The S&P 500 is a famous stock market index that tracks the largest 500 companies listed on U.S. exchanges. Widely seen as a barometre for the U.S. stock market, it is comprised of large-cap companies spanning the technology, healthcare, financials, communications, consumer staples, consumer discretionary, industrial, and energy sectors.

Since 1957, the S&P 500 has delivered a solid 8% CAGR. This return is so difficult to consistently beat over time that it is widely accepted as a benchmark for fund managers to compete against. Thanks to the proliferation of exchange-traded funds (ETFs), Canadian investors have easy means of gaining exposure to the S&P 500.

However, many new investors get confused at the myriad of choices out there — in particular, whether to buy a currency hedged vs. unhedged S&P 500 ETF. Today, I’ll be clarifying that for Canadian investors.

What is currency hedging anyway?

The underlying stocks of the S&P 500 trade in USD. When you buy a Canadian ETF, the difference between the CAD-USD pair can affect the value of the Canadian ETF beyond the price movement of the underlying stocks.

ETFs that are not currency hedged accept and ignore this phenomenon. What that means is if the U.S. dollar appreciates, the ETF will gain additional value. Conversely, if the Canadian dollar appreciates, the ETF will lose additional value. This introduces additional volatility that could affect your overall return.

ETFs that are currency hedged will use a derivative called a future to lock in a set CAD-USD exchange rate every month. With a currency hedged fund, the changes between the CAD-USD pair will not affect the value of the fund. You only get the movements of the underlying stocks — nothing more.

Which one should I pick?

For most investors with a higher risk tolerance and longer time horizon, I would recommend unhedged. This is because over time, currency fluctuations (especially between the CAD-USD) tend to even out. Moreover, because the USD usually appreciates vs. the CAD, unhedged ETFs benefited from a boost in performance over the last decade.

The other reason to pick unhedged most of the time is that currency hedging is expensive. Trading those futures contracts and rolling them (selling and buying new ones every month) to hedge currency fluctuations adds trading expenses, which eat into the ETF’s returns.

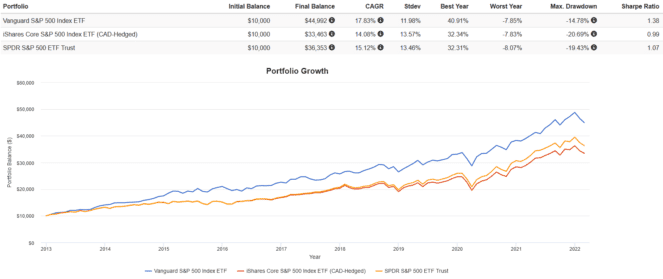

This creates what is called tracking error, or the percentage in the ETF’s performance that differs from the performance of the index it is trying to track. Below I’ve plotted a backtest from 2013 with dividends reinvested of two Canadian S&P 500 ETF’s against the U.S. version:

- Vanguard S&P 500 Index ETF (TSX:VFV), an unhedged ETF with a management expense ratio (MER) of 0.08%.

- iShares Core S&P 500 Index ETF (CAD-Hedged) (TSX:XSP), a hedged ETF with a MER of 0.10%.

There are two things to note here. Firstly, unhedged VFV had massive outperformance, with better returns, less volatility, and lower drawdowns due to the boost it got from the USD appreciating vs. the CAD during this time frame.

Secondly, currency hedged XSP underperformed its U.S. cousin over time. This is due to the tracking error incurred by the trading costs of the currency futures, and the imperfect way they are rolled forward.

The Foolish takeaway

For most investors, currency hedging is simply not worth the additional cost or tracking error. If you have a long time horizon, currency volatility usually evens out and, in some cases, can boost your returns while reducing risk.

That being said, investors who are about to retire may want to consider currency hedging to mitigate unwanted foreign exchange risk. By currency hedging, you ensure that your gains and losses are only due to the movements of the underlying stock and not due to changes between the CAD-USD pair.