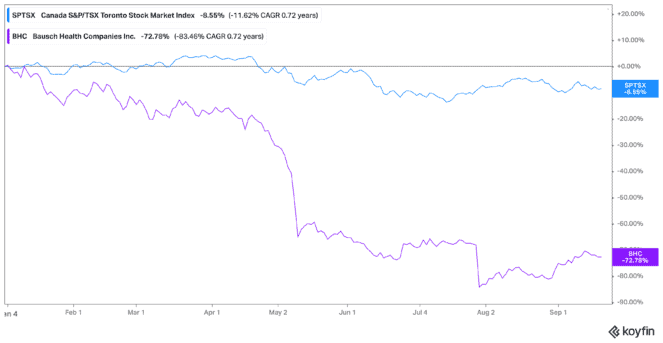

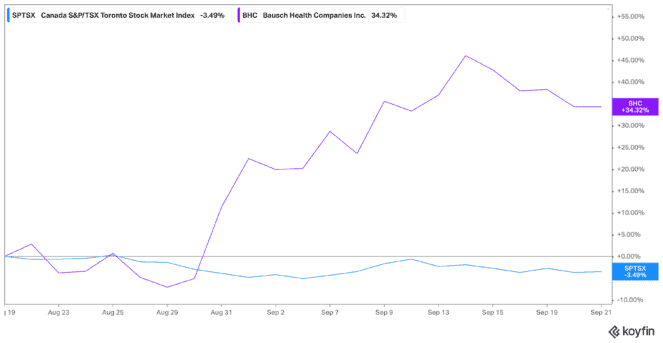

Bausch Health (TSX:BHC)(NYSE:BHC) has seen shares climbed by over 30% in the last month alone. At a time when the TSX continues to trade down by 8.55% year to date, Bausch Health stock seems to be on the increase. However, shares are still down by 73% year to date.

Today, I’m going to look at why this sudden increase in share price has been going on, and whether it means Canadians should consider buying the stock.

Separation anxiety

The catalyst for growth seems to be related to Bausch Health stock’s separation of its Bausch + Lomb company. The process continues to be underway, but the company continues to work through patent litigation so that it can separate the distribution of its Bausch + Lomb shares.

On top of this, the company announced in its second-quarter results that its balance sheet continues to improve, and it’s moving forward with an appeal of a patent dispute. More recently, there was also a tentative approval of Bausch Health stock’s rifaximin drug for traveler’s diarrhea by the Food and Drug Administration (FDA) of the United States.

Still, the biggest piece seems to be the Bausch + Lomb separation. As of Aug. 30, 23% of existing senior note holders agreed to hand over their notes for secured senior notes. While we’re still waiting for the holdout, it seems like there is progress being made.

Revenue improvement needed

One of the biggest factors for the separation comes down to managing the company’s debt, and, as of the latest quarter, it doesn’t look too great. The second quarter saw Bausch Health stock report US$145 million. While this is still a fairly large loss, it’s a massive improvement from the loss of US$595 million a year before. Still, revenue was down to US$1.97 billion from US$2.1 billion the year before.

Given this information, Bausch Health stock updated its year-end guidance, with revenue expected to be between US$8.05 billion and US$8.22 billion. This is down from the US$8.25 billion and US$8.4 billion expected before. Yet when you look at how Bausch + Lomb performs, it’s great news. The company reported revenue of US$941 million for the second quarter, which was up from US$934 million in 2021.

Experts are in

Pretty much everyone supports the separation of these companies, with Bausch + Lomb able to focus on its eye health line, and Bausch Health stock able to focus on its continued debt reduction. Analysts, in fact, have continued to raise their price targets for the stock, as the separation looks more likely.

One analyst expects the net debt to decline by $2.9 billion if Bausch Health stock is successful in this debt exchange. “This should pave the way for 50.1% distribution of BLCO shares to BHC shareholders.”

Worth the risk?

As mentioned, shares of Bausch Health stock are still down by 73% year to date, even with this 30% growth. It also still trades at 52.72 times earnings as of writing. So, while there’s some reason to buy the stock, it remains an incredibly risky buy. It’s up to you and your risk tolerance on whether you’re willing to take it on.