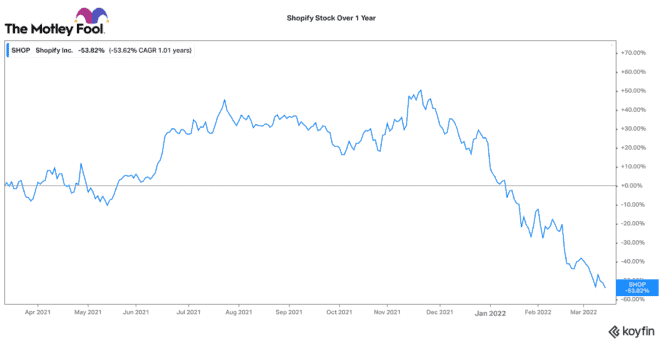

Shopify (TSX:SHOP)(NYSE:SHOP) stock continues to tumble in 2022. Just in the past three months alone, Shopify stock has fallen by nearly 63%, and that selling pressure doesn’t appear to be abating. Perhaps before we ask if it is a buy, we should ask why it has collapsed.

Shopify stock was trading at sky-high valuations

In the third quarter, Shopify stock was trading for nearly 32 times sales, 230 times EBITDA, and 280 times earnings. With pandemic lockdowns massively pulling forward e-commerce sales, Shopify enjoyed a once-in-a-lifetime revenue and earnings windfall. For example, sales and EBITDA jumped 85% and 582% in 2020 alone. Obviously, this massively propelled interest in Shopify stock as well.

Liquidity is constricting

As the economy crashed on news of the COVID-19 pandemic (and subsequent lockdowns), governments stimulated the economy with tools like the CERB, stimulus cheques, and nearly all-time low interest rates. This meant investing with margin (debt) was cheap and excess cash was thrown into the stock market. This helped fuel the drastic rise in COVID-19 stock winners like Shopify.

Today, central banks are raising rates and pulling back economic stimulus policies. As a result, less capital is out there chasing stocks today. Investors are taking profits from their 2021 winners and recycling that capital into more defensive stocks.

Shopify’s guidance was lower than expected

The spark that triggered Shopify’s severe decline was its lower-than-expected 2022 guidance. E-commerce demand is normalizing, and sales growth is slowing. Consequently, Shopify will likely face some very tough year-over-year comparable results. Likewise, the company is rejigging several services (including its fulfillment network), and that could lead to intensified capital spending in 2022.

There is no doubt Shopify is an exceptional business. However, there are many exceptional Canadian stocks that are growing steadily but trade at much more reasonable valuations. Despite Shopify’s recent collapse, it is still a pricey stock.

Shopify is an exceptional business but still a pricey stock

Right now, at around $660 per share, it still trades for 10 times 2022 projected sales, 90 times EBITDA, and 147 times earnings. Certainly, the shares are getting more attractive, but they are far from a steal here.

Chances are good that Shopify’s forward annual growth will likely normalize to the mid-30% range. Given that, it appears the valuation may still be a little steep. What’s to say there isn’t more downside to come? Unfortunately, it is impossible to predict when Shopify stock will bottom. Even the most seasoned investors find it challenging to time the market.

The Foolish takeaway

If you are convinced that Shopify stock is worth its value at today’s price, one investment method is to break your position into thirds. Tech stocks could still see more downside, but they can reverse course quickly. If it goes down, you could always add another third to your position. If the market recovers, you could always add more on the upswing.

At the end of the day, take a long-term approach. If you believe Shopify’s business is going to be much, much larger in three, five, or 10 years, then you should probably own its stock. Over the long term, even valuation errors can be ironed out by stocks in great-quality businesses like Shopify.