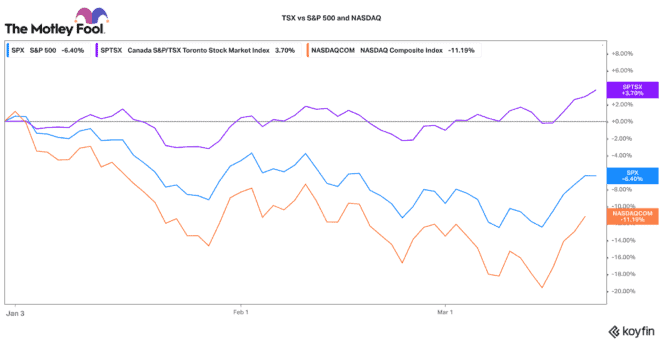

Despite all that is going on in the world, Canadian stocks have been performing with strength in 2022. I hope I don’t jinx it, but so far, the S&P/TSX Composite Index is outperforming top American indices (the S&P 500 and the NASDAQ) by at least 10%. There is certainly a lot of bad news in the world. At least this is one thing Canadian investors can be optimistic about.

I have never met a rich pessimist

Have you ever heard the saying, “I have never met a rich pessimist”? It is completely true. Doom and gloom predictions ultimately cause you to generally do nothing. As a result, you are much more likely to miss out on great investing opportunities. Dark times are often the best times to start investing. As Warren Buffett has said, “You pay a very high price in the stock market for a cheery consensus.” The inverse of this statement is also true.

Optimism can go a long way when investing in Canadian stocks

Optimism is a crucial aspect of investing. As Motley Fool co-founder David Gardner tweeted a year or so ago, “Optimism is rational! … And boy, does it work for investing.” Investing is all about looking to the future and believing a business will have better prospects, better products, better sales, and better earnings/cash flows. If you can’t believe in a better future for a business (or the world), you really shouldn’t be investing in it at all.

If you are feeling optimistic this March, here are two top Canadian stocks you might want to consider buying now and owning for the long term.

Brookfield Asset Management: A high-quality Canadian stock to be optimistic about

Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) operates an incredibly diverse business of alternative assets. It is a great anchor for any Canadians portfolio. You get exposure to renewables, real estate, private equity, infrastructure, debt, and insurance.

Not only are these good assets, but they are also highly envied by large institutions. As a result, institutional investors are flocking to partner with Brookfield for a stake in their cash flows and profits.

Despite that, Brookfield trades at a material discount to its peers — so much so that management believes Brookfield’s intrinsic value is as much as 30% higher from its current stock price. Given that margin of safety, this is a very attractive Canadian stock to buy today and hold for that value to unlock.

TELUS International: A stable growth stock

TELUS International (TSX:TIXT)(NYSE:TIXT) is a beat-up technology stock. Year to date, this Canadian stock is down 22%. While that doesn’t sound like a screaming endorsement, TELUS International really does have an interesting business.

It helps large-scale corporations digitize their customer experiences and offerings. It has a specialized focus on artificial intelligence and machine learning. In essence, it helps some of the world largest businesses (think Facebook, Google, etc.) streamline and better manage their customer interactions.

While growth may will taper in 2022, projected high-teens revenue and EBITDA growth is nothing to scoff at. The company has a solid balance sheet, so an acquisition or two could bolster its outlook.

Fortunately, the stock only trades with an enterprise value-to-EBITDA ratio of 13 and a free cash flow yield near 5%. Consequently, on a price-to-growth-to-value metric it is pretty attractive. For a stable Canadian growth stock, TELUS International is a great long-term bet for optimistic Canadians.