Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

The financial sector outperformed in 2021 and 2022 thanks to a series of central bank interest rate hikes. Both BlackRock and BMO Global Asset Management provide a set of low-cost, high-liquidity ETFs that offer exposure to a portfolio of TSX financial sector stocks.

The two tickers up for consideration today are iShares S&P/TX Capped Financials Index ETF (TSX:XFN) and BMO Equal Weight Banks Index ETF (TSX:ZEB). Which one is the better option? Keep reading to find out.

XFN vs. ZEB: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

XFN has an MER of 0.61% vs. ZEB at 0.28%. ZEB is clearly the cheaper ETF here. For a $10,000 portfolio, choosing ZEB over XFN will save you around $33 annually, which can add up significantly over the long run.

XFN vs. ZEB: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

XFN has attracted AUM of $1.49 billion, whereas ZEB has AUM of $2.77 billion. Although both are sufficient for a buy-and-hold investor, ZEB is currently the more popular ETF among Canadian investors.

XFN vs. ZEB: Holdings

XFN tracks the S&P/TSX Capped Financials Index, which tracks the performance of 27 TSX energy stocks. Each stock in XFN is subjected to a 25% cap on their weight. The top holdings of XFN include all five big bank stocks, but also Brookfield Asset Management, Manulife Financial, and Sun Life Financial.

ZEB tracks the Solactive Equal Weight Canada Banks Index, which tracks the performance of TSX bank stocks. ZEB is equally allocated between six stocks: Royal Bank, Bank of Montreal, National Bank of Canada, Toronto-Dominion Bank, Bank of Nova Scotia, and Canadian Imperial Bank of Commerce.

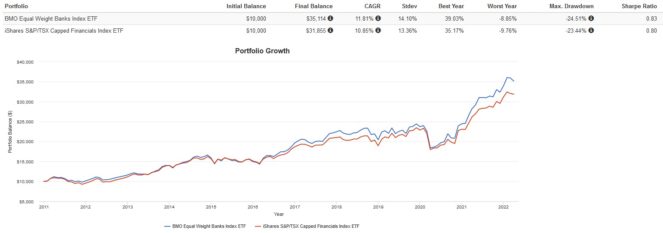

XFN vs. ZEB: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2011 to present:

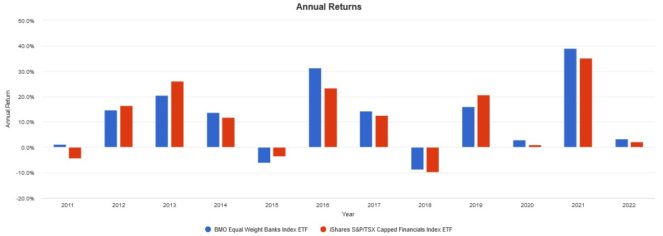

Here are the annual returns from 2011 to present:

ZEB outperformed XFN over the last decade. I attribute this to ZEB’s concentration in TSX bank stocks, which posted higher-than-average revenue and earnings growth and consistently increased dividends over the last decade. This outperformance depends on their ability to continually beat the market moving forward, which is not assured.

The Foolish takeaway

If I had to choose one ETF to buy and hold, it would be ZEB. Although it is less diversified, Canada’s Big Six banks are solid enough picks that I would feel comfortable holding them as a proxy for the TSX financial sector. ZEB also has much lower MER and higher AUM compared to XFN. Still, if you wish to track the broad TSX financial sector by also including insurance companies, asset managers, and alternative lenders, XFN is a good pick as well.