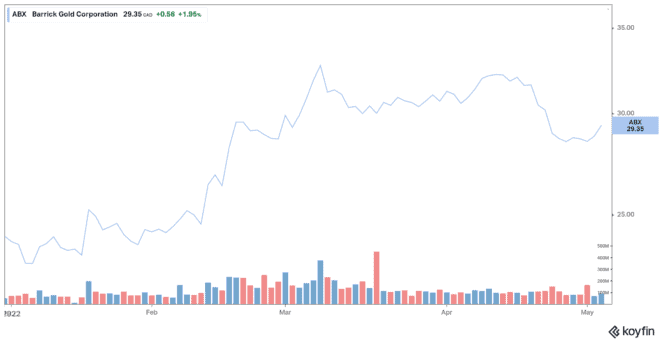

Mining company Barrick Gold (TSX:ABX)(NYSE:GOLD) reported its first-quarter financial results on Wednesday. The miner reported lower first-quarter earnings, but profit was above expectations. Let’s see if Barrick stock is a buy after its Q1.

Barrick Gold posts lower earnings and gold production

The Canadian mining giant said net income fell to $438 million, or $0.25 per share, in the quarter ended March 31, down from $538 million, or $0.30 per share, a year earlier. The drop in earnings was due to lower production at its Carlin and Cortez mines in Nevada.

Adjusted earnings per share of $0.26 in the first quarter were above estimates of $0.24. Profit was above Wall Street expectations thanks to higher gold and copper prices.

Revenue fell to $2.85 billion from $2.96 billion, while analysts had expected a drop to $2.8 billion.

Realized gold prices rose 5.6% to $1,876 an ounce in the first quarter from a year earlier, while copper jumped nearly 14% to $4.68 a pound.

Gold prices rose above $2,000 an ounce in early March, as Russia’s invasion of Ukraine boosted its appeal as a safe haven.

Similar to other miners, gold production fell 10.1% to 990,000 ounces in the quarter due to lower output from its Nevada gold mines.

Reko Diq project restarts

Barrick’s Reko Diq project, suspended since 2011 due to a dispute over the legality of the licensing, restarted in March thanks to an agreement with the government of Pakistan, where it is proposed. CEO Mark Bristow is due to meet Pakistan’s new prime minister Shehbaz Sharif later this month to discuss the proposed project in Balochistan province near the border with Afghanistan.

The senior executive said that Reko Diq is one of the largest undeveloped copper and gold deposits in the world, noting that a feasibility study is underway.

Mark Bristow underlined that the first quarter showed promising results for all regions, with new mining potential identified in Nevada, Argentina and in the Loulu district in Africa.

2022 guidance maintained despite headwinds

Barrick Gold expects a better financial performance in the second half of the year, despite the slowdown in the first quarter. The mining giant remains on track to meet its full-year production guidance.

The company said rising inflation, exacerbated by the conflict in Ukraine and Western sanctions on Russia, had a direct impact on its business, not just through oil and gas prices on the rise, but also the cost and availability of raw materials.

Barrick’s president and chief executive Mark Bristow said, “Fortunately for Barrick, managing risks in challenging geopolitical jurisdictions is one of our core competencies, largely gained in Africa, where our mines have continued to operate steadily and profitably through civil wars, coups d’état, complex logistics and delicate negotiations with host governments.”

The company nearly doubled its quarterly dividend to $0.20 per share.

Is Barrick Gold stock a buy?

Gold is a good hedge against inflation, and its price tends to rise during a market downturn.

While Barrick Gold stock is up more than 20% year to date, it still has upside potential. The stock looks undervalued based on current gold prices and balance sheet strength, making it a buy.