For most of the past decade, we Canadians have been fighting with an entirely stubborn Canadian stock market.

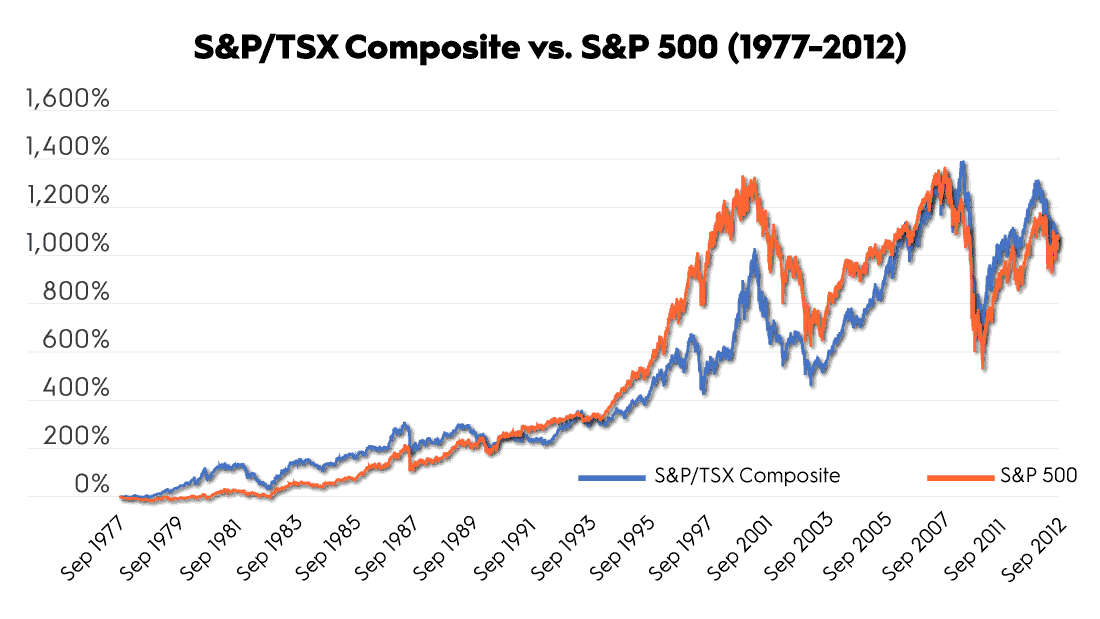

From 1977, when the index was created, up until about 10 years ago, the Canadian market and the U.S. stock market booked nearly identical returns … which is rather astonishing given the different makeup of the two economies.

You can see that there were periods of divergence, but overall, you’d have been just as well off invested in a Canadian index fund as you’d have been in a U.S. index fund – ignoring currency considerations:

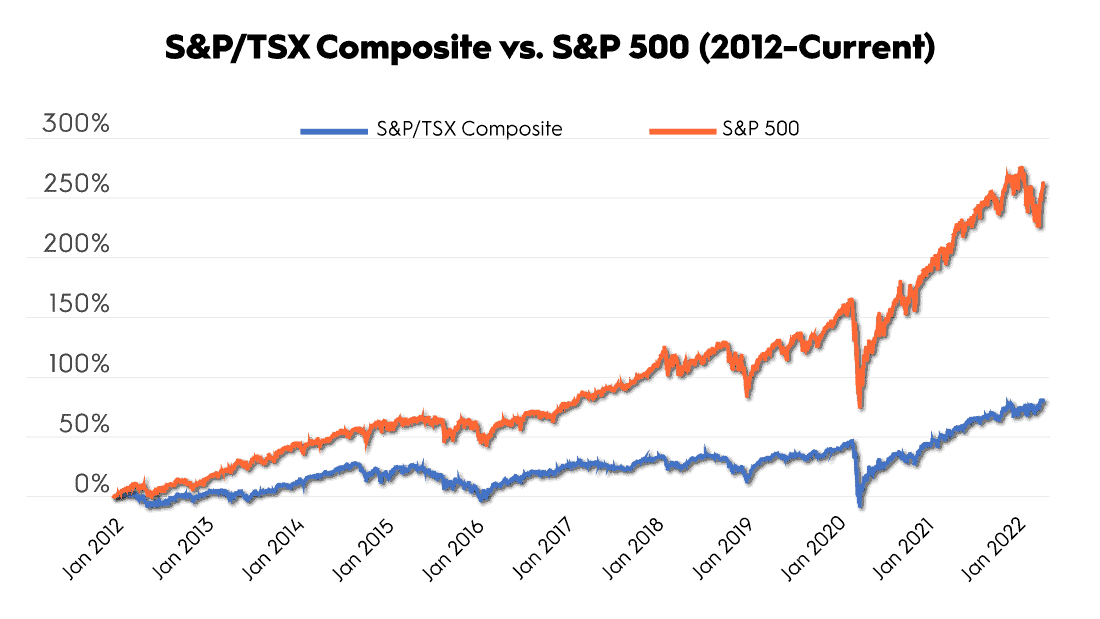

But starting in 2012, market performance began to diverge – and we Canadians got the short end of the stick. We’ll get to the “why” in a moment, but as you can see in the graph below, we’re talking a rather meaningful difference, especially in the context of history.

(The only other time the Canadian and U.S. stock markets veered apart this significantly was during the 90’s, when U.S. tech stocks were running wild – something that serves as a touch of foreshadowing.)

So What’s Happening Now? Investing in the TSX vs. SP500

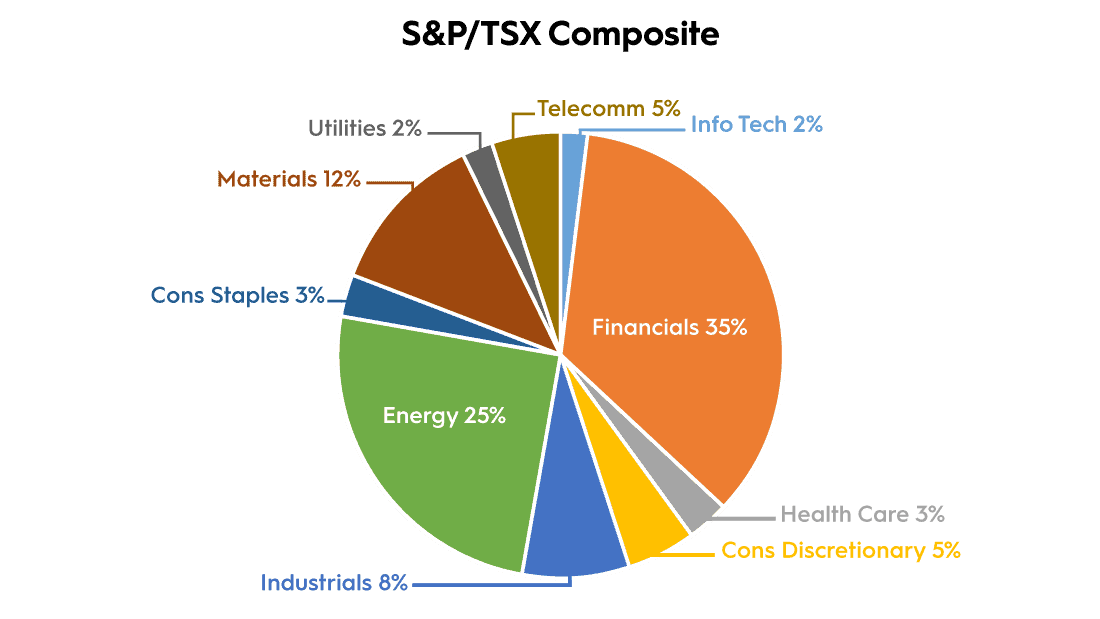

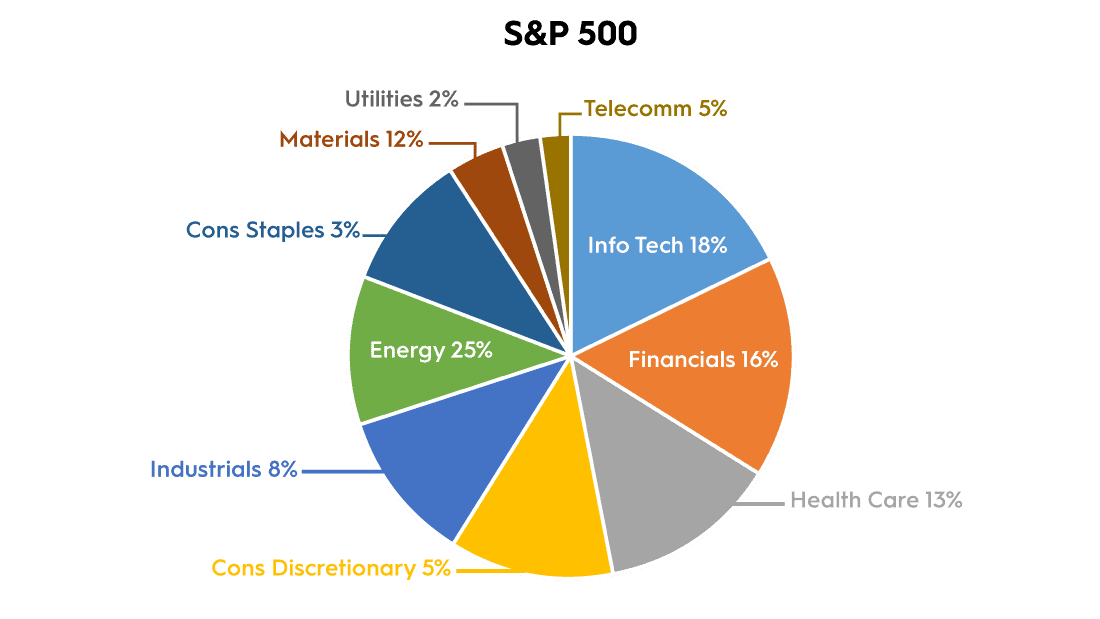

To understand why the markets have diverged in the past decade, let’s look at the actual companies in each market.

The charts below convey the makeup of the Canadian and U.S. markets, by sector, starting about when our Great Divergence began to take hold:

There are three sectors that I’ll draw your attention to: energy, materials and information technology, or simply technology, as the kids like to say.

In the early days of the divergence, energy (oil and natural gas) and materials (think mining and natural resources) accounted for a whopping 37% of the Canadian stock market, compared with just 15% of the U.S. market. Technology was a measely 2% of the Canadian market and 18% of the U.S.’s.

Guess what has and has not performed very well over the past decade?

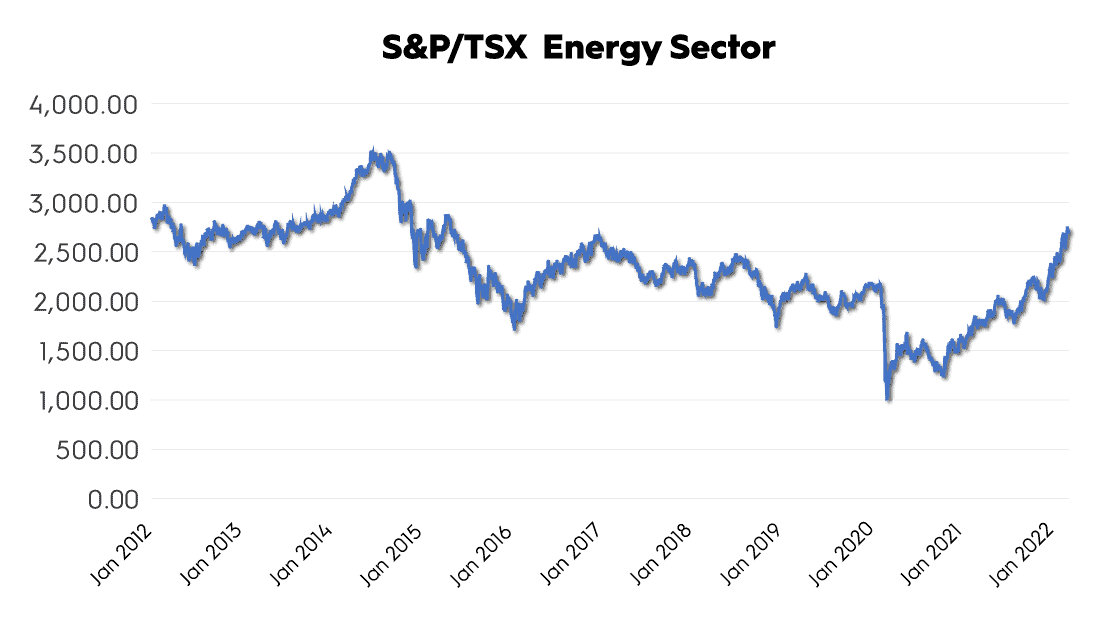

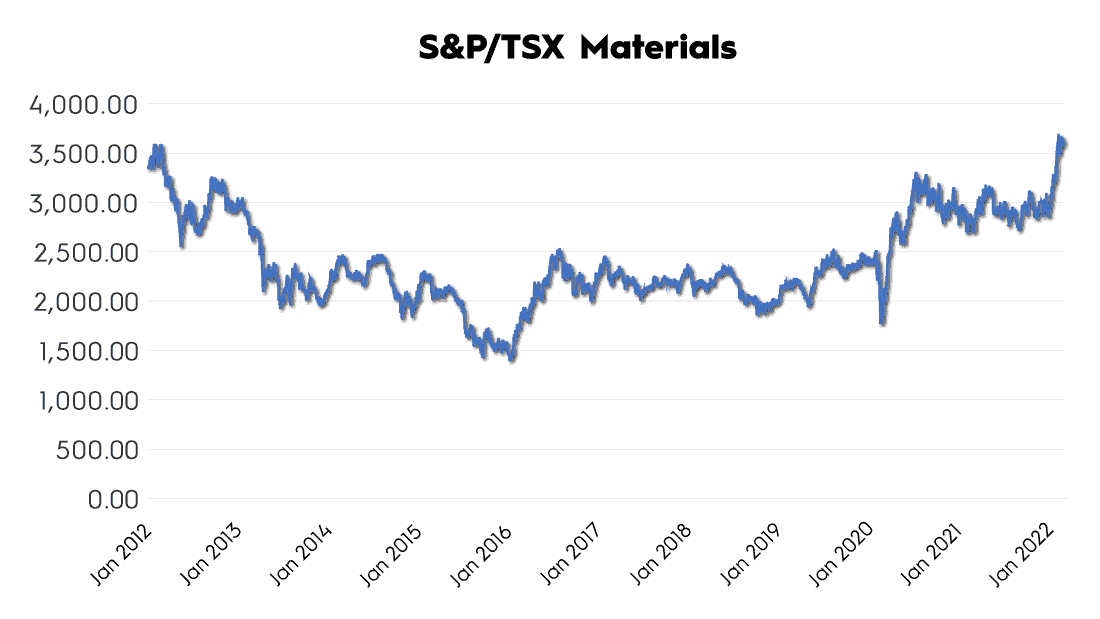

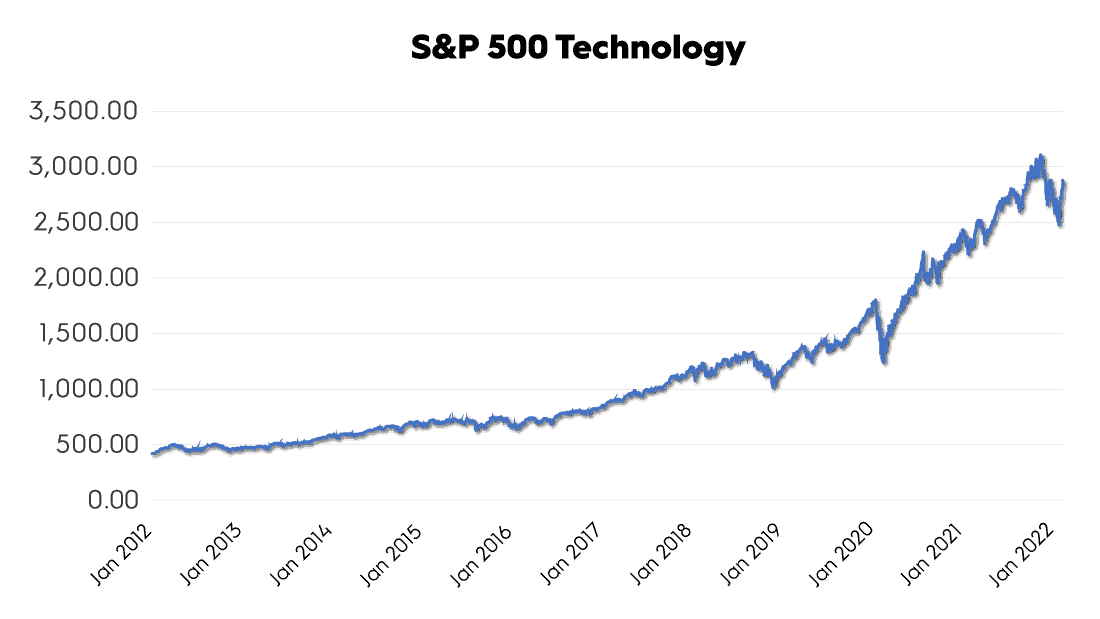

The following charts almost speak for themselves and show what it’s been like for Canadian investors – the TSX has basically been fighting with both hands tied behind its back.

Essentially, the Canadian energy and materials sectors are now where they were at the beginning of 2012. And that’s with a considerable move over the past year or so.

Meanwhile, the technology sector in the U.S. has grown about 6 times.

Here’s how the sectors currently stack up:

| Canada | U.S. | |

| Energy | 16.2% | 3.8% |

| Materials | 13.2% | 2.6% |

| Technology | 6.8% | 28.0% |

As you can see, the coming decade stands to be even more defined by Energy/Materials/Technology (EMT) given how much more significant technology has become in the U.S. stock market and how inconsequential energy and materials have been for the investors to our south.

Alright – that’s the easy part out of the way.

We just need to know how the EMT sectors will perform in the decade ahead, and then we’ll know which market, the Canadian or U.S., will be the winner.

See the problem?

Nobody knows how EMT will perform over the next week, let alone the next decade.

BUT … there are indications that at least the here-and-now will be much friendlier to our good ol’ energy and materials.

Canada’s Commodities Moment: Finally Shining in the Spotlight

Commodities are cyclical investments, which means that they fall in and out of favor and back in again.

It can seem intimidating to invest in commodities, but commodity “analysis” doesn’t have to be any more complicated than this:

The answer to high prices is high prices, and the answer to low prices is low prices.

When prices for commodities, such as oil, are high, capital pours into the earth and all sorts of new commodity plays are brought to life … so much so that supply eventually overwhelms demand, which drives down commodities’ prices.

When prices are subsequently low, capital evaporates. Existing commodity plays are not replenished or replaced, and eventually, demand has the upper hand over supply. Prices rise, and around and around we go.

Timing these cycles precisely is impossible, but as sure as the sun will rise in the east tomorrow, elevated commodity prices will lead to depressed commodity prices which will lead to elevated commodity prices.

Oh Canada: It’s Time to Invest

And fellow Fools, we are now on the back end of a decade in which a variety of commodities, especially oil and natural gas, have been trudging through a cyclical downturn.

Heck, in April 2020, the price of oil went negative for a relative minute. If that doesn’t mark a cyclical bottom, I don’t know what does.

Remember our equation:

The answer to high prices is high prices, and the answer to low prices is low prices.

Currently, it’s our opinion that we’re at “the answer to low prices is low prices” portion of this equation.

Commodities have been relatively starved for capital over the past decade. But demand for those commodities remains. This should bode well for investors in the years ahead.

What makes this our “Canadian Moment,” however, comes down to the geopolitical situation that’s arisen between Russia and Ukraine.

Russia’s sanction pains have turned into maple leaf gains in a matter of weeks due to the two countries’ strikingly similar commodity baskets. Before invading Ukraine, Russia provided about 10% of the global oil supply. Canada has the fourth-largest oil reserves in the world. Roughly 30% of the global potash supply has been removed from markets because Russian and Belarus producers can’t export. Canada has the world’s largest potash reserves, at 1.1 billion tonnes.

We’re talking commodities that are critical when it comes to keeping the lights on, providing heat (and air conditioning) and most importantly of all, feeding we humans.

Which is why, as reported by the Wall Street Journal, two weeks after Russia invaded Ukraine, Brazil’s agriculture minister was on a plane to Canada to head off a potential crop crisis.

Before the Ukraine conflict, Brazil imported about 36% of its potash from Canada, compared with close to half imported from Russia and Belarus.

Crude oil, uranium, nickel and potash … just to get the list going. Russia is a big producer of all, and if the world has turned a cold shoulder on Russia, the world is going to come knocking on Canada’s door to meet the ongoing demand.

How the War in Ukraine Affects Canadian Companies

To serve as some indication of what’s ahead:

Nutrien, the world’s largest corporate potash producer, is increasing production by 10%, to 15 million metric tons in 2022. Canada’s largest uranium producer, Cameco, plans to ramp up production at its mines by 10 million pounds by 2024.

The federal government has said Canadian oil producers — including Canadian Natural Resources, Suncor, Cenovus, and Exxon affiliate Imperial Oil — will raise production and boost exports by 300,000 barrels a day to help countries trying to wean themselves off Russian supply. Alberta, Canada’s main oil-producing province that relies on industry revenues, expects a budget surplus for the first time in eight years.

Increased production means fattened bottom lines for all of the companies mentioned, especially considering that they’ve spent much of the past decade cutting costs to insulate as best they could from the harsh environment that depressed commodity prices brought on.

(I know, I know, we can already see the seeds of the next cyclical downturn being sown.)

Again though, timing these cycles is impossible and from where we sit, we’re far more in the throes of a cyclical recovery than we are a cyclical decline. And bodes well for the Canadian stock market overall given the near 30% exposure we’ve to energy and materials.

TSX Hits All-Time Highs: Are You Getting Your Share?

If you’re one of the many investors who’s written off the Canadian market to chase U.S. tech stocks, you might want to reconsider. Consider this your alarm clock.

The Canadian stock market is finally having its moment in the sun. The S&P/TSX Composite posted a first-quarter gain of 3.1% and is touching all-time highs.

The world is waking up to our vast resources and it’s an exciting time to be a Canadian investor investing in high-quality Canadian companies, such as the aforementioned Nutrien (TSX:NTR). This giant of the global fertilizer industry is a long-time recommendation of our flagship Stock Advisor Canada advisory service and has generated a 294% return for those who bought shares when the original recommendation was made all the way back in 2014.

And keep in mind that this investment return was generated under relatively cloudy skies for Nutrien and many of its commodity-producing peers. Now that the clouds have parted, we could be looking at significantly better business results for Nutrien and further outsized return in the years ahead.

If you don’t already own the likes of Nutrien and the many other Canadian companies poised to profit, what are you waiting for?

Our Canadian investing team hasn’t been afraid to wade in throughout the commodity downcycle and find some very attractive bargains, like Nutrien, for our members.

We’re as excited as we’ve been since the inception of Fool Canada (10 years ago!) about what’s in store for the Canadian stock market. The friction we’ve experienced has diminished, and it’s time to make hay.

Join us!!!!