There are a few elite growth stocks in Canada that consistently provide shareholders with elevated compounded returns. These are often called multi-baggers, because they regularly multiply value for shareholders. One of these top TSX stocks is Descartes Systems Group (TSX:DSG)(NASDAQ:DSGX).

A global leader in logistics networks and software

Descartes operates a comprehensive logistics and transportation services platform. It operates one of the world’s most expansive logistics networks. This is complemented by a wide range of software services that help streamline logistics operations and processes.

Given the increasingly complex global trade environment, Descartes has seen demand increase for its services. In fact, it tends to prosper when supply chains become more complex and difficult for logistics businesses.

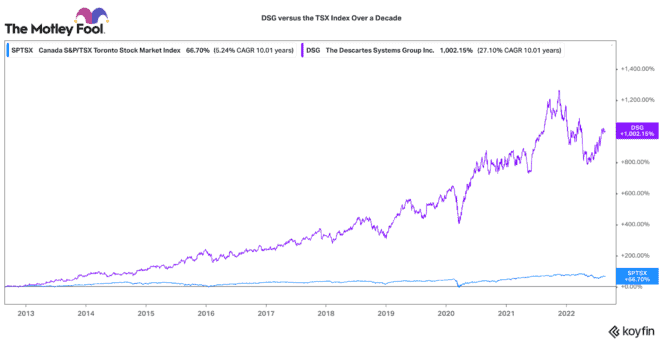

A 10-bagger stock in 10 years

Over the past 10 years, Descartes Systems has earned faithful shareholders a 1,000% total return. Acclaimed investor, Peter Lynch, would affectionately call that a 10-bagger. On average, that is a 26% compounded annual rate of return! For context, a $10,000 investment in Descartes 10 years ago would be worth around $110,000 today.

While past returns are not certain to be replicated in the future, a track record of consistent growth and profitability is a very good indicator of the quality of a business. Over the past decade, Descartes has grown revenues by a compounded annual rate of around 14%. Earnings per share and free cash flow have grown annually by a compounded rate of 18% and 24%, respectively.

This stock produces a tonne of cash

Descartes is not perhaps the fastest-growing Canadian tech stock. However, its base business is reliable and very profitable. Given the recurring nature of its software services, its earnings naturally generate a lot of spare cash.

For its fiscal 2022, Descartes earned $424.69 million in revenues. That was a 21% increase over fiscal 2021. Earnings were $169.86 million (up 19.6% over 2021). That is whopping 40% net earnings margin on revenues!

Descartes earned around $171 million of excess spare cash in the year, which was also a 40% margin. It just demonstrates that earnings convert into cash flow very efficiently. It ended the year with $213 million of cash and no debt on its balance sheet.

No dividend, but lots of opportunities to compound cash flow

This tech stock doesn’t pay a dividend, so it utilizes its excess cash to snap-up smaller software businesses that complement or expand its service offerings. Since 2013, Descartes has acquired over 30 logistics solutions businesses worth a combined $1.1 billion. In 2022, it has already announced two substantial acquisitions and one smaller tuck-in acquisition.

The Foolish takeaway

All around, Descartes Systems is a great business with a long runway of organic and acquisition growth ahead. However, given the quality of its finances and operations, it trades at a premium price. At $91 per share, it trades at a steep price-to-earnings ratio of 54. It has an enterprise value-to-EBITDA (EBIDTA is earnings before interest, taxes, depreciation, and amortization) ratio of 26.

However, Descartes trades at a fair discount to other Canadian tech darlings like Kinaxis or Shopify. In fact, its valuation is aligned with other multi-bagger quality tech stocks, like Constellation Software.

Given this compromise of quality and valuation, any investor should take a long investment horizon with Descartes stock. With patience, Foolish investors could enjoy a similar historical rate of return (20-25% annually), or perhaps even better.