Canada has some great blue-chip stocks. These large-cap companies have excellent fundamentals, with strong business models, excellent management, solid dividend growth, and good competitive advantages.

However, choosing which one to buy and hold can be tricky. Keeping up with the news, re-balancing, and staying on top of earnings reports can be tiring. Buying a diversified portfolio can be costly as well, with shares of a few companies priced too high for some investors.

Fortunately, there are a variety of exchange-traded funds (ETFs) out there that take the hassle out of stock picking. For a very low fee and zero effort, you can own ETFs that track the broad Canadian market. Today, we’ll be examining two great low-cost choices from BlackRock.

S&P/TSX 60 Index

Up first is iShares S&P/TSX 60 Index ETF (TSX:XIU). XIU is the oldest and most liquid ETF in Canada, with assets under management (AUM) of more than $11 billion and high volume trading daily.

XIU tracks the performance of a market cap weighted index of the 60 largest stocks trading on the Toronto Stock Exchange (TSX) net of expenses. Holding XIU will cost you a management expense ratio (MER) of 0.18% per year.

XIU also pays a respectable dividend, thanks to its many underlying Dividend Aristocrat stocks. Currently, the 12-month trailing yield stands at 2.41%, and is paid quarterly. Reinvesting this dividend can significantly boost your returns.

The top 10 holdings of XIU contain many solid companies that should be held by Canadian investors for the long term. They include Royal Bank of Canada, Toronto-Dominion Bank, Shopify, Bank of Nova Scotia, Enbridge, Brookfield Asset Management, Canadian National Railway, Bank of Montreal, Canadian Pacific Railway, and Canadian Natural Resources.

S&P/TSX Capped Composite Index

The TSX doesn’t end at just 60 companies though. What XIU does not include is the 100+ small- and mid-cap stocks that make up the remainder of the market. These stocks are riskier, but have higher potential for growth.

To truly own the entire Canadian stock market, you’ll want iShares S&P/TSX Composite High Dividend Index ETF (TSX:XIC). XIC tracks 240 large-, mid- and small-cap stocks, with its top 10 holdings the same as XIU.

Currently, XIC costs a MER of just 0.06% to hold, which is a third of the cost of XIU. The 12-month dividend yield stands at a decent 2.38%, which is close enough to XIU.

XIC is still concentrated in the financials and energy sectors, but there is a more balanced allocation to other sectors such as materials, industrials, technology, utilities, and telecoms as a result of the small and mid-caps.

The Foolish takeaway

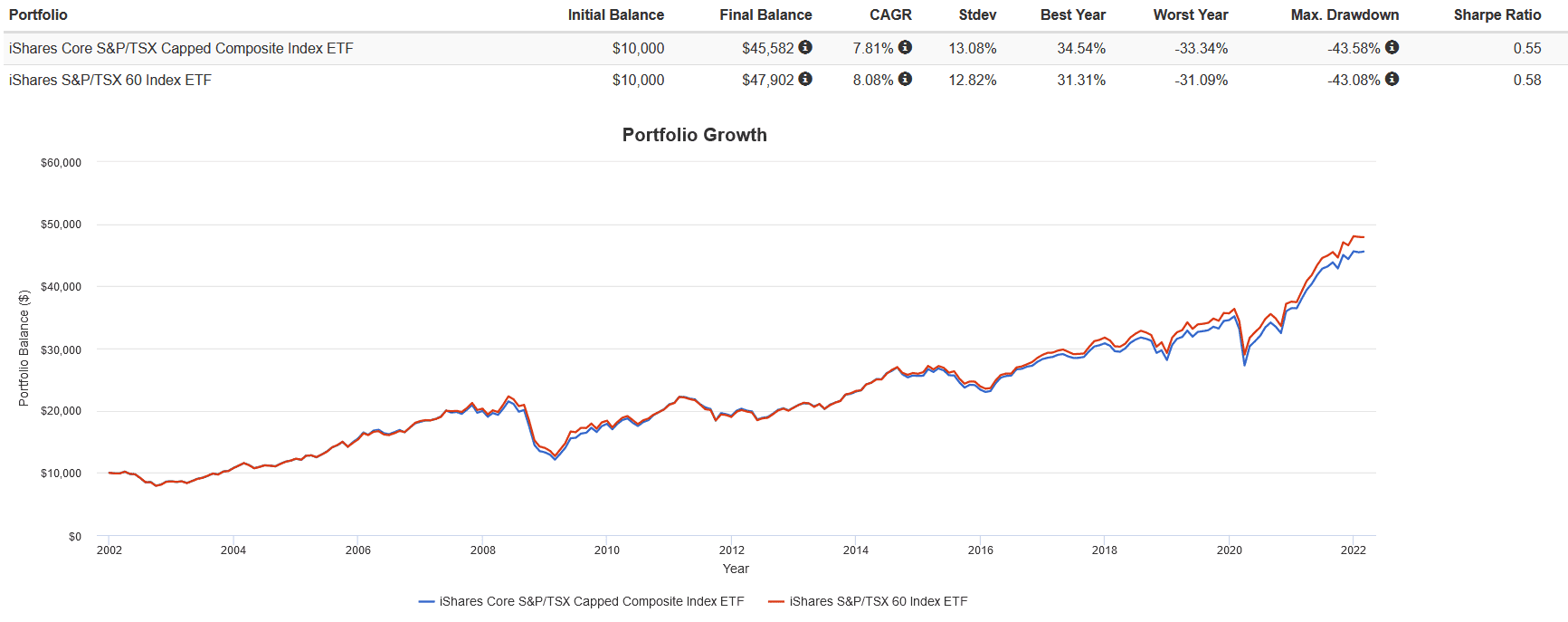

A word of caution: the backtest results provide below are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Hypothetical returns do not reflect trading costs, transaction fees, or actual taxes due on investment returns.

That being said, from 2002 to present with all dividends reinvested, both XIU and XIC were neck-to-neck, with XIU having slightly better risk-adjusted returns. I attribute this to the outperformance of large-cap stocks in the last decade and their lower volatility. Over time, I think the difference will narrow as small caps make a resurgence.

If I had to pick one to buy and hold until retirement, I would pick XIC. Controlling sources of known risk like fees and under-diversification are important to me. In this regard, XIC is both cheaper and holds more stocks. For a long-term bet, I’d place my money there.