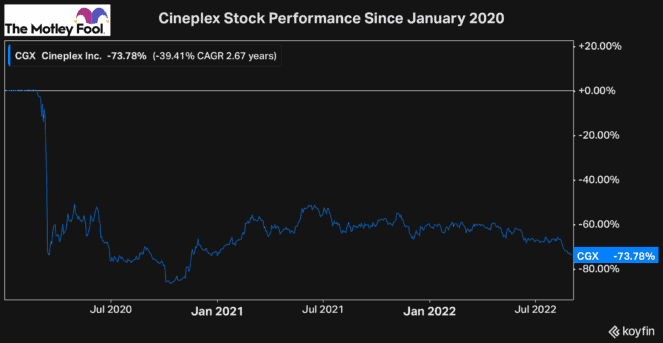

For about the last 30 months now, it’s been a challenging operating environment for Cineplex (TSX:CGX) stock.

At the start of 2020, Cineplex was trading just off $34 a share, as it was set to be taken over. Then the pandemic hit, the deal was called off, theatres were impacted significantly, and, as a result, the entertainment stock lost tonnes of market value.

For many investors, though, Cineplex seemed like a high-quality stock to own that was a simple buy and hold until it could recover. After all, movie theatres aren’t going anywhere, Cineplex has a significant market share in the space, and it had done an excellent job of diversifying its operations prior to the pandemic.

However, with numerous sectors now back at or even exceeding their pre-pandemic capacity, and even with Cineplex stock rapidly recovering in sales, many investors are wondering why the stock hasn’t recovered.

Even with a clear recovery in revenue and cash flow over the last few quarters, the stock is cheaper than it was in all of 2021 and hasn’t been this cheap since December 2020.

So, what’s going on with the Canadian entertainment company, and is Cineplex stock still worth a buy as we approach 2023?

It’s been a tough road for Cineplex stock

Just as the pandemic impacted other travel and tourism businesses so significantly, its impact on Cineplex stock has been significant as well. And while its immediate impacts on business operations were the most consequential, the long-term effects that the pandemic had on the business have been significant as well.

Furthermore, Cineplex is still expecting to receive a significant payment for damages of the cancelled takeover attempt from Cineworld, which could be up to $1.2 billion. However, there are increasing reports of a potential bankruptcy from Cineworld, which would limit any payments made to Cineplex and have also recently weighed on the stock.

The operating environment is far from ideal for Cineplex stock, especially as it recovers its operations rapidly through 2022. And with inflation as well as potential recession impacting consumers’ spending habits, it’s not surprising to see Cineplex stock struggle.

With that being said, though, the stock has become so cheap lately that there is little downside risk left in the shares.

Cineplex offers long-term investors a tonne of opportunity today

Because of the struggling macroeconomic environment right now, the recovery in Cineplex stock could take longer than initially expected. One thing looks clear, though: it’s extremely undervalued today and trades at just $8.85.

At below $9 a share, Cineplex stock has a market cap of just $560 million and an enterprise value (EV) of roughly $2.4 billion.

And with the stock already recovering its sales rapidly, up over 400% year over year in each of the last three quarters, there’s no surprise that analysts expect its sales to reach pre-pandemic levels by next year. In addition, analysts also expect that Cineplex stock can earn roughly $1 in earnings per share as well next year.

Therefore, with the stock price trading below $9 today, Cineplex is trading at a forward price-to-earnings ratio of less than nine times. That’s not all, though. In addition, Cineplex is expected to earn nearly $400 million in earnings before interest, taxes, depreciation, and amortization (EBITDA) next year. So, right now, the stock is trading with a forward EV-to-EBITDA ratio of fewer than six times.

There’s no question that the stock has been cheap. And as the share price continues to struggle in this uncertain investing environment while its business operations recover rapidly, there is a significant opportunity being created for long-term investors who have the patience to buy and wait for a full recovery.

Therefore, if you’ve been watching Cineplex stock or just looking for a high-potential value stock to buy now, there’s certainly a significant opportunity for capital gains once the market sentiment begins to improve.