The S&P/TSX Composite Index continued its rally this week, with shares climbing on good news from the United States. It looks like the worst of inflation may be behind us. After inflation of 9.1% year over year in June, the country announced that had been tamped back to 8.5% in July. And there was a collective “Woohoo!” from investors everywhere.

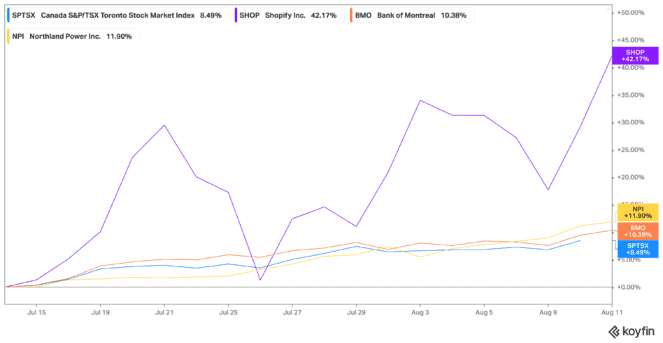

That included Canada, where TSX stocks continued to climb. Shares are now up 8.5% in just under a month. And as that rally continues, I really, really don’t plan on missing out on these TSX stocks — even as they continue to climb higher and higher.

Shopify

Yes, Shopify (TSX:SHOP)(NYSE:SHOP) is one of the more volatile TSX stocks out there. But seriously, don’t let that deter Motley Fool investors. The company is going through a lot right now after it bet too much, too soon on e-commerce. It made massive layoffs, and investors weren’t impressed but saw the necessity of it.

Now that Shopify stock has made the difficult choices, it’s time to rebuild. And let’s be clear, it doesn’t have to rebuild much. It simply has to stay on track. That means continuing its growth projections of being the top choice among online merchants — clients that include governments, charities, and institutions.

And it looks like Motley Fool investors and others haven’t been shy about buying back the once-great growth stock. As other TSX stocks climb, Shopify stock is now up 42% in the same month! That’s after dropping about 80% from all-time highs. And yes, it’s still down. But that’s why now is a great time to pick up the tech stock before Shopify stock climbs even further in this recovering rally.

Shares of Shopify stock were up 11% at the time of writing this article.

BMO

So, you want a little less volatility? Definitely look at the Big Six banks then. But, in particular, I’d look at Bank of Montreal (TSX:BMO)(NYSE:BMO) during this rally. BMO stock is stable as one of the Canadian banks with provisions for loan losses. It’s been around almost 200 years, and that makes it likely to be around at least for a few more decades among your other TSX stocks.

But it’s also cheap and growing. BMO stock currently trades at just 7.15 times earnings, offering a substantial dividend yield of 4.35%. In the last month, shares of the company have grown a TSX-beating 9.5%. What’s more, it’s not just shares that are growing but its business, too. The bank partnered with a major French bank and is now growing its United States operations. All in all, it looks like a good time to buy some BMO stock.

Shares of BMO stock were up 1% at the time of writing this article.

Northland Power

So, we have some short-term growth and long-term growth. What about something in the middle? Say, around the next five to 10 years? For that, I’d look at Northland Power (TSX:NPI). It’s one of the TSX stocks in the renewable energy sector. But it’s also one of the TSX stocks that’s remained up, even while the rest of the market was down.

In the last month alone, Northland is up 11%. That’s fine. But year to date, shares are up the highest among all these TSX stocks at an impressive 19%. While it’s not exactly cheap trading at 33.51 times earnings, it’s a great medium- to long-term hold for Motley Fool investors. It’s one I would certainly consider during this transition to clean energy use. Plus, you get a 2.78% dividend yield.

Shares of Northland stock were up 0.52% at the time of writing this article.