Welcome to a series where I break down and compare some of the most popular exchange-traded funds (ETFs) available to Canadian investors!

Canadian investors looking for the strongest hedge against equity risk at the cost of interest rate risk can consider an allocation to long-term bonds. Fund managers like Vanguard and BMO Global Asset Management provide a set of low-cost, high-liquidity ETFs that offer exposure to a portfolio of long-term bonds.

The tickers up for consideration today are Vanguard Canadian Long-Term Bond ETF (TSX:VLB) and BMO Long Federal Bond Index ETF (TSX:ZFL). Which one is the better option? Keep reading to find out.

VLB vs. ZFL: Fees

The fee charged by an ETF is expressed as the management expense ratio (MER). This is the percentage that is deducted from the ETF’s net asset value (NAV) over time and is calculated on an annual basis. For example, an MER of 0.50% means that for every $10,000 invested, the ETF charges a fee of $50 annually.

VLB has an MER of 0.16% vs. ZFL at 0.22% — a difference of $6 in a $10,000 portfolio. In this case, VLB is the cheaper ETF, especially over the long run.

VLB vs. ZFL: Size

The size of an ETF is very important. Funds with small assets under management (AUM) may have poor liquidity, low trading volume, high bid-ask spreads, and more risk of being delisted due to lack of interest.

VLB currently has AUM of $43 million vs. ZFL at $1.57 billion. VLB’s AUM is rather small and could be a cause for concern in a liquidity crisis. In this case, ZFL is the winner.

VLB vs. ZFL: Holdings

When selecting a bond ETF, investors should pay attention to three considerations. First, check the credit quality of the bonds. Ideally, we want bonds rated A, AA, and AAA. We don’t want junk bonds, as our goal here is to reduce volatility, not increase it. VLB is 19% AAA, 60% AA, 15% A, and 5% BBB, while ZFL is 100% AAA.

Second, check the composition of the bonds. Bonds are generally separated into corporate and government bonds. Corporate bonds have higher yields but also carry default risk, making them fall when stocks crash. Government bonds have lower yields but virtually no default risk. VLB is around 66% provincial/municipal and 17% federal, with the rest in corporate, while ZFL is 100% federal.

Third, check the effective duration of the bond. This is a measure of how sensitive the bond is to interest rate movements. Bond prices move inverse to interest rates. For example, a bond with an effective duration of 2.46 years would lose approximately 2.46% if interest rates rose by 1%. VLB and ZFL have average durations of 15.1 and 17.5 respectively, making the latter much more sensitive to interest rates.

VLB vs. ZFL: Historical performance

A cautionary statement before we dive in: past performance is no guarantee of future results, which can and will vary. The portfolio returns presented below are hypothetical and backtested. The returns do not reflect trading costs, transaction fees, or taxes, which can cause drag.

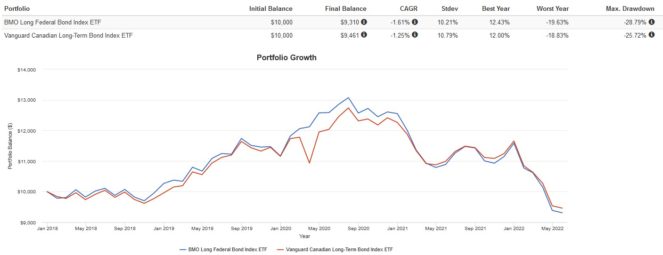

Here are the trailing returns from 2018 to present:

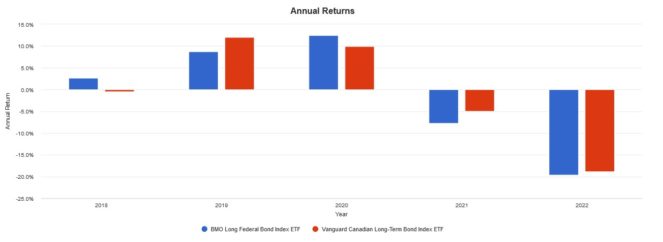

Here are the annual returns from 2018 to present:

Both long-term bond ETFs performed very similarly except in one case: between February and March 2020, VLB dipped sharply, while ZFL increased. This was due to the higher credit qualify of ZFL, being comprised of 100% AAA-rated federal bonds. The provincial/municipal and corporate bonds in VLB are more correlated with equities during a crash.

The Foolish takeaway

My pick here is ZFL. It has much greater AUM and crash protection. The tradeoff is a slightly higher duration. ZFL will benefit strongly during a deflationary crash but will lose value substantially during a rising-rate inflationary environment. Case in point, it has done very poorly in 2022. Still, this could be a good time to buy low.