Over the last few years, industrial REITs have been some of the best Canadian stocks to buy, as the industry has seen rapidly growing demand, and that hasn’t changed this year.

In addition to e-commerce companies like Amazon expanding rapidly and needing tons of new warehouse space, existing retailers are adopting an omnichannel approach. And, in many cases, that means closing some of their brick-and-mortar stores while also increasing their need for warehouse space to store inventory.

This is particularly attractive because when demand is stronger than new supply, it takes time for the economics to balance out, and in this environment, with inflation impacting costs, significant supply chain issues and interest rates making funding more expensive, it could take even longer for new projects to come online.

Therefore, industrial REITs should continue to see strong tailwinds for some time and look to be some of the best stocks you can buy both for growth and resiliency in this environment.

So, if you’re looking for top Canadian stocks to buy while the market is still offering attractive bargains, here are two top industrial REITs to buy now.

One of the top REITs to buy for growth in recent years

One of the top-performing REITs in recent years and a top stock to buy now after it’s pulled back significantly is Granite REIT (TSX:GRT.UN).

Granite owns a massive portfolio with assets in Canada, the United States and Europe. In total, it owns over 50 million square feet of industrial space and has another 5.7 million square feet of growth projects in development as well — 40% of which have already been leased.

However, the most significant reason that it’s such an attractive growth stock is that as its leases expire, the rents it can charge are increasingly notably due to the strong demand.

In the past few years, its occupancy rate has consistently been around 99% or higher. In addition, its same property net operating income has been growing at an average of nearly 4% over the last 10 quarters.

Therefore, while the stock trades at just 0.8 times its estimated net asset value, it’s one of the best REITs to buy now.

A lesser-known REIT with excellent long-term growth potential

Another high-potential industrial real estate stock to buy now is Nexus Industrial REIT (TSX:NXR:UN). Nexus is much smaller than Granite, with a market cap of just $550 million. However, it’s still one of the best REITs to buy now due to the value it offers today, along with its long-term potential.

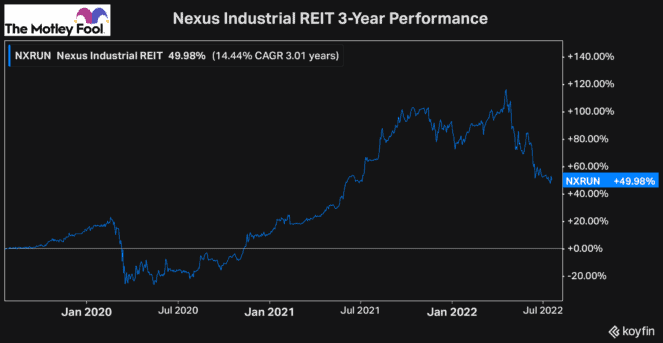

As industrial real estate has come into favour, Nexus stock has rallied considerably in recent years. In fact, as you can see by the chart below, even after the significant selloff it’s seen along with the rest of the market this year, it continues to trade well above its pre-pandemic high.

A large part of the reason why the stock has rallied so significantly is due to the tailwinds industrial REITs are seeing. And while Nexus also owns some office and retail assets, its main strategy is to focus on acquiring more industrial properties.

Plus, because it returns more capital to investors than Granite, dividend investors may prefer Nexus, as its current yield is roughly 6.6%.

Therefore, if you’re looking for some of the top REITs to buy now, especially after they’ve recently sold off so significantly, Nexus is one of the best there is.