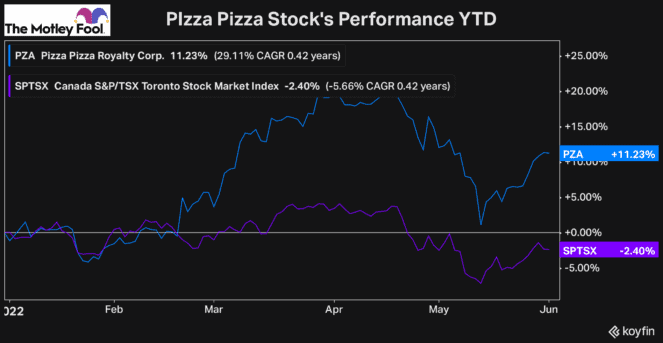

Dividend stocks are some of the most in-demand stocks, as the market has started to face headwinds this year. One of the best performers so far year to date has been Pizza Pizza Royalty (TSX:PZA), the $320 million restaurant stock.

It’s not uncommon to see dividend stocks rally when markets are struggling, as investors are looking to shore up their portfolios and lock in any gains they can find.

Therefore, the fact that Pizza Pizza stock has been recovering from the pandemic and is one of the best stocks to buy for passive income, it’s no surprise that it’s significantly outperformed the market so far this year.

However, after Pizza Pizza stock has pulled back lately, you may be wondering if the stock is worth an investment today.

Is Pizza Pizza stock worth an investment today?

Pizza Pizza is a unique stock because, unlike many other restaurant stocks, Pizza Pizza doesn’t have to worry about the profitability of individual restaurants. Instead, because it receives a royalty on total sales, Pizza Pizza is mainly focused on growing its stores’ revenue.

Of course, if several restaurants are unprofitable and decide to shut down, there would be much fewer restaurants in the royalty pool, significantly lowering the income that Pizza Pizza stock receives.

For the most part, though, as investors, all that we’re concerned with is how much revenue its pool of restaurants can generate.

For context, prior to the pandemic, Pizza Pizza was bringing in about $8.75-$9.5 million in revenue per quarter, depending on the time of the year. On that roughly $9 million in sales that Pizza Pizza would generate each quarter, the stock would have expenses ranging from $100,000 to $200,000.

Pizza Pizza stock would then pay interest and taxes on its earnings and return the rest of the cash, earning roughly $6.5 and $7.25 million of cash each quarter.

Then along came the pandemic. And while many restaurant stocks were impacted severely, Pizza Pizza showed its resiliency. In fact, at the worst point of the pandemic, Pizza Pizza’s sales fell just 16% year over year.

Today, the stock’s sales are nearly back in line with where they were before the pandemic. In addition, since trimming the dividend at the start of the pandemic, Pizza Pizza has increased it on three separate occasions.

Therefore, with the stock having recovered well from the pandemic and now offering a dividend yield of roughly 6%, it certainly seems like an attractive investment.

Pizza Pizza’s outlook is slightly uncertain

Despite the recovery in Pizza Pizza stock and the resilience it’s shown over the last two years, there is still uncertainty about how Pizza Pizza may perform in the short term.

As inflation continues to surge, Canadians’ finances are being affected severely. And without seeing a raise that matches or outpaces inflation, Canadians will either have to save less, spend less, or go into debt to continue the same level of spending.

Furthermore, of all the expenses that Canadians plan to cut, dining out is one of the first. Therefore, in this high-inflation environment, investors are worried about how Pizza Pizza may perform, which is one of the main factors in why the stock has sold off recently.

It’s worth noting that one of the benefits of Pizza Pizza is that it’s a quick-service restaurant and a low-cost option compared to many of its competitors. So, while it could still be impacted, it will likely see a smaller impact than many of its restaurant stock peers, similar to what we saw in the pandemic.

Currently, Pizza Pizza stock has a payout ratio of roughly 93.5%. That may seem high, but in the past, the stock has typically had a payout ratio of around 100%. Therefore, there is room for Pizza Pizza’s sales to fall slightly.

However, if it was to see a significant impact on sales, there’s a possibility it would have to trim the dividend once again. Therefore, due to the uncertainty, you’ll want to watch the stock closely.

The stock certainly has the potential to continue returning investors attractive passive income. Therefore, I’d be watching Pizza Pizza closely in the coming months. Because if it was to be impacted by inflation and temporarily selloff, that could create an excellent buying opportunity for long-term investors.