The Bank of Canada (BoC) raised interest rates to 0.50% following the results of their March 2nd policy deliberations. A combination of high inflation (5.1%) and GDP growth (6.75%) meant that the BoC had to pull the trigger on a 0.25% increase.

What does this mean for your portfolio? Well, for one, bond yields will be increasing, which causes their prices to decrease, as the two have an inverse relationship. When it comes to stocks, overvalued pandemic-era growth and tech sector stocks will likely face strong headwinds moving forward.

Why we want big bank stocks

However, not all market sectors are affected badly by rising interest rates. Certain ones, like the banking industry, have historically shown improved profitability in a rising interest rate environment. In this situation, banks can charge higher interest rates on their loans, which increases their revenue and profitability.

Combined with a history of unbroken dividend payouts and increases, consistent earnings beats, share splits, and sound management, Canada’s big bank stocks could be an excellent defensive play when the rest of the market and U.S. indexes are trading more or less sideways.

The best candidates for the role

My top two TSX big bank stocks to buy here are Royal Bank (TSX:RY)(NYSE:RY) and Toronto-Dominion Bank (TSX:TD)(NYSE:TD). Both dominate the S&P/TSX Composite Index by market cap and have been some of the best-performing stocks in the Canadian market for decades now.

Both RY and TD operate in the following general segments: personal & commercial banking, wealth management, insurance, investor & treasury, and capital markets. Both TD and RY enjoy an oligopolistic relationship in the Canadian financial sector, with a very strong and wide competitive moat.

When it comes to fundamentals, both RY and TD have excellent ratios: profit margins of 32% vs. 33%, ROE of 16.95% vs. 14.64%, forward P/E of 12.64 vs. 13.56, and P/B of 2.16 vs. 2.03, respectively. Both companies also pay respectable dividend yields of 3.42% vs. 3.48% respectively, with sustainable payout ratios of 40% and under.

The Foolish takeaway

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

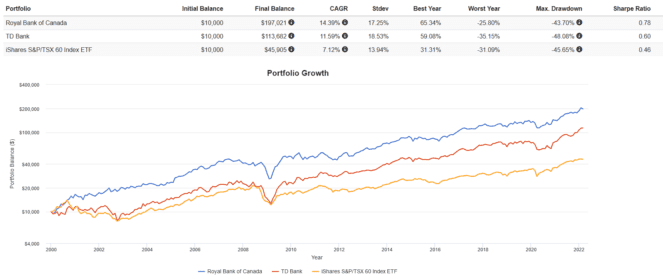

That being said, from 2000 to present, with all dividends reinvested, both RY and TD outperformed the S&P/TSX 60 Index, with better returns, less volatility, and lower max drawdowns.

The results speak for themselves. Both RY and TD are some of the best stocks in the Canadian market to hold. A combination of a wide moat, ever-increasing dividends, and continued profitability and excellent management make both stocks great core holdings in any Canadian portfolio. With RY and TD, I wouldn’t try to time buying at a low price. Both are solid enough buy-and-hold stocks at any price.