The Tax-Free Savings Account (TFSA) is one of the best tools a Canadian can use to accumulate wealth. Any opportunity an investor can get to lower their tax bill and maximize returns ought to be used.

Any investment made in a TFSA, whether it be a mutual fund, index fund, bond, or stock, is safe from Canadian tax. That means that all returns including dividends, interest, and capital gains stay with you. It is a perfect account for building and compounding wealth.

Use your TFSA for your forever-hold stocks

I like to think of the TFSA as my “coffee can” account. In essence, it holds money and investments that I plan to tuck away and not trade for a very long time (like 20 or more years). I try to never withdraw from the account. That way I can allow companies that I own the time to compound earnings and returns for me.

Never interrupt the compounding process

World renowned investor Charlie Munger once said, “The first rule of compounding: Never interrupt it unnecessarily.” That is the motto I try to apply to my TFSA. Hopefully, one day those initial contributions and investments will be many times larger.

It is simple: buy a stock, hold it, and then hold it some more. The hardest thing is to be patient and let the investment accumulate.

If you like the idea of building a TFSA investment fortune over the long term, here are two stocks of interest. Put $20,000 into these stocks, and that investment could be worth more than $150,000 in a decade or so. Here is how.

TFSA stock #1: Calian Group

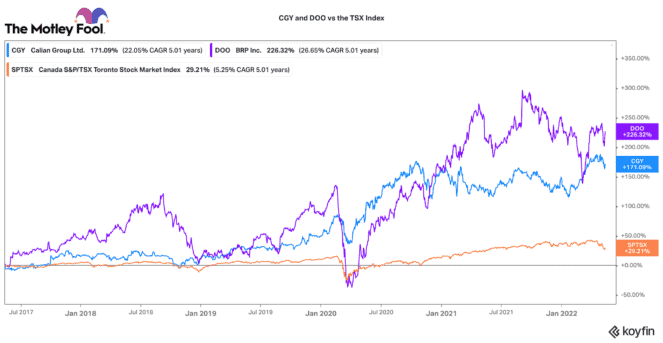

One TFSA stock to consider investing $10,000 into is Calian Group (TSX:CGY). While this is not a widely followed stock, it has been delivering very consistent returns over the past few years. Since 2016, it has compounded annual returns by around 22% (including re-invested dividends). It pays a 1.7% dividend yield today.

Calian operates a diversified conglomerate of technology-focused services in healthcare, advanced technologies, education/training, and cybersecurity. Its diversified platform has helped support compounded EBITDA and adjusted earnings growth of 18% and 21% annually since 2016.

If Calian can maintain a 20% annual rate of return going forward, $10,000 could become $60,000 in a decade or less. Recently, its business has been gaining strong momentum from several smart acquisitions. If it can keep doing this, it could be a great TFSA stock for long-term multiplying returns.

Stock #2: BRP

If you had another $10,000 in your TFSA, you could consider putting it to work in BRP (TSX:DOO)(NASDAQ:DOOO) stock. It is one of the world’s largest manufacturers of recreational and marine vehicles. The company has some dominant brands like Ski-Doo, Sea-Doo, and Can-Am.

In the past five years, it has delivered a 226% return. It has earned a 26.5% compounded annual return in that time. This has been supported by around 9% annual revenue growth and 25.8% annual adjusted earnings-per-share growth. The company generates tonnes of excess cash, so it has consistently been buying back a lot of stock.

Given BRP’s growth in several large new product verticals (like electric motorcycles), a 25% annual rate of return could continue for some time. At that rate, put $10,000 into this TFSA stock, and it could be worth more than $90,000 in 10 years from now.

There is no guarantee, but great companies multiply wealth over long stretches. You just have to be patient and let them do it.