Air Canada‘s (TSX:AC) stock price rose more than 3% since its 2021 earnings release on Friday, as the battered airliner’s recovery is gaining momentum.

The last two years have been brutal for Air Canada and its stock price. There was nothing that could have prepared this airliner for the challenges that the pandemic brought. But Air Canada’s 2021 earnings have brought hope. Are things finally changing? Are we finally seeing reasons to buy into Air Canada stock?

Air Canada’s stock price rises, as Air Canada sees demand returning and gaining momentum

- Advance ticket sales increased almost $400 million in Q4 and reached 65% of pre-pandemic levels.

- Air Canada cargo reported record revenue of nearly $1.5 billion.

- Air Canada vacations saw a significant return of business with bookings at pre-pandemic levels.

- EBITDA of $22 million was modest but represents the first positive EBITDA in seven quarters.

What happened in 2021?

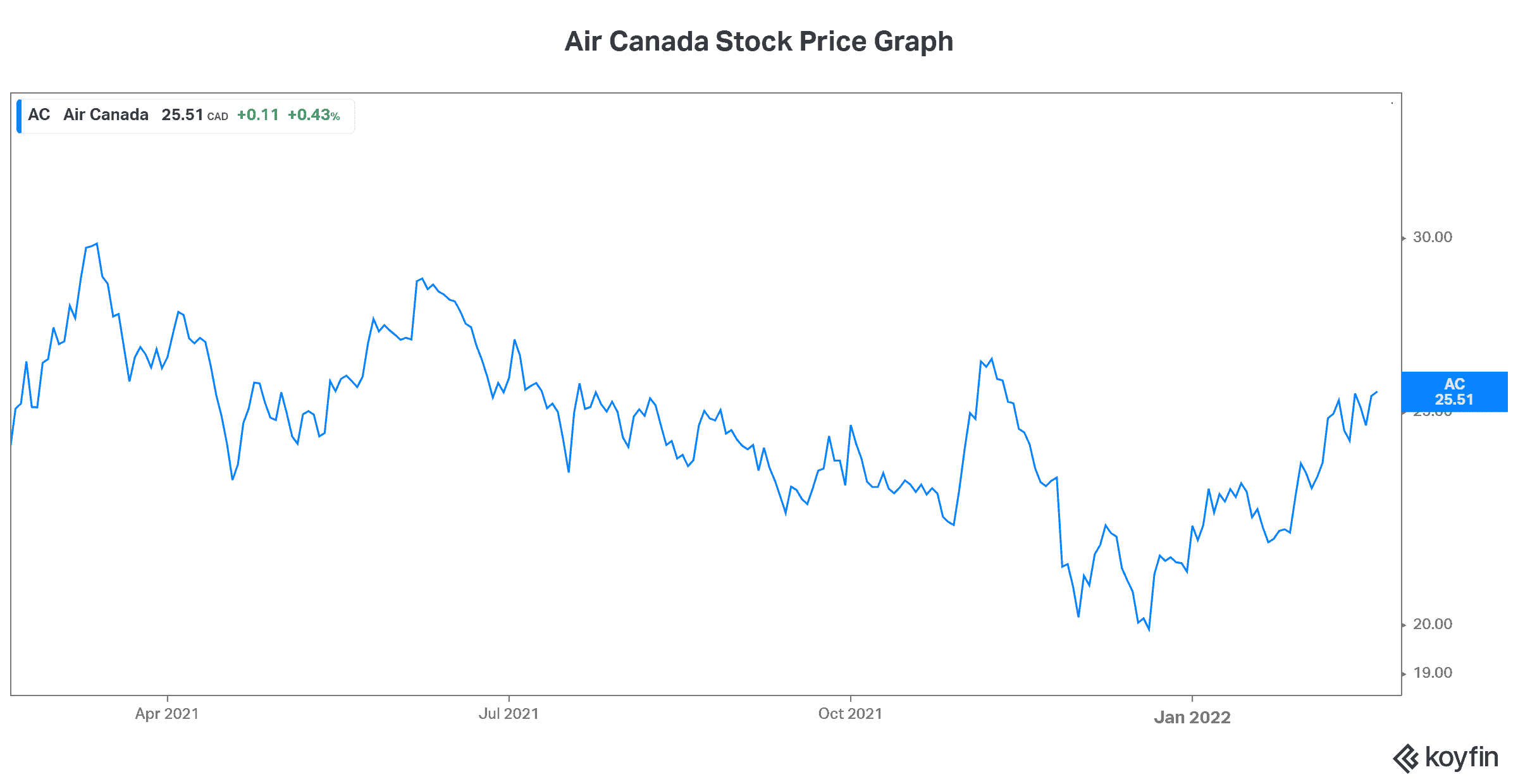

2021 wreaked havoc on Air Canada stock price. But in the third quarter, Air Canada began to really see a resurgence in demand and traffic. This resurgence was temporarily halted by the Omicron variant in late 2021, but 2022 is showing an even stronger recovery. Restrictions are being lifted at an aggressive pace, travelers are booking, and the momentum has clearly shifted.

So, as Air Canada’s stock price fell in 2021, the beginning of the end of the pandemic was drawing near. Today, Air Canada is emerging with a newer fleet, a revamped Aeroplan program, and many lessons learned. Capacity is being increased, and more flights are being added every week.

What did Air Canada’s management say?

For the first time in a long time, the CEO of Air Canada expressed optimism during the earnings call. “The sequential and year-over-year improvement of Air Canada’s fourth-quarter results shows the underlying recovery remains intact despite the Omicron variant.” Looking to the future, he was just as optimistic. “As we move into 2022, all expectations are that the recovery in air travel will continue.”

What’s next for Air Canada?

As for what’s next for Air Canada, I think it’s pretty clear at this point. It looks like a recovery is well underway. Therefore, we can look forward to a better environment for Air Canada and its stock price.

Capacity will continue to be increased. While it more than doubled versus last year, it’s still down 47% versus 2019 levels. Government restrictions are expected to continue to be lifted. Countries are getting back to “normal,” trying to live with this virus. Unless another new variant disrupts this, 2022 will see the Covid pandemic recede into the background. With this, we will see Air Canada enjoying a resurgence of demand and, ultimately, profitability.

Air Canada’s stock price fell in 2021, but it’s been pretty much flat over the last 12 months. Investors have been awaiting the rebound, and it looks like it’s come; in fact, Air Canada’s stock price is up 21% year to date.