Finding the best growth stocks to buy can make for excellent investments. Of course, it’s always great when a stock can grow rapidly. But it’s even better when a stock can grow at an impressive pace and do so consistently for years, such as Aritzia (TSX:ATZ).

Aritzia has been an incredible growth story. The vertically integrated women’s fashion retailer has been growing in Canada for years, but, as of late, it’s become increasingly popular, as it quickly expands across the United States.

And, more recently, it’s been defying expectations, growing through the pandemic and continuing to report strong results so far in 2022, despite many other similar companies already seeing significant negative impacts on their businesses.

The stock has achieved truly impressive results over the last five years and continues to have a tonne of potential going forward. So, if you’ve been looking for some of the best growth stocks to buy now, here are three reasons why Aritzia is worth consideration.

Its performance has been spectacular

For years, Aritzia has been a popular shopping destination among women, but recently, its popularity has been skyrocketing.

In addition, the company has been performing exceptionally well, particularly through the pandemic and so far this year.

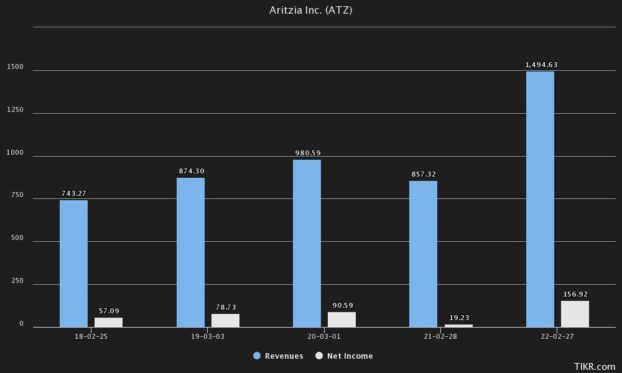

Of course, just like almost every other retail company, it was negatively impacted by the pandemic. In the first year, with all the shutdowns and the unprecedented nature of a global pandemic, its sales fell, albeit only by 12%, showing why it’s one of the best growth stocks you can buy.

The minimal reduction in sales was largely due to its e-commerce platform being among the best in the industry and accounting for roughly half of Aritzia’s sales that year. Furthermore, the stock remained profitable through the first year of the pandemic.

In addition, by 2021, the second year of the pandemic (Aritzia’s fiscal 2022), the retailer was much more prepared. And while there were more lockdowns, its e-commerce platform continued to see incredible growth.

In total, Aritzia managed to grow significantly last year, growing its sales by over 50% from its pre-pandemic numbers, despite more lockdowns throughout the year. Furthermore, it posted record earnings last year as well, showing what an incredible stock Aritzia is, how well it can adapt to changing economic conditions, and why it’s one of the best growth stocks to buy now.

Aritzia is one of the best stocks to buy due to its significant runway for growth

In addition to Aritzia’s past performance, it has a tonne of potential going forward. For years, it’s been rapidly expanding its store count, as it continues to be successful, and as its products resonate with consumers.

In fact, Aritzia has been so successful that new boutiques often earn back the capital needed to open them within 12-24 months of operation.

And now, with Aritzia expanding rapidly across the United States, its runway for growth is massive, which is why it’s one of the best stocks to buy now.

This year, for example, it will open between eight and 10 new boutiques, with all but one in Canada. Furthermore, Aritzia now has 42 boutiques across the U.S. and 68 in Canada for a total of 110.

But with the U.S. population at roughly nine times Canada’s, its growth potential south of the border is incredible. Furthermore, Aritzia has already identified at least 100 locations where it plans to open boutiques in the U.S.

If you’re looking for the best stocks to buy now, Aritzia has years of growth potential ahead of it.

Aritzia trades at an attractive discount

The last reason why Aritzia is one of the best stocks to buy now is that it trades at a significant discount. High-quality stocks like Aritzia that have major growth potential often trade at a premium.

But due to today’s market environment, many high-quality growth stocks have sold off, creating the perfect opportunity to buy.

Right now, Aritzia trades at just 26.2 times its forward earnings, which is well below its five-year average of 35.5 times its forward earnings.

Therefore, if you’re looking for some of the best growth stocks to buy now, I’d certainly check out Aritzia.