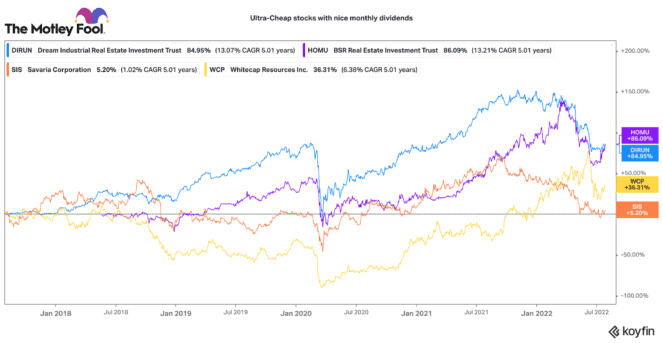

If you want Canadian stocks that pay monthly dividends, there are plenty of bargains out there today. Here are four incredibly cheap stocks that could help you boost your monthly stream of passive income.

A Canadian energy stock with a fast-growing monthly dividend

Whitecap Resources (TSX:WCP) is a mid-cap TSX energy stock that has been pushing out significant dividends. After a recent 20% decline, this stock is yielding a 4.67% dividend. It just increased its monthly dividend by 22% to $0.0367 per share. If you put $5,000 into Whitecap, you would earn nearly $20 a month in dividends.

This Canadian stock just announced better-than-expected second-quarter results. Oil production more than doubled last year, and funds flow per share was 150% higher.

This company continues to aggressively reduce debt, buy back stock ($121 million in the quarter), and increase dividends. Trading at five times earnings and free cash flow, it is hard to find a cheaper monthly dividend stock out there.

Real estate stocks are perfect for monthly dividends

Real estate investment trusts (REITs) are phenomenal investment vehicles for monthly dividend income. Their distributions are largely covered by contracted monthly rents collected. Two Canadian real estate stocks I love for monthly income are BSR REIT (TSX:HOM.U) and Dream Industrial REIT (TSX:DIR.UN).

BSR operates a very high-quality portfolio of garden-style residential complexes in Texas and Oklahoma. Its properties are in some of the fastest-growing regions in the United States. As a result, it is enjoying incredibly robust double-digit rental rate growth.

This supports its $0.0433 monthly distribution, which equals a 3.3% yield today. Put $5,000 into BSR stock, and it would earn $13.75 per month.

Given its strong expected growth, chances are likely the dividend could increase again soon. After an 8% selloff in 2022, BSR is cheap at 20 times adjusted funds from operation (AFFO). For context, many U.S. peers trade at 25 times AFFO.

Dream Industrial REIT owns industrial multi-tenant properties across Canada and Europe. It also has a joint venture stake in the United States.

Its properties are very well-located and are seeing very strong rental rate growth. Add in new acquisitions and a robust development pipeline, and this REIT has many levers for +10% cash flow-per-unit growth.

Right now, Dream Industrial pays a $0.05833 per unit distribution monthly. That is a high 5.8% distribution yield at today’s price. $5,000 in this Canadian stock would earn $24.16 monthly. At 15 times AFFO, Dream is one of the cheapest, high-quality industrial REITs in Canada and Europe.

A top industrial stock for monthly income

Savaria (TSX:SIS) is an interesting Canadian stock that pays a monthly dividend. Savaria manufactures specialized lifts, mobility, and specialty equipment for ageing and mobility impaired individuals. Given the ageing demographic across the world, Savaria expects a long-term boom in demand.

Over the past five years, Savaria has grown revenues, EBITDA, and earnings per share annually by around 34%, 32%, and 5.5%, respectively. Likewise, it has grown its dividend annually by around 10%. Today, it pays a $0.0417 dividend monthly.

That is a 3.8% dividend today. $5,000 in this Canadian stock would earn $15.80 a month. With an enterprise value-to-EBITDA of 9.8 and a price-to-earnings (P/E) ratio of 18, Savaria is trading at the low-end of its valuation range. For context, its 10-year mean P/E is 22.6. This is a great Canadian stock for a combination of growth and steady income over the longer term.