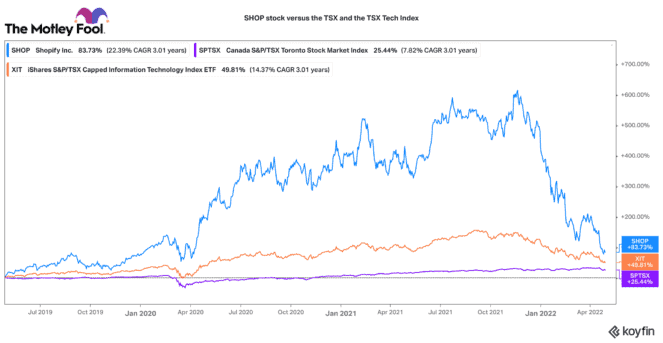

2022 has been an ugly year for Shopify (TSX:SHOP)(NYSE:SHOP) stock. It has declined by 68.5% since the beginning of the year. At around $550 per share, its stock is down 74% from its all-time highs set in November last year.

It may be some comfort to know that Shopify is not the only stock down significantly in 2022. Many high-flying Canadian technology and growth stocks have seen 50% drawdowns or more. Why is this?

Why are tech stocks like Shopify collapsing in 2022?

There are several reasons. Firstly, interest rates and stock valuations tend to have an inverse relationship. As interest rates increase, the cost of investable capital increases. Consequently, cheap money is no longer available for high-growth stocks to fund unprofitable ventures. Consequently, the market discounts their growth estimates and valuations pull back.

Secondly, the rapid decline in a stock’s value tends to cause a domino effect. The more a stock drops, the worse the sentiment gets, and the more the stock drops. It is amazing how sentiment for a real business can drop so quickly, just because the stock has declined.

Lastly, the growth outlook for high-growth tech stock is starting to wane. The easy money has been made over the pandemic, and the market is adjusting for more normalized results. Likewise, factors like inflation and supply chain challenges are starting to impact margins and decrease profitability.

Shopify stock is near its March 2020 lows

All these factors are contributing to Shopify’s recent decline. The stock has now hit levels not seen since the March 2020 crash. Yet even after the recent decline, Shopify stock is still not exactly cheap.

It still trades for 144 times 2022 expected earnings. Likewise, it trades with an enterprise value-to-EBITDA ratio of 93. Fortunately, its price-to-sales ratio appears a bit more attractive today. At nine times sales, it is trading at levels not seen since February 2017.

While the valuation has improved, it remains a very expensive stock, especially when compared to the market. The biggest concern investors need to factor is whether it can sustain its +30% annual growth projections for the next few years. If its outlook waivers from that rate, the market may further discount the stock.

A top tech analyst is warning caution on Shopify stock

Recently, veteran tech analyst, Mark Mahaney warned Shopify stock investors to be “cautious near term.” He noted several headwinds that are facing the e-commerce business. These include softening e-commerce demand (particularly in Europe), supply chain challenges, rising wages and operating costs, a slowdown in merchant growth, and rising competition, especially in fulfillment.

Amazon.com, the largest e-commerce business in the world, just came out with results that were heavily impacted by rising inflationary costs. Its stock dropped 14% after its earnings release. Shopify will report earnings in a few days, and we could find it is not immune to similar headwinds.

The bottom line

Shopify is an exceptional business. It has positioned itself as one of Amazon’s most formidable competitors. Its services empower global small- to medium-sized merchants to effectively compete against retail giants. It has executed on this mission with precision.

Yet we are in unprecedented economic times, and there are many factors that could lead to short-term volatility. At some point, Shopify stock may hit a valuation that screams a buying opportunity.

However, it doesn’t appear to be “screaming” just yet. While I wouldn’t bet against Shopify over the long run, there is merit to being cautious with this stock until some of the near-term clouds clear.