Canadian growth stocks have been decimated in 2022. All I have to say is “Shopify,” and you will know exactly what I mean. It was once Canada’s most valuable public company. Today, it is down 72% since the beginning of the year!

The time to buy growth stocks is on market corrections

However, just because growth stocks are down doesn’t mean they are no longer good investments. In fact, the time to buy growth stocks is when they are beaten up and their valuations/prices are more attractive. While I can’t pick a bottom to this market rout, it really doesn’t matter.

If you don’t like stock market volatility, simply buy stocks in great businesses, hold them for the long term, and basically do nothing beyond that. Several studies have found people who do not open their investment trading accounts for many years regularly outperform those who do. It is in our human nature to do something when things turn bad.

Tinkering with your portfolio can hamper long-term returns

Consequently, our portfolio tinkering often leads investors to sell low and buy high. That is the opposite of how it should work. The best remedy is to invest with a very long time horizon. By long, I mean five, 10, or even +20 years. If you want to build a fortune, don’t just think about the price action today.

Rather, think about what the actual company is trying to do for the next few decades. Generally, companies can compound earnings better than you can by trading in and out of stocks.

Its best to just find the best businesses and own them for long periods. If you are looking for a long-term growth stock to buy, hold, and never sell, Constellation Software (TSX:CSU) should be on the top of your list.

A growth stock to buy for the long term

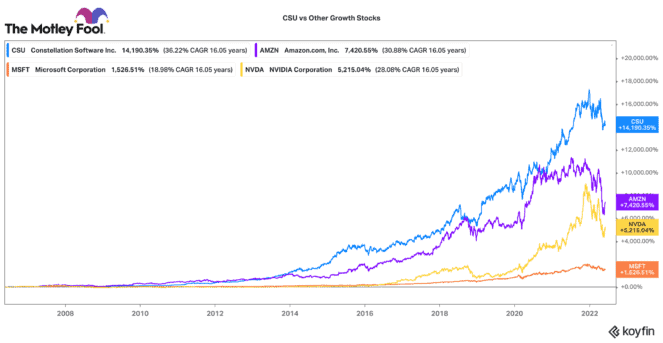

Constellation has been one of the best-performing growth stocks on the TSX over the past few decades. Over the past 15 years, it has delivered a blistering 8,000% total return for long term shareholders. You may not realize, but its performance has outpaced household tech names like Amazon.com, Microsoft, and Nvidia.

Nobody talks about Constellation, because it doesn’t openly market its stock, and it doesn’t dominate a horizontal software application. Rather, it quietly acquires very small, niche vertical market software businesses all over the globe.

These are not flashy tech businesses, but they generally provide an essential, irreplaceable service for their customers. These businesses have low costs and high recurring revenues.

A compounding machine

As a result, Constellation has very low customer churn, and these businesses yield tonnes of excess cash. It takes those proceeds and then prudently re-invests into more software businesses. Its business is made for compounding returns.

While Constellation stock is rarely ever cheap, it has pulled back 16% this year. This growth stock rarely pulls back by more than 20%.

Despite that, Constellation continues to generate and deploy large amounts of cash at high rates of return. In fact, last year it deployed over $1.3 billion. That is the largest amount of money it has ever spent on acquiring software businesses. At some point, this will start producing significant returns for investors.

The Foolish takeaway

With a stock like Constellation, investors will have to be patient and have a very long time horizon. The company focuses on keeping perpetual shareholders. Its management team are all large shareholders, so the company is very aligned and focused on delivering long-term, sustainable returns.

All you need to do is buy this stock, hold it for decades, and let Constellation’s compounding machine create wealth for you.