There have been a lot of popular stocks taking over the market lately, and all of them provide one thing: defence. Canadian investors are looking at these popular TSX stocks for protection during these volatile times. However, the popularity has led to some investors thinking twice.

It’s clear why. Soaring share prices mean you’re thinking that there isn’t the deal that you once had access to. And that’s totally fair. However, if you’re a long-term investor, I honestly wouldn’t be as concerned about buying at a higher share price. Because over time, you’ll get that back in spades.

With that in mind, these are the two popular TSX stocks I would still consider, even with prices climbing.

Loblaw

Loblaw Companies (TSX:L) has proven its worth to investors over the last few years. A pandemic threatened to take out many companies, but Loblaw stock wasn’t one of them. Instead, it expanded its online options, and this led to an explosion of revenue for the company. Even as curb-side pickup slows, its in-store sales are now back up. And all this growth has led to even more company growth for investors to sink their teeth into.

Loblaw stock’s loyalty program has proven to be the one to beat. The company is using it to make deals or even acquire some of the biggest Canadian brand names. That includes Shoppers Drug Mart, Esso, and more. And with options to either shop at its cheaper or luxury locations, Loblaw stock is certainly one of the companies that provides consumers with every option of remaining loyal.

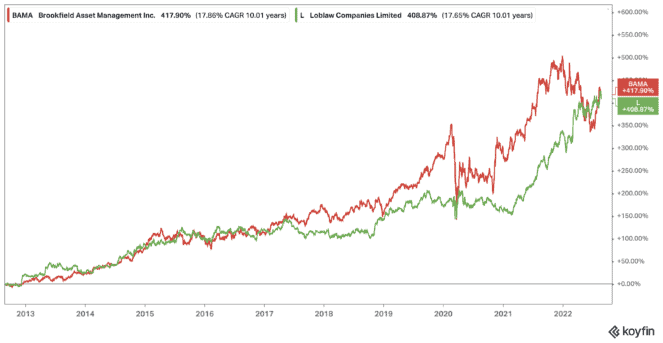

So, yes, shares of Loblaw stock are up 17% year to date. It also trades at 20.3 times earnings, so it’s not exactly a deal. But long-term investors would be wise to consider it with your other TSX stocks. It offers a 1.35% dividend yield and decades of growth. In fact, over the last decade shares have increased by 410% — a compound annual growth rate (CAGR) of 17.67%.

Brookfield Asset Management

Another company that’s winning a popularity contest these days is Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM). The asset manager has proven a great buy thanks to its diversified exposure to properties all around the world. Whether its infrastructure for oil and gas, or buying up a Vegas hotel, it really does offer it all.

And Brookfield stock has been expanding for decades, with a proven track record of making strong acquisitions and managing stellar assets. This includes the most recent deal with Intel to invest up to US$30 billion in chip factories in Arizona. It could be the turnaround agreement that puts Intel back on top, and Brookfield is part of it.

Yet Brookfield stock isn’t cheap trading at 22.48 times earnings. Even still, shares are still down about 13% year to date, offering you a solid place to jump in. Then you can lock in the 1.09% dividend yield and look forward to more stellar growth among your other TSX stocks.

That’s because Brookfield stock has proven its track record for decades, just like Loblaw stock. Shares are up 417% over the last decade — a CAGR of 17.84% for investors to consider.

Foolish takeaway

Between the two TSX stocks, Brookfield stock does look like the better deal. However, both have a strong record of solid growth and don’t show any signs of slowing down. So, if you’re an investor looking for TSX stocks you can hold for decades, it’s always a good time to consider these two — even as they climb higher in popularity and share price.