Canadian real estate investment trusts (REITs) are a great vehicle to earn monthly passive income for lazy landlords. If you have ever owned an income property (a condo, vacation rental, retail property), you probably know it is hardly passive.

A lot of work goes into managing an investment property

There is always something to do. You have budgets, accounting, tenant expenses, constant maintenance and repairs, taxes, utilities, lease negotiations, tenant evictions, advertising, and the list goes on.

Unless you are very experienced and knowledgeable in these aspects, owning a passive income property can be a lot of work. Many people forget to factor in the time/energy component when contemplating a rental property purchase. As a result, an income property can be much less profitable than first thought.

REITs are diverse, liquid, and passive

Given some of these challenges, I prefer to buy stocks in Canadian REITs instead. Through REITs I can buy a broad array of real estate asset classes (industrial, residential, retail, medical, seniors, storage, etc.). Publicly traded REITs are liquid (cheap and easy to buy and sell) and are easy to research. Likewise, many pay attractive monthly distributions.

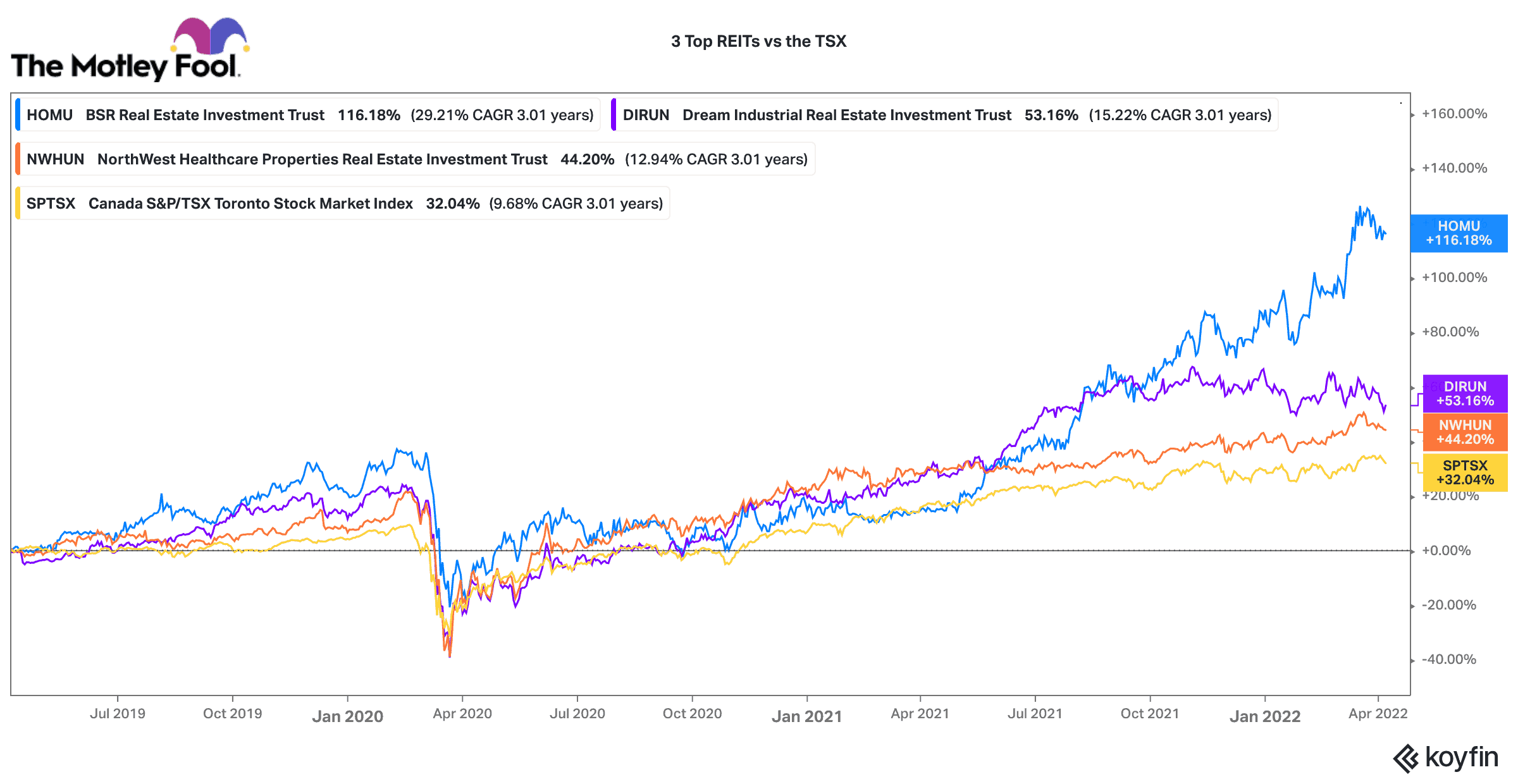

For reliable income and capital appreciation, these can be very effective passive investment vehicles. If your interest is piqued, here are three Canadian REIT stocks I would buy today.

Dream Industrial REIT

Dream Industrial REIT (TSX:DIR.UN) is one of Canada’s largest industrial REITs. It owns warehouse, distribution, and light-industrial properties across Canada, the U.S., and Europe. During the pandemic, Dream drastically accelerated its acquisition strategy (especially in Europe), which diversified its portfolio and rapidly reduced its cost of capital.

Last year, Dream grew funds from operation per unit (a key cash flow metric) by 13%. That was better than the 10% expected. Its net asset value increased by over 20%. These metrics were driven by a very low cost of debt (0.83%), accretive acquisitions, and strong rental rate growth (19%).

Dream pays a monthly distribution of $0.05833 per unit. That equals a 4.5% yield right now.

NorthWest Healthcare REIT

If you want an elevated distribution yield upfront, NorthWest Healthcare REIT (TSX:NWH.UN) is a stock to look at. It pays a $0.0667 per unit distribution every month. That equals a 5.8% dividend yield today.

NorthWest owns a large portfolio of medical, hospital, and life science properties across the world. The health care property asset class is attractive because of its high-grade (often government) tenant mix and long-term leases (over 12 years). Of NorthWest’s properties, 70% have inflation-indexed leases. Consequently, it has an attractive hedge against inflation.

NorthWest is transitioning to an asset management strategy, which should help deliver higher margins and better cash flow per unit accretion going forward.

BSR REIT

Residential real estate is another attractive, stable asset class. Everyone needs a place to live. In a high-inflation environment, these REITs can quickly raise rents to counter rising costs. That is why I like BSR REIT (TSX:HOM.UN).

Its multi-residential properties are in some of the fastest growing municipalities in the U.S. (like Austin, Dallas, and Houston). These are unregulated markets, so rent control is not a concern. High immigration and low vacancy in these markets means ultra-fast rental rate growth.

Given this dynamic, one analyst noted that BSR is putting up numbers that are “‘techish’ these days.” The strong market could translate into +20% cash flow per unit returns in 2022. The strong market dynamics are not expected to abate any time soon.

This Canadian REIT pays a $0.054 distribution every month. For a 2.5% distribution yield and attractive capital upside, this BSR is a great REIT to buy and hold for the long term.