There’s no doubt that one of the most impressive and best stocks in Canada over the last five years has been Shopify (TSX:SHOP)(NYSE:SHOP), the e-commerce giant headquartered in Ottawa. At the end of 2016, the price of Shopify stock was just under $60 a share. That had increased to roughly $1,750 a share by the end of 2021 — a more than 2,900% gain and a compounded annual growth rate of 97.6%.

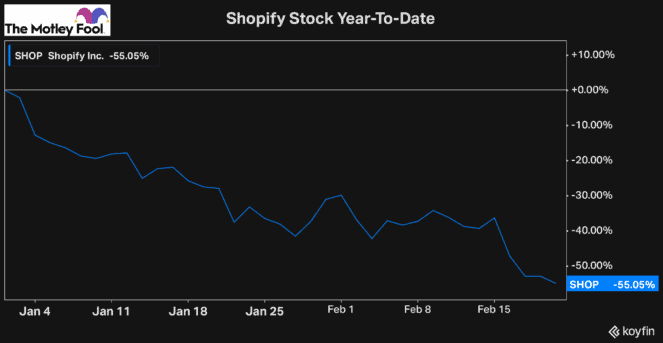

However, since the beginning of the year, the stock has lost more than half of its value, leading many to wonder whether it’s a steal at this price or if the price of Shopify stock will continue to fall.

So, why is Shopify stock down so severely, and is it worth a buy today?

Why is Shopify’s stock price falling significantly?

At first, Shopify was caught up in the tech stock selloff. Tech stocks and other higher-growth stocks that have more risk than established businesses have been some of the biggest losers lately, as investors rebalance their portfolios.

So, as these companies saw their valuation metrics contract, naturally, Shopify began to lose some value. Meanwhile, because investors are rebalancing their portfolios, lower-risk businesses such as utility stocks and large-cap telecoms have fared much better.

The biggest factor in the recent selloff of the Shopify stock price, though, came after it reported earnings earlier this month for the period ended December 31, 2021. While Shopify’s results were once again strong, it was its forward outlook and guidance that the market didn’t like.

First, Shopify doesn’t expect to grow its sales as quickly as it did in 2021, which were up 57% year over year. However, this was to be expected, as it continues to grow massively in size and as the tailwind from the pandemic continues to ease.

Therefore, the more impactful takeaway from its earnings report is the massive amount of capital Shopify plans to spend to grow its Shopify Fulfilment Network (SFN). The company mentioned it would invest all its gross profit back into the business to grow its research and development as well as its marketing and sales teams. In addition, it’s expected to have capital expenditures of $200 million in 2022 and another $1 billion between 2023 and 2024.

So, why is this investment that Shopify is making such a negative development and causing its stock price to fall? The answer is that it’s not necessarily negative. It’s more the timing of this investment is not necessarily ideal.

Is Shopify a buy after its recent selloff?

In my opinion, Shopify investing capital to build a fulfilment network is a significant opportunity that can help the company scale considerably and improve its margins, as its business grows over the long haul. However, with that being said, I understand why the stock has been selling off.

As interest rates are being increased, investors are looking to own more mature businesses that can generate strong free cash flow. So, for Shopify to be spending capital to invest in growth at a time when capital is getting more expensive can be off-putting to some investors. Couple that with the fact that these tech stocks continue to face headwinds in the market, and it makes sense that shorter-term investors are looking to bail on the stock and find better opportunities.

For long-term investors, however, at this stock price, Shopify presents an excellent opportunity. It may not recover immediately, but being able to buy such a high-quality company with such a dominant position in an e-commerce industry that has a huge runway for growth is an excellent opportunity.

Therefore, over the next couple of months, I’d pay close attention to Shopify and its stock price. It’s one of the best Canadian stocks you can own, so while it trades cheap, it’s offering investors an incredible opportunity.