Growth stocks have been hit hard by the recent market selloff. However, this selloff is actually an opportunity to buy great Canadian growth stocks at a discount before the market recovers. Here are three growth stocks you might want to add to your buy list in July.

Lightspeed

Lightspeed (TSX:LSPD)(NYSE:LSPD) continues to invest to drive future growth and is adding new solutions to its platform, which bodes well for growth. In addition, it is expanding its presence in existing verticals, targeting new verticals, and selectively pursuing acquisitions to accelerate its product development and growth.

Positive growth drivers include a growing and diverse customer base, a high retention rate, and a growing mix of revenue from recurring subscriptions and transaction-based revenue.

Economic headwinds will pass eventually and Lightspeed will once again be the race for e-commerce darlings. The company’s consistent performance and strong growth prospects point to a strong recovery in its price. Lightspeed forecasts organic sales growth of 35-40% for fiscal 2023.

We can expect management to continue making deals to better position itself for the next bull run.

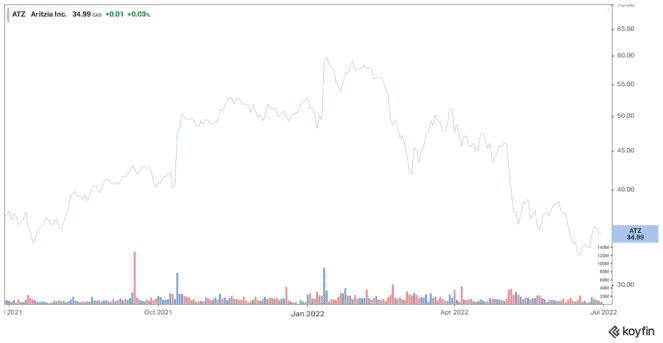

Aritzia

Aritzia (TSX:ATZ), a designer and retailer of clothing and accessories, is one of the best Canadian growth stocks to buy in July.

With a track record of successful execution, Aritzia has strong leadership and a healthy balance sheet. The brand is seeing growing awareness and has plenty of opportunities for further growth. The retailer continues its expansion in the U.S. by opening new stores. The company plans to open between eight and 10 stores in fiscal 2023, which will be mostly located in the U.S.

Growth is also driven by e-commerce. Management has for goal to increase e-commerce revenue to over 50% of its business.

In its most recent quarter, the company saw a 66% increase in revenue. Net profit over the same period increased by 113%. U.S. revenue grew 108.8%, while e-commerce sales jumped 21.4% in the quarter.

Aritzia will report its first-quarter financial results on July 7. Shares could have a boost if the company beats estimates like this has been the case in the past quarters.

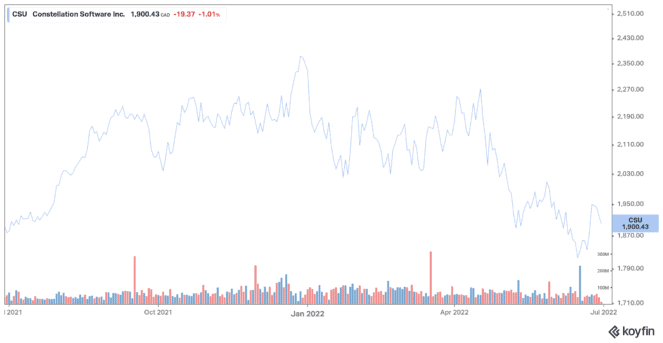

Constellation Software

Constellation Software (TSX:CSU) makes its money by acquiring relatively small niche software companies around the world. Although a recession can impact its business, most of its revenue is recurring and economically resilient. The company’s strategy of using its free cash flow for acquisitions is attractive and will allow it to continue to create value for its shareholders.

Likewise, tech companies‘ valuations are rapidly declining. This means Constellation can deploy more of its excess cash flow into acquisitions at bargain prices and better long-term returns. Constellation has been one of the best-performing Canadian growth stocks over the past few decades.

The company’s earnings in the first quarter of fiscal 2022 were good. Constellation revenue increased 22% year over year to $1.43 billion. Meanwhile, the company posted a net profit of $111 million. Analysts expect this software aggregator to post even better numbers in the coming quarters. Such a promising stock is worth putting on your watch list during market downturns.