Satellite and space technology firm MDA (TSX:MDA) stock has ample capacity to recover from a nearly 50% decline to produce multi-bagger returns over the next three to five years. However, the market seems to have ignored a defensive MDA stock’s potential while fixated on the potential recession that may never touch the company’s operations.

MDA went public in 2021, just around the time when Cathie Wood-led ARK Investment Management was marketing its ARK Space Exploration and Innovation ETF (ARKX). The market roared in favour of anything and everything space related at the time. Feverish bullish sentiments have cooled down so far this year, valuation multiples have shrunk in the face of rising inflation and soaring interest rates, and MDA stock has lost 48% of its value over the past year.

The recent dip in MDA’s shares could be what a long-term-oriented investor needs to create generational wealth through buying MDA stock now and holding onto the space-growth theme play for five or more years.

Here’s why.

Rapid growth to propel MDA stock

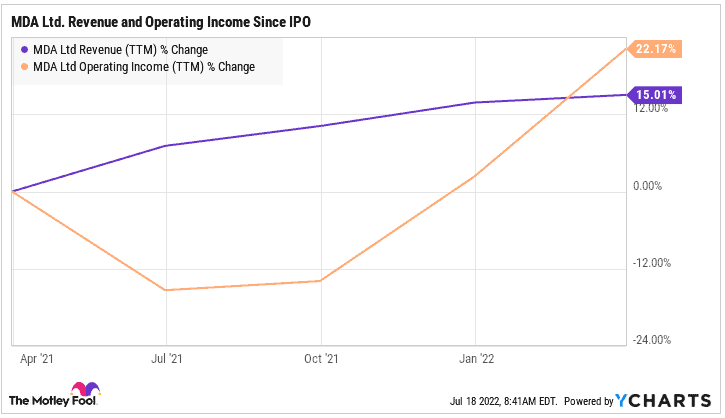

MDA has been around for more than 50 years, but its rapid growth phase is just getting started. It recently became profitable, but investors looking at the company’s most recent steady revenue growth, and the earnings performance may miss the big picture that could play out.

The global space industry is in a rapid growth phase, and MDA’s proven track record in designing advanced space tech gives it superior marketing and contracting advantages.

The rapid growth of the in-space economy is premised upon increasing space exploration expenditure, space tourism, space mining, Lunar mobility logistics and support, space debris removal, climate change monitoring, satellite intelligence surveillance, broadband internet, 5G backhaul, growing IoT, connected vehicles, and expanding defense applications.

How fast could MDA grow?

MDA reported $412M in total revenue in 2020 and managed to increase sales to $477 million in 2021. In an investor presentation in May, management recently issued revenue guidance for $750-800 million for 2022 — a growth rate between 55% and 65% year over year.

Most noteworthy, management claims that about 75–85% of the growth is already secured.

The company anticipates adjusted EBITDA of $140-160 million in 2022. Management confidently expects to maintain adjusted EBITDA margins strong in the 19-20% region.

MDA’s revenue backlog has been growing beautifully during the past 12 months. The company reported a $684.7 million revenue backlog by the end of March 2021. Amazingly, MDA’s total backlog swiftly crossed $1 billion after a 122% annual growth to $1.52 billion by the end of the first quarter of 2022.

Management believes the company should exceed $1.5 billion in annual sales while servicing a $200 billion total addressable market by 2025, and Wall Street is sold on the MDA’s phenomenal growth potential.

Recession or no recession, MDA could print double-digit solid revenue and earnings growth numbers and excite its stock investors over the next three years.

Is MDA stock a buy?

According to Stock Rover data, equity analysts expect MDA to report $756 million in revenue for 2022 (a 58.5% year-over-year growth). Sales could reach $1.08 billion by 2023 — 43% year-over-year growth. The consensus analyst rating on MDA stock is that it’s a buy, with an average price target of $54.62 per share which implies a phenomenal 620% potential upside over the next 12 months.

MDA has a historical price-to-sales multiple of about 1.9 times and a forward price-to-earnings multiple of 14.2. If management executes as it promises to do this year MDA stock may still rebound strongly even if multiples contract in a bear market.

Investor Takeaway

If MDA’s recent revenue and earnings guidance is anything to go by, the company’s stock may outperform, as new evidence of tangible growth becomes available. Even if a global recession were to happen now, companies that deliver robust growth rates will most likely attract the market’s full attention — and MDA stock might do just that.