asides from buying shares of the ETF, you don’t have to worry about rebalancing. The dividend payments are easily tracked too, with the 22 dividends averaged out to pay an annual yield of 1.79% currently.

XEG currently trades at around $13 a share, making it a very capital efficient method for investors with smaller accounts to gain exposure to energy stocks, some of which trade in the $50+ share price range. If you don’t have too much money to allocate to multiple individual energy stocks, XEG is the way to go.

The stock method

There is a big downside to XEG – the management expense ratio (MER). This is the cost charged by the fund provider to you on a annual basis for managing the ETF. The current MER is 0.61%, which means that for a $10,000 account, you are being charged $61 dollars annually to hold XEG.

That might not sound like a lot, but it does add up over time. For larger accounts, the opportunity cost of the MER can compound significant to result in missed gains. Compare this to buying and holding each of the 22 energy stocks individually. If you are using a$ 0-commission brokerage like Wealthsimple Trade, your fees would be 0%.

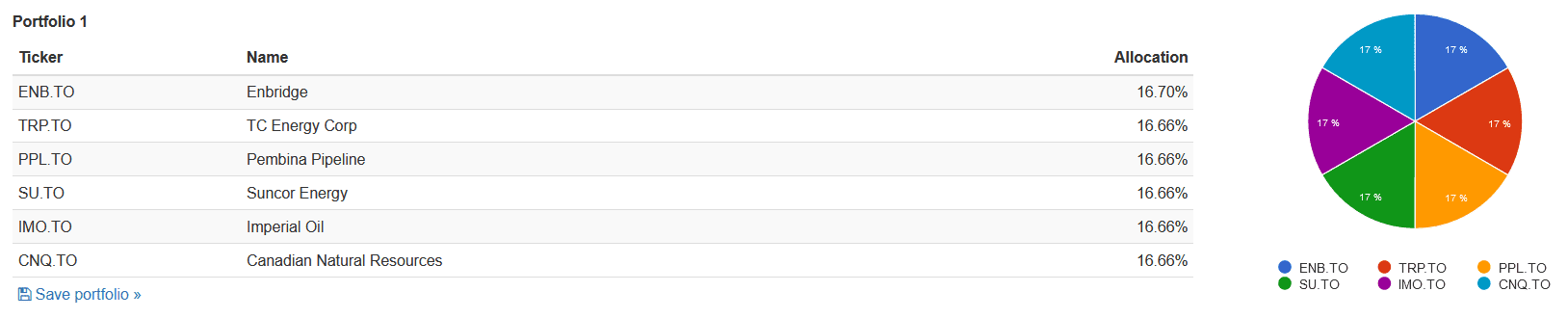

If you wanted to create a portfolio of the six largest energy stocks (Enbridge, TC Energy, Pembina Pipeline, Suncor Energy, Imperial Oil, and Canadian Natural Resources) by market cap, you should purchase enough shares of each, so the total dollar amount in each stock represents roughly 16.66% of your allocation, as seen in this image:

The Foolish takeaway

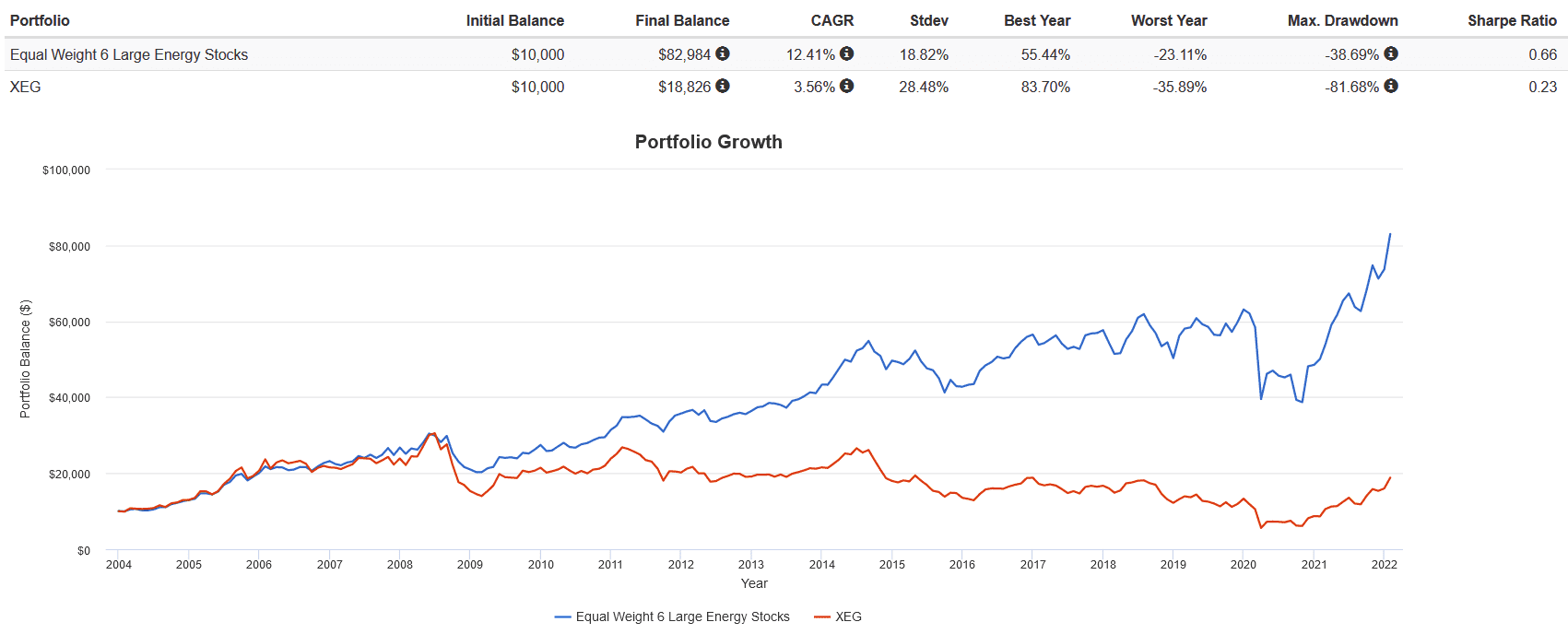

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

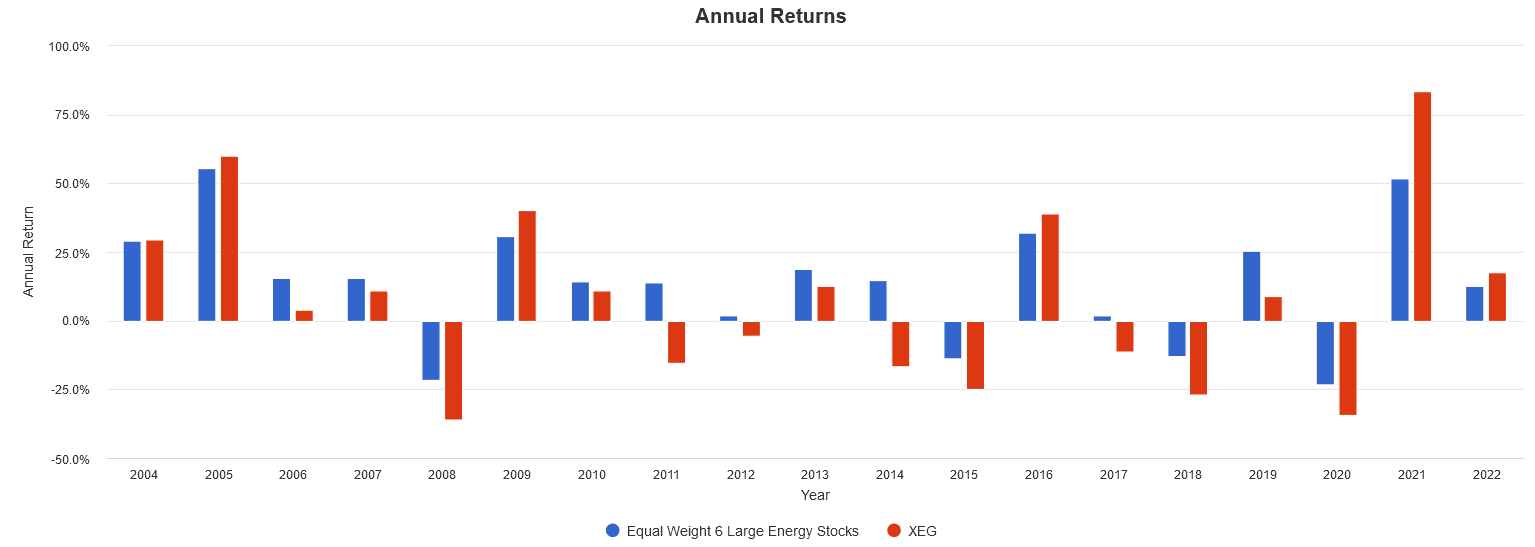

That being said, from 2003 to present, with all dividends reinvested and quarterly rebalancing, the equal weight six-fund portfolio of the largest Canadian energy stocks beat XEG significantly in terms of risk and return.

This can be attributed to the high MER of XEG, the much greater dividend yield and growth of the six large-cap stocks, and the under-performance of small-cap energy stocks in XEG.

Choosing between the two boils down to two questions:

- Do you have the time and discipline to manage a portfolio of six stocks, reinvesting the dividends and rebalancing every quarter without tinkering or deviating from your strategy?

- Do you think the large-cap Canadian energy stocks will continue to outperform and increase their dividends? Historically, investors have been compensated with greater returns for the risk of small caps, although the TSX energy sector hasn’t reliably produced that small-cap risk premium.

If your answer to both of those questions is no, paying 0.61% to buy an ETF and have someone manage it for you might make more sense.