Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Yield-hungry passive-income investors in 2022 have turned to covered call ETFs as a viable alternative in sideways-trading volatile market conditions. For those of you unfamiliar with how these ETFs work, I highly suggest giving this article a read first.

BMO provides an excellent lineup of covered call ETFs, which hold a variety of different market sectors as their underlying assets to write covered calls against.

The two tickers up for consideration today are BMO Covered Call Canadian Banks ETF (TSX:ZWB) and BMO Covered Call Utilities ETF (TSX:ZWU). Which one is the better option? Keep reading to find out.

ZWB vs. ZWU: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

ZWB has an MER of 0.72%, compared to ZWU at 0.71%. The difference between the two is $1 in fees annually on a $10,000 portfolio, making them virtually tied. Still, if we had to pick a winner, the nod goes to ZWU.

ZWB vs. ZWU: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

ZWB has attracted AUM of $2.76 billion, whereas ZWU has AUM of $1.66 billion. Although both are sufficient for a buy-and-hold investor, ZWB is currently the more popular ETF among Canadian investors right now.

ZWB vs. ZWU: Holdings

ZWB holds six big Canadian bank stocks at equal weights, with an overlay of out-of-the-money calls on 50% of the holdings. The current distribution yield is 6.24%. The ETF is therefore 100% in the banking sector, which is not diversified at all.

ZWU holds 24 Canadian and U.S. utilities, telecom, and energy sector stocks, with an overlay of out-of-the-money calls on 50% of the holdings. The current distribution yield is 6.98%. The ETF is better diversified, with 55% in utilities, 25% in telecom, and 20% in energy sectors.

ZWB vs. ZWU: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

Here are the trailing returns from 2013 to present with all distributions reinvested:

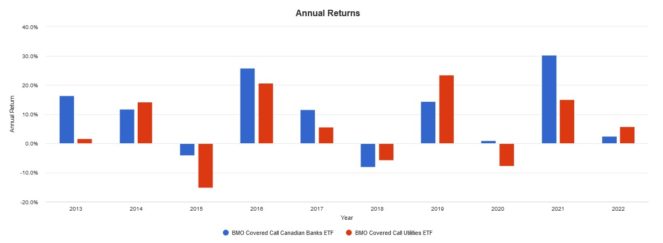

Here are the annual returns from 2013 to present with all distributions reinvested:

ZWB outperformed ZWU over the last decade. I attribute this to the stellar performance of Big Six Canadian banks — in particular, their ability to continually beat earnings expectations and raise dividend payouts. This hasn’t been the case in 2022 though, as the energy and utilities sector pulled ahead.

The Foolish takeaway

If I had to choose one ETF to buy and hold, it would be ZWU. Both ETFs have nearly identical MERs, and ZWB has more AUM, but when it comes to holdings, I feel more comfortable not staking my portfolio on just six big Canadian banks, no matter how solid they are. Covered call ETFs are intended for those with high passive-income needs, so staying as diversified as possible is beneficial for long-term holding.