Canadians may forget that there isn’t any rule that states you cannot invest in United States stocks. In fact, there are many U.S. stocks Motley Fool investors should highly consider. And not all of them are the big-name brands we’ve become used to.

Today, I’m going to go over three U.S. stocks you perhaps haven’t heard of — ones that also offer strong dividends for you to consider from our neighbours to the south.

A Warren Buffett favourite

Investment mogul Warren Buffett continues to hold U.S. Bancorp (NYSE:USB) in his top 10 largest holdings of Berkshire Hathaway. The bank continues to beat earnings estimates in this highly stressful environment on banks. Most recently, it reported revenue was up 4% year over year to US$6 billion.

The downside was the provisions for loan losses and the weak economy caused a 22% decrease in net income. This hit revenue, sure, but there is some promising news. Loans increased by 10% year over year. This could be a good sign that it’s one of the U.S. stocks that could rebound soon. In fact, it could even raise its dividend.

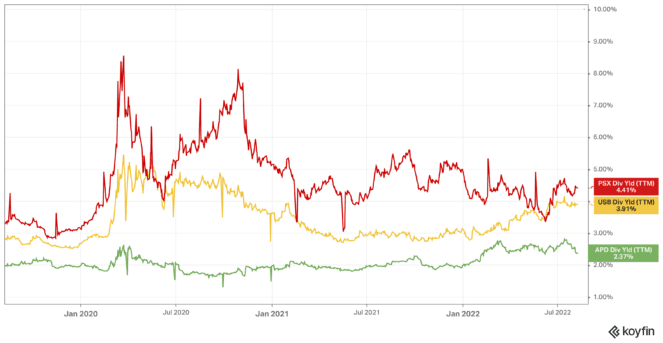

The U.S. stock offers a juicy dividend of 3.88% as of writing and trades at a valuable 10.85 times earnings.

An energy leader with earnings to prove it

Phillips 66 (NYSE:PSX) is another of the U.S. stock that Motley Fool investors may want to consider. What this energy stock offers is quality through its performance. And that quality that remains unrelated to the rising price of oil; it’s from being a solid company.

This is a U.S. stock trading at a strong discount, especially considering that quarter after quarter, it’s beat out analyst estimates. During its second-quarter earnings, the company announced it now aims to put 60% of its allocation framework into reinvesting in the business, with 40% of cash returned to shareholders through dividends and buybacks.

That’s 40% you can look forward to from this dividend stock! And it’s cheap in every sense of the word. Shares are up 18.8% year to date but down 24% from 52-week highs. It trades at just 7.15 times earnings and offers a 4.63% dividend yield at the time of writing.

Just breathe it in

Finally, Air Products and Chemicals (NYSE:APD) is the final of the U.S. stocks I would consider for Motley Fool investors. It offers a dividend of 2.47%, which may not seem high. However, that comes out at $6.48 per year, and yet it still offers a share price far below what analysts have pegged at fair value.

Long-term investors would certainly do well to consider this dividend stock, a leading supplier of industrial gases such as argon, oxygen and hydrogen. That last one is worth noting, as there is a high degree of certainty the product will be needed for clean energy power. Therefore, dividend growth could be in the future.

The thing is, there are some skeptics that look at the last few years of share movement with a wary eye. Shares are down 12.29% year to date and have bounced around the last few years. Still, that was during the pandemic and market corrections, so I would certainly look back to the 40-year history of this company if you want to be certain of its future growth.

And while its 26.98 times earnings ratio doesn’t sound cheap, it remains on par with its five-year historic average. Plus, it continues to trade at a valuable 3.8 times book value.