No segment has been hurt more in the recent TSX stock correction than high-growth stocks. Many of Canada’s fastest-growing companies are technology businesses. They have been hit the worst.

For example, S&P/TSX Capped Information Technology Index is down 35% this year. In comparison, the S&P/TSX Composite Index is only down 10.3% in 2022.

It is difficult to say when this downward pressure could reverse. These days, the stock market appears to be pricing in a serious recession. The downdraft could be maintained longer than we all hope.

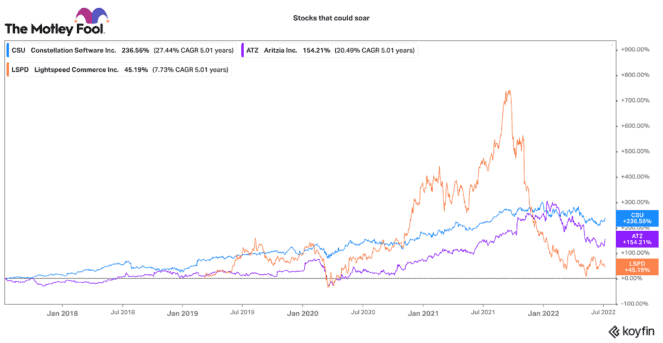

Yet if the market senses things will be better than expected, there could be significant upside for stocks. High-growth stocks would likely recover the fastest. If you are okay with being patient and waiting for this bear market to reverse, here are three TSX stocks primed for significant and explosive upside.

Lightspeed: A TSX stock set for a rebound

Lightspeed Commerce (TSX:LSPD)(NYSE:LSPD) stock used to be a technology darling on the TSX. After a short report and the recent market decline, its stock has fallen 73.5% in the past year.

Certainly, there are fears that e-commerce and spending will slow, especially if a recession occurs. However, Lightspeed has a strong platform that simplifies business for thousands of retail, dining, and hospitality merchants.

Over the long term, it still has many levers to grow internationally and by service vertical. This TSX stock is certainly not cheap today. It still trades for four times sales. It is not yet profitable, although it is promising profitability in 2023. Despite that, investment analysts have an average $49 price target. That would project over 80% upside from here!

Aritzia: Business is booming, despite economic fears

Speaking about retail, Aritzia (TSX:ATZ) stock could soar once recession fears abate. At $37 per share today, its stock is down 28% this year. Yet so far, this Vancouver-based women’s apparel retailer has continued to deliver exceptional fundamental results.

Just last week, it reported earnings that exceeded the markets expectations. Net revenues, net earnings, and adjusted EBITDA each grew year over year by 65%, 85%, and 70%, respectively! Aritzia is gaining very strong traction in the United States and through e-commerce channels.

Despite supply chain challenges, it continues to impress. It still has substantial opportunities expanding its store count in the United States and eventually internationally. At 13 times EBITDA, this TSX stock presents attractive value for a high-quality, very well-managed retail business.

Constellation Software: This top TSX stock could win from a recession

It is a very rare occasion that Constellation Software (TSX:CSU) stock corrects. With a 10-year return track record of over 2,000%, it is one of the best-performing stocks on the TSX. Yet, year to date, it is down 28%. At 26 times earnings, it still not the cheapest stock. However, this is a case of paying up for quality.

Constellation is one of the best compounding businesses in Canada, perhaps even the world. It acquires both small and large vertical market software businesses across the globe. It reaps their cash flows and then re-invests it into new acquisitions.

Given that tech valuations have significantly declined, it has ample cash to rapidly deploy into hundreds of potential acquisitions. An economic decline would likely support outsized cash flow growth over the longer term. Consequently, this TSX stock could substantially soar once the dust settles from this downturn.