No stock has been immune to the 2022 market correction — not even trustworthy dividend stocks. Yet dividends provide investors an attractive natural hedge against stock market volatility.

Dividend stocks are perfect for tangible cash returns

Dividends are a great way to earn a tangible return in your investment account, even when the overall stock market is going down. If you don’t immediately need the cash from dividends (like to fund your lifestyle), you can re-invest them into more stocks at even lower prices. This is called dollar-cost averaging.

Compound wealth by re-investing in dividend stocks

Over time, as your equities grow, so too does your dividend income. As your dividend income grows, so too does your equity value as you re-invest into more dividend stocks. It’s a snowball cycle and it’s a great recipe to build long-term wealth and passive income.

Of course, it is also important to be choosey when it comings to picking Canadian stocks you want to add. I like to focus on dividend stocks with strong earnings growth potential and a history of dividend growth.

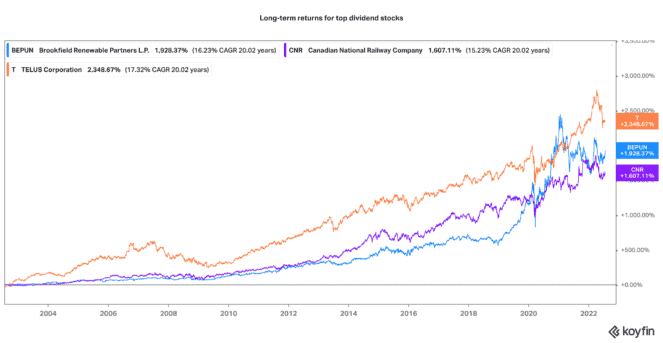

Three top Canadian stocks that meet this criteria are TELUS (TSX:T)(NYSE:TU), Canadian National Railway (TSX:CNR)(NYSE:CNI), and Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP).

TELUS

I like TELUS because of its economically resilient business model. It is one of Canada’s leading telecommunications providers. Internet connectivity and cellular service are essential to modern society. TELUS earns a contracted stream of steady cash flows from its bundled package of services.

Over the past few years, TELUS has consistently outperformed peers in customer wins and earnings growth. Over the past three years, it has grown earnings per share by about 10% annually. Its dividend has grown by about 7% annually.

After a recent 14% share decline, TELUS shares look attractive with a 4.7% dividend yield. For stable growth and a rising stream of dividends, this is a great long-term stock.

CNR

Speaking about crucial services, Canadian National Railway’s shipping and railroad network is crucial for moving raw and bulk goods across the continent. This affords CN a long-term competitive moat and attractive pricing power.

CN has been a very good stock for long-term shareholders. For the past 20 years, it has earned a 14.2% compounded total annual return. That is a 1,350% total return — not bad for a boring, blue-chip transportation stock.

This stock may only yield a 2% dividend today. Yet it has a decade of over 14% annual dividend growth. This is a great stock for defence and growth.

Brookfield Renewables

Like the above stocks, Brookfield Renewables is a top player in its industry. It is one of the biggest pure-play, green energy stocks in the world. Its portfolio has irreplaceable hydro dam assets that are complemented by wind, solar, battery, and distributed generation assets.

For the past five years, it has compounded its adjusted funds from operation per share (its key profitability measure) by nearly 10% annually. Given concerns about climate change and energy security, Brookfield has a huge opportunity to finance, develop, and manage renewable projects around the world.

Today, it operates 21 gigawatts of power. However, its development pipeline is more than three times that size. These opportunities should translate into low-teens growth for many years ahead.

Brookfield Renewables stock yields a 3.5% dividend. It has grown its dividend rate by mid-single digits annually since inception. It is an ideal stock to buy-and-hold for income and to participate in a massive trend.