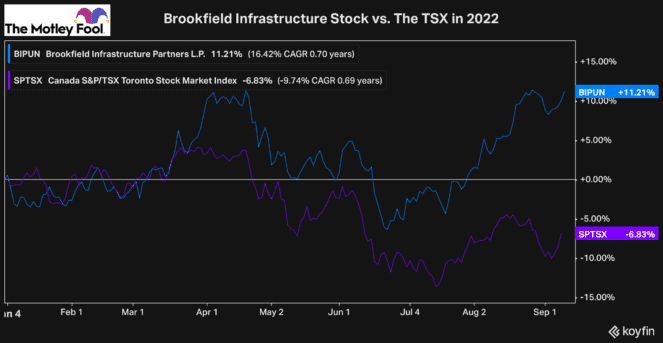

With such a complex investing environment these days, there are really only a handful of stocks that you can expect to outperform, with Brookfield Infrastructure Partners (TSX:BIP.UN)(NYSE:BIP) being one of them.

Many companies are still feeling the effects of the pandemic, and now inflation, supply chain issues, and a potential recession on the horizon are all impacting businesses of various industries.

Therefore, naturally, some of the best-performing stocks this year have been defensive companies. But while Brookfield Infrastructure is certainly a top pick due to the defensive nature of its assets, here’s why it’s a perfect stock to buy in this environment.

Brookfield Infrastructure stock has an attractive mix of assets in its portfolio

Brookfield Infrastructure stock is one of the best investments to buy now due to its high-quality and defensive assets, which allow the company to consistently earn tonnes of revenue and cash flow whether or not the economy is thriving.

Brookfield’s assets are divided into its four main segments. Its two most significant segments, utilities and transport, own assets such as over 16,000 km of natural gas pipelines, over 60,000 km of electricity transmission lines, as well as over 30,000 km of railway lines and nearly 4,000 km of toll roads.

In addition, the stock’s midstream segment owns over 22,000 km of transport pipelines and 17 natural gas-processing facilities.

Finally, its data segment owns high-value assets such as 22,000 km of fibre optic cable, 50 data centres, and over 162,000 telecom towers and rooftop sites.

In addition to being highly defensive, these assets have high barriers to entry, giving Brookfield Infrastructure stock a competitive advantage and making it one of the best stocks you can buy in this environment.

Brookfield operates like a growth stock

The fact that Brookfield owns such defensive assets makes it highly reliable. No matter what the economic situation, these infrastructure assets are critical to the global economy.

However, Brookfield is much more than just a defensive stock. It’s also a growth stock that’s constantly looking at how it can rapidly increase value for investors.

Part of that has to do with the stock always looking to expand its portfolio and buy new assets that it deems to be undervalued or which it can use its expertise to grow organically.

However, it’s also constantly selling off its assets when it believes it can fetch an attractive premium. It then recycles that capital into those newer, undervalued assets to consistently increase the fund’s value and the cash flow its portfolio can generate.

Plus, Brookfield Infrastructure stock is constantly looking to increase the distribution each year by between 5% and 9%. And even with Brookfield’s impressive performance this year, the stock still offers a yield of roughly 3.4%.

The stock has a tonne of tailwinds from inflation

The last reason why Brookfield is one of the best stocks you can buy in this environment is that it’s one of the few companies that can actually benefit from soaring inflation.

While the majority of companies are seeing either their costs rise, their revenue impacted, or both, Brookfield is in a much different position.

Most of the stock’s costs are fixed. Meanwhile, a tonne of its revenue is indexed to inflation. Therefore, as prices continue to rise, naturally, it should allow Brookfield’s margins to expand.

Already in the first and second quarters of 2022, Brookfield’s revenue rose by 27% and 38% year over year, respectively.

Therefore, if you’re looking for a high-quality stock that you can buy today and rely on for years, Brookfield Infrastructure stock is one of the best investments to consider today.