True “passive” income should be simple and relatively worry free. Unfortunately, often traditional sources of passive income, like rental properties, are far from that. Fortunately, TSX dividend stocks can provide stable passive income and relative peace of mind.

Buy-and-hold stock investing can create true passive income

Now, as you may have seen lately, stock markets can be very volatile. One day the TSX Index is up a few percentage points, and the next it is down a few percentage points. The reality is, in the short term, stocks are incredibly volatile. However, over years and decades, stocks have been very good investments for reliable returns.

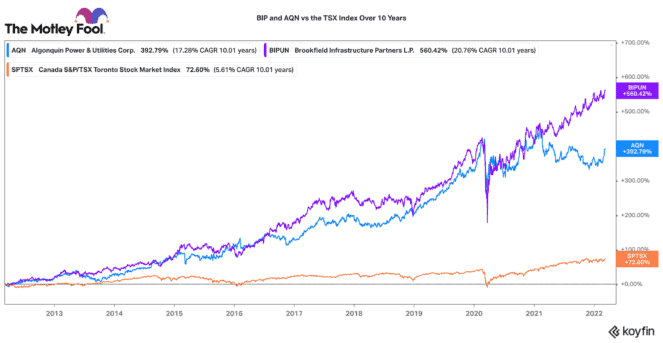

If you don’t mind buying and holding stocks for the long term, you can earn a very attractive combination of passive dividend income and modest capital gains. In fact, if you pick the right stocks wisely, you can even outperform the TSX.

Two reliable passive-income stocks that might help you get there are Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) and Algonquin Power (TSX:AQN)(NYSE:AQN).

Brookfield Infrastructure: Growth and income combined

Brookfield Infrastructure Partners is one of the largest singularly focused infrastructure businesses in the world. It owns and operates everything from toll roads, railroads, and ports to data infrastructure, cell towers, midstream assets, and utilities. It is diversified by geography and asset class, so this helps offset operational cyclicality in its portfolio.

Last year, it grew funds from operation per share by 16% to $3.64. Net income per share increased nearly 400% to $1.74! This was supported by very strong organic growth and the smart acquisition of Inter Pipeline’s integrated midstream network.

BIP stock is a great hedge against inflation because over 70% of its assets have inflation-indexed assets. Consequently, it gets an attractive boost in cash flows when the economy heats up. It also stands to benefit when commodities rise, because it captures better pricing and higher volumes through its energy and transport assets. It stands to do very well in the present uncertain environment.

BIP stock has been great for growing streams of passive income. Over the past 10 years, it has increased its dividend annually by 9.9% on average. Today, it pays an attractive $0.69 distribution per share every quarter. That equals a 3.6% dividend yield now. For a great combination of growth and income, you don’t find much better than BIP today.

Algonquin Power: A top utility for passive income

Algonquin Power is also a great infrastructure stock. It has a core focus on utilities and renewable power assets. Like BIP, it has been a great passive-income stock for years. Over the past 10 years, it has grown its dividend annually by 9.5% a year. Right now, it pays a quarterly dividend worth $0.2161 per share. On an annualized basis that equals a 4.4% dividend yield.

Despite several weather and operational challenges in 2021, Algonquin still grew adjusted earnings per share by 11% and adjusted EBITDA by 24%. The company is investing in a $12.4 billion capital plan that should translate into 7-9% annual earnings-per-share growth for the next five years. That will likely translate into a similar rate of dividend growth going forward.

Algonquin is in a sweet spot today. Energy is in short supply, and Algonquin is in a prime spot to provide green renewable energy across its utility portfolio. Likewise, it has a growing fleet of renewable power projects and partnerships.

Consequently, opportunities may be plentiful in the future. For a utility growing faster than average, Algonquin is in a prime position to deliver passive income and reasonable capital returns for many years to come.