If you’re one of the Canadian investors that’s been pretty much shell shocked by the recent bear market, you’re likely not looking to drop thousands in investments. But it is likely that many investors have about $500 they can put towards TSX stocks right now. And frankly, that’s all you need.

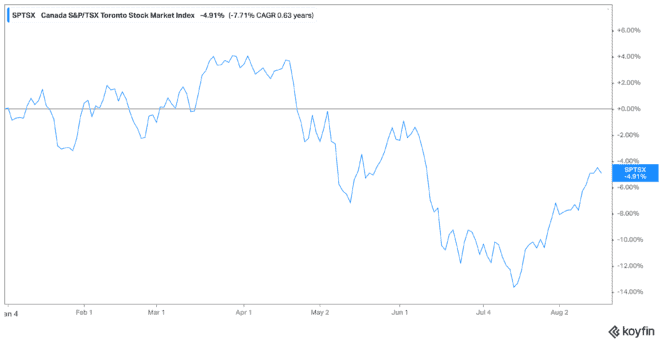

Because you definitely want in on this market. The TSX is still down year to date, but out of market correction territory. Plus, it’s been on the recovery, climbing 9.7% in the last month alone at a very steady rate, as you can see below.

So with that in mind, and a recovery looking like it may be far more stable, these are the only two TSX stocks I would consider buying right now – even with only $500.

NorthWest REIT

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is the first I would choose because this health care real estate investment trust (REIT) gives you a significant amount of cash just to hold it. Right now, it offers a dividend yield of 6.13% coming out at $0.80 per share annually. And whereas other REITs might be less stable in this high interest rate environment, that’s not the case for NorthWest.

That’s because it’s one of the TSX stocks operating in the health care industry. The REIT offers a diverse range of properties within the health care sector, including hospitals. This gives it access to long-term lease agreements, averaging 14 years as of writing. Plus, the properties offer a very secure occupancy rate on top at 97%.

The REIT has been expanding its operations as it’s still quite new, and this has meant more diverse, global properties. However, it also means less dividend growth. Still, at this rate you’ll be happy with share growth of 72% in the last five years, and 6.5% in the last month.

But NorthWest is still cheap, trading at only 7.5 times earnings, with shares down 1.7% year to date.

Kinaxis

You know how we’ve been experiencing all those supply-chain disruptions? What if there was a supply-chain company that could ease those worries? Oh wait, there is, and it’s called Kinaxis (TSX:KXS).

The software-as-a-service (SaaS) company is one of the strongest TSX stocks you can buy right now, even with only $500. That’s because it offers a solution to today’s supply-chain woes, and continues to have an incredible balance sheet and portfolio of large corporations around the world.

Kinaxis stock continues to see its recurring revenue rise, as more and more businesses choose to work with the SaaS stock. During its recent quarter, Kinaxis stock saw SaaS revenue rise 21% year over year, and recurring revenue increase by 21%. The company continues to grow, even during this poor economic environment. And that’s why analysts hold to their belief that it’s a great long-term buy.

Kinaxis stock is one of the TSX stocks trading far below fair value, pretty much only because it’s a tech stock. That’s why it should rebound quickly in a growth environment. For now, shares are down 5.5% year to date, and up 15% in the last month alone.

Bottom line

These two TSX stocks are solid choices for investors who only have $500 on hand. As the TSX moves higher, you’ll be happy to have them in your portfolio not just for now, but for at least the next decade.