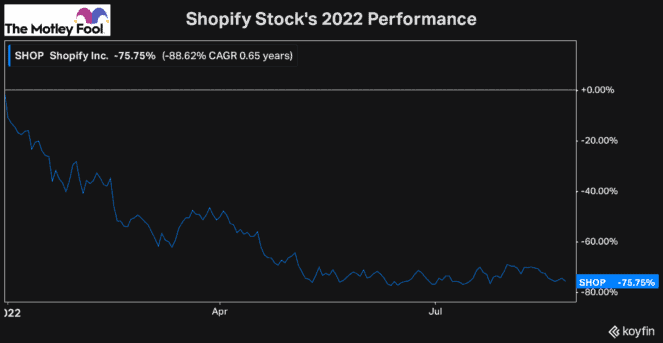

As many investors know, nothing in the stock market is ever a sure thing. And while a historical track record can signal that the stocks you buy are high quality, there’s never a guarantee that any company will continue to grow. So, as Shopify (TSX:SHOP)(NYSE:SHOP) stock has fallen over 75% this year, it may not have been something that investors were predicting, but it’s also not surprising either.

Throughout 2022 there have been several factors that have impacted markets. Even before Russia’s invasion of Ukraine, there were already significant inflationary pressures impacting the economy. However, those issues have been exacerbated since the invasion and its impact on global energy markets. And as we can see by Shopify’s selloff, those issues are even impacting high-growth tech stocks.

So, while Shopify continues to be an incredible company with significant long-term potential, there’s no question that it’s facing severe headwinds in this environment. Therefore, if you’re wondering why the stock has sold off so much, here’s what’s impacting the share price and when it could potentially begin to recover.

The economic situation is hurting Shopify stock’s growth potential

In general, high-quality stocks that are growing rapidly, and especially ones that can continue to do so for years, such as Shopify, typically trade with premium valuations.

These are some of the hottest stocks on the market. Therefore, in order to buy shares, you’ll have to overpay slightly due to the quality of these businesses.

However, because high-potential stocks like Shopify trade with premiums, they are at risk of falling faster in price than most of their peers when volatility picks up. Because as soon as investors lose confidence in the company’s ability to continue growing at that same rapid pace, the premium that these stocks trade at begins to erode.

Therefore, as the economy has started to see several negative factors impacting it, the growth expectations for Shopify from investors and analysts have fallen significantly. So, it’s no surprise that the stock has lost a tonne of value.

At the start of the year, Shopify traded at a forward price-to-sales ratio of more than 30 times. And even at the end of last September, roughly 11 months ago, the stock’s valuation was as high as 32.3 times its forward sales.

Today, Shopify stock trades for just 6.8 times its forward sales, showing what a significant decline the stock has seen. But although the stock is clearly priced at a massive discount today, is it worth a buy just yet?

Despite an ultra-cheap share price, there could be more volatility ahead for the tech stock

One of the most significant reasons that Shopify’s valuation has fallen so significantly is that investors expect its growth potential to slow rapidly. Not only is Shopify stock not seeing the tailwinds caused by the pandemic, but with surging inflation and a potential recession on the horizon, consumer spending, particularly on discretionary goods, is likely to slow down significantly.

This has worried investors and analysts, which is why Shopify stock is so cheap. And until the market can have more certainty about the economic situation and the impact it will have on consumers, Shopify stock is likely to remain out of favour.

Most of these issues, however, should only impact the high-potential tech stock in the short run. And as we can see by its valuation, the stock is already ultra-cheap.

Therefore, for the time being, I would keep a close eye on Shopify and have it at the top of your buy list. Because if the stock was to fall any further in value or if the economic situation was to begin to improve, Shopify would likely be one of the best stocks you can buy now.

Not only does it have years of growth potential, but as the economy and stock market recover, it will almost certainly see a major increase in its valuation.

Therefore, if you’re looking to take advantage of the market environment in 2022 and buy high-quality long-term growth stocks while they are cheap, Shopify is one of the top stocks to add to your watchlist today.