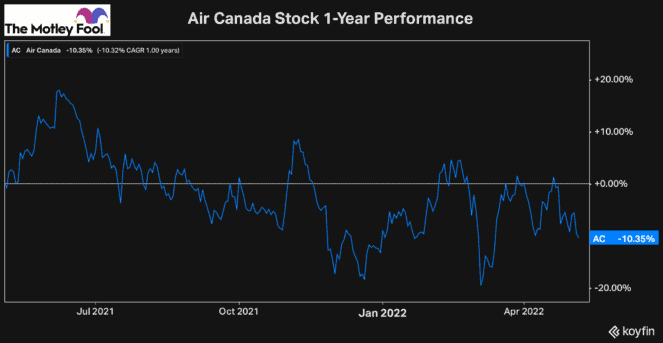

For over a year now, ever since the initial impacts of the pandemic began to diminish and vaccination rates were improving, investors have had a tonne of hope for Air Canada (TSX:AC) stock. Yet even this year, with the stock now showing a noticeable improvement in its operations, the share price has hardly budged and it’s actually lower than where it was this time last year.

Investors may be wondering why Air Canada stock continues to trade at such a low price compared to where it was pre-pandemic and if that means it’s worth buying in their TFSA today.

Should you buy Air Canada for your TFSA?

If you’re looking at buying Air Canada stock as a long-term investment, thinking it’s a dominant company in an industry with tonnes of long-term potential, then you’re on the right track.

Any stock you consider buying in your TFSA, you should make sure you plan to own for the long haul. Speculating is far too risky, especially in an account like a TFSA, where investors’ contributions are limited.

In the case of Air Canada stock, though, while it certainly looks cheap, in reality, it’s not quite as undervalued. And while you can certainly argue it has tonnes of potential and room to recover in the coming years, in my view, it has a long way to go before the stock can begin to rally consistently.

Why hasn’t Air Canada stock recovered yet?

The fact that Air Canada stock hasn’t managed to recover yet, and that it’s actually lower today than where it was a year ago is not that surprising. First off, at around $25 a share, Air Canada has already been fairly valued for some time, if not overvalued.

With all the debt it had to take on during the pandemic and the new shares it had to issue, its pre-pandemic price of $50 a share is essentially irrelevant now. Today, Air Canada’s enterprise value (EV) of roughly $15.5 billion is just 5% below its EV of $16.3 billion at the end of 2019, right before the pandemic. So, while it may look cheap, it’s, at best, fairly valued.

And now, as uncertainty has picked up in markets, and Air Canada faces new headwinds such as rising fuel costs, it’s understandable that the stock continues to struggle.

Instead, another recovery stock that’s been popular among investors over the last year, Cineplex (TSX:CGX), could be a much better stock to buy for your TFSA.

Cineplex stock offers great value for long-term investors

One of the reasons that Cineplex could offer more potential than Air Canada is that although its operations were impacted quite severely too, it didn’t have to take on nearly as much debt. In addition, Cineplex didn’t have to dilute shareholders.

So, now, as its locations are all opening back up, and it’s seeing a recovery in its operations, just like Air Canada, it has the potential to rally much quicker and with fewer financial headwinds.

Right now, neither stock is expected to be profitable this year (although Cineplex is estimated to nearly break even). However, even if you take the estimated earnings from each stock in 2023, Cineplex trades at a forward price-to-earnings ratio of 11.6 times compared to Air Canada stock trading at 13.9 times.

That’s not all, though. Looking at their EVs to 2022 estimated EBITDA, Cineplex trades at a ratio of 6.3 times. Meanwhile, Air Canada stock is trading at an EV-to-EBITDA ratio of 9.9 times.

Therefore, considering Cineplex stock is facing fewer headwinds in the short term and is actually cheaper than Air Canada stock when comparing their forward earnings estimates, it’s a much better stock to buy for your TFSA today.