When I turned 18, my parents told me to “go invest.” I didn’t know who or what to trust, so I naively went to my local bank and spoke to a “financial advisor” (aka salesperson). After being asked some know-your-client questions and filling out a questionnaire, I was presented with a list of mutual funds.

I remember the advisor taking pains to highlight the great past returns of the actively managed (read: more expensive) options. When I asked about fees, I received a simple calculation of how much the annual management expense ratio (MER) would take out of my holdings.

Eight years later, I now know that the impact of the high MER doesn’t end just there. Turns out, it can cost you dearly in terms of missed returns in the future. I have since switched to a low-cost exchange-traded fund (ETF) portfolio, and today I’m going to explain why you should as well.

Understanding MER

The MER is simply the combination of a management fee paid to the mutual fund’s manager and the other trading/administrative expenses they incur. It is expressed as a percentage taken out of the underlying assets under management (AUM) on an annual basis.

For example, a passively managed index mutual fund with an MER of 1.0% (the average in Canada), will cost an investors with a portfolio valued at $100,000 a fee of $1,000 annually. A passively managed index ETF with the same holdings might have an MER of just 0.10. This will cost that same investor just $100 annually.

So, right off the bat, we see a huge difference, and that’s just the passively managed cheaper funds. The actively managed funds that try to “beat the market” can have an MER of up to 2%, despite the fact that the majority of them fail to outperform an average index fund.

The opportunity cost

There is a concept called “the time value of money.” Put simply, a dollar invested today is worth more years down the line. If we apply this line of thinking to high mutual fund fees, we see right away that we are losing a substantial amount of potential future gains.

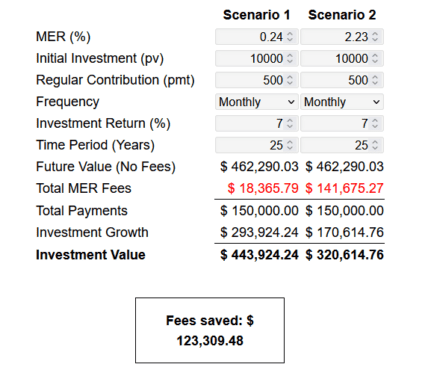

Consider this example: I have two fund both tracking a globally diversified portfolio of equities that earns a CAGR of 7%. One is an ETF, and the other is a mutual fund. The ETF’s MER is 0.24%, and the mutual fund’s MER is 2.23%. Let’s assume that two different investors put in $10,000 each to start and an additional $500 monthly for 25 years.

The difference is astounding. The second investor lost out on six figures’ worth of gains because of the higher fees they paid. For a retirement portfolio, this could mean the difference between retiring earlier or a higher safe withdrawal rate. The 2.24% MER was a significant source of drag, essentially burning money that could have been compounded.

The Foolish takeaway

Ditch the mutual funds, unless the MER is low (below 0.50%). Being able to buy fractional shares and set up auto-contributions has completely negated any advantage they might have had.

Canadian investors are better off writing an investment policy statement to follow and then setting up a self-directed investment account at one of the various brokerages.

From there, you can invest in a globally diversified, passively managed portfolio of stocks and bonds using low-cost ETFs, with MERs of 0.24% and lower.