Often one of the biggest mistakes that investors will make is holding onto a stock for too long after the investment clearly hasn’t worked out. Holding onto a stock hoping for it to appreciate back to the price you bought it for is usually driven by emotion, something we as investors need to avoid. So it’s crucial that when you have a losing stock, you know when to double down and invest more, but also when to cut your losses and sell.

Not only can holding onto an underperforming stock continue to lose you money if it falls even further in price, but even if it trades flat, you’ll be underperforming several other stocks and opportunities that you could have reinvested that money into.

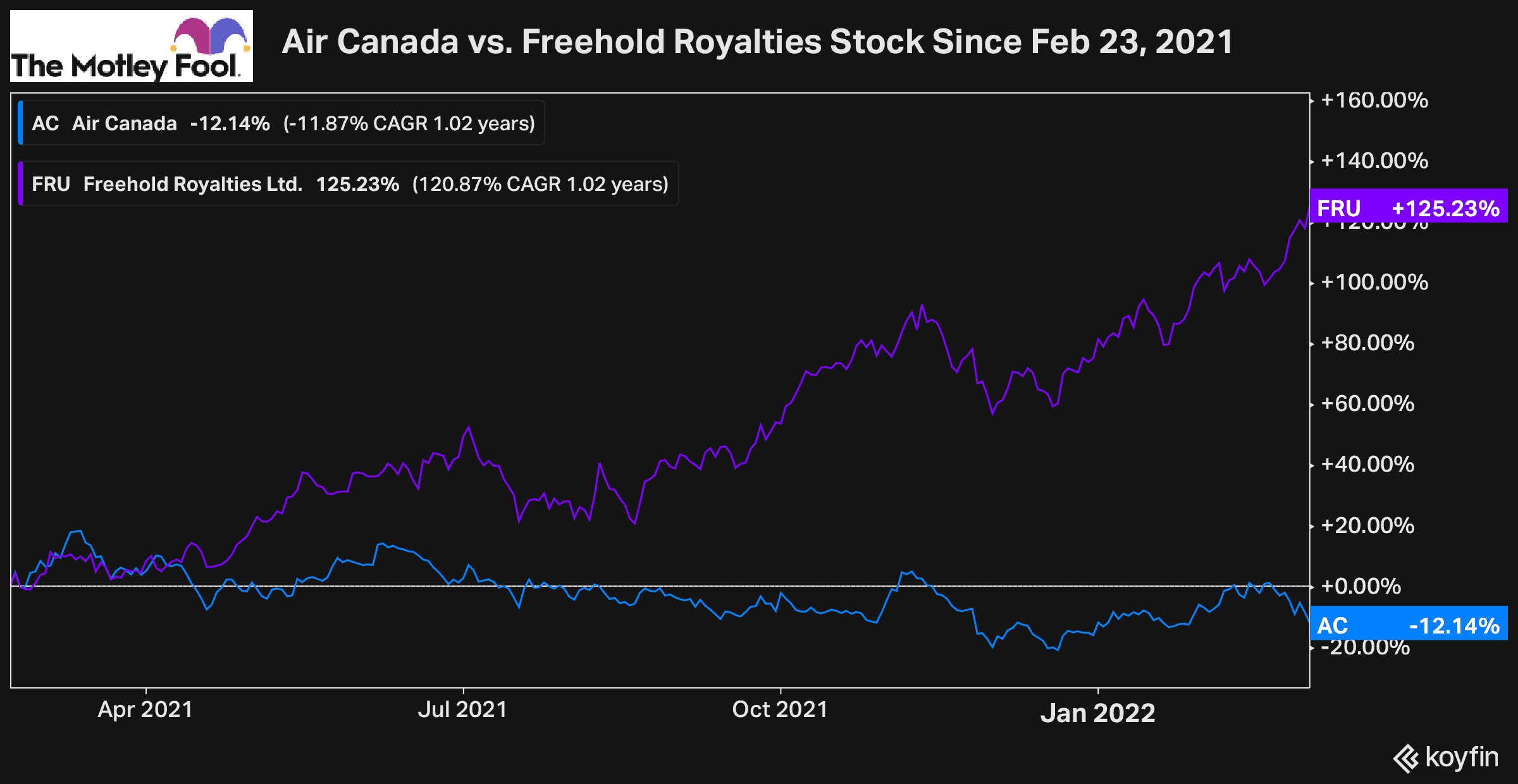

An excellent example of this is Air Canada stock. While it hasn’t declined that much over the last year, it hasn’t gained in value either. I warned of this a little over a year ago and instead recommended investors forget Air Canada and buy a stock with potential now, such as Freehold Royalties.

And as you can see, over the last year, while Air Canada stock has continued to trade flat, and actually lost investors some value, Freehold has earned a total return for investors of 125%.

So here’s how to decide when to sell and move on from a losing stock in your portfolio.

When to sell a losing stock

Typically, you’ll want to abandon an investment idea and sell your stock when the situation changes significantly, or your original investment idea hasn’t worked out. When you originally bought the stock, there was likely a reason you did it.

Consider what has happened in the meantime. If the circumstances in the industry have changed, or if the company has been unable to execute on goals, you’ll want to re-evaluate your investment and potentially decide to sell the stock. If something different has happened, such as the pandemic impacting it, and it’s significant enough to impact the strategy considerably, it’s likely worth selling.

Sometimes unfortunate things happen. That’s why we diversify our portfolio. But more often than not, it’s much better to cut your losses quickly than to hold on for months or even years and hope for a stock to recover.

Investors still holding BlackBerry, for example, after last year’s massive rally may want to sell. The stock was already highly speculative last year, plus it faces heavy competition in the tech space. In addition, there are plenty of other tech stocks that not only trade cheap but offer a better opportunity for growth.

Bottom line

Investors need to exercise discipline at all times. It’s crucial we do our best not to let emotions drive decisions. At the same time, we don’t want to hold on to poor-performing stocks, we also don’t want to sell high-quality stocks just because they are down slightly, out of fear of larger losses.

You shouldn’t sell every stock that underperforms or experiences a dip. You need to decide which stocks are the highest quality to know when to abandon an idea and when to double down and use the dip as an opportunity to buy more of the stocks you truly believe in.

If you can do this, stay disciplined, and keep a long-term mindset, cutting your losses and riding your winners, you’ll maximize the long-term growth potential of your portfolio.