Canadian investors continue to eye up dividend stocks, as the market continues its volatile path. Meanwhile, growth stocks have been less of an option. But what if you could get both dividends and growth? That’s exactly what you can achieve with Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) right now.

A strong dividend stock

First off, let’s look at Brookfield Renewable stock as a dividend stock. In this instance, the company is quite strong, as it provides a dividend yield of 3.33%. That dividend has grown year after year on a consistent basis and looks likely to continue this trajectory.

Why? Brookfield Renewable stock is in the energy business. It owns renewable energy assets around the world, which means it can lock in long-term agreements. Those dividends are fed by a long line of revenue that isn’t disappearing.

In fact, it’s growing. Brookfield Renewable stock has been signing on even more deals with Europe, making a massive move away from Russian oil. Instead, these countries are seeking their own power through renewable energy — energy provided in part by Brookfield Renewable stock.

As a dividend stock, it’s solid. And that 3.33% dividend yield has grown by a compound annual growth rate (CAGR) of 7.76% in the last decade.

A top growth stock

Now that you have a reason to buy Brookfield Renewable stock during a volatile time, there are a few other reasons to consider it. One of those reasons is that it’s a top growth stock — not just over time but this year alone.

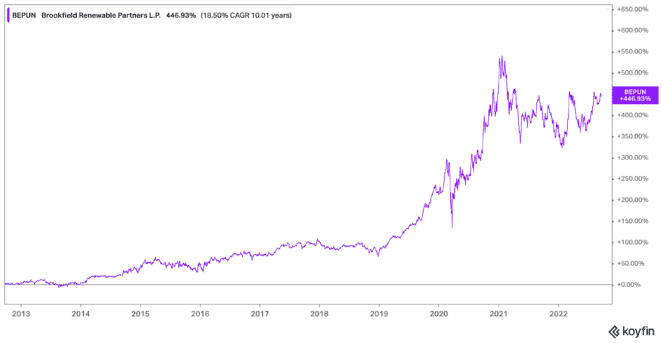

Shares of Brookfield Renewable stock are up 14% year to date. That rise has come from new contracts as well as increasing revenue. But it’s important to note that this isn’t some short-term performance. The growth stock has a long history of growth — up 445% with a 18.5% CAGR. However, it has a solid future as well.

Europe may be shifting to clean energy, but there are so many more opportunities for this company to keep growing. As the globe shifts to renewable energy, Brookfield Renewable stock will be a prime target for further deals.

So, you have a history as a growth stock and a future as a growth stock. What could be better?

It’s a deal

What’s better is that Brookfield Renewable stock is still considered cheap, in my opinion. Shares are up 14% year to date but still down by the around $70 share price achieved in January 2021. That alone gives you a potential upside of 40% as of writing.

The company also has some cheap fundamentals to consider. It trades at 1.9 times book value and is just shy of having enough equity to cover all of its debts. Honestly, that’s likely to change, as the stock climbs higher.

Bottom line

If you’re a Canadian investor who wants a dividend stock to pay you now but a growth stock to grow later, Brookfield Renewable stock is the one for you. A $5,000 investment would bring in $168 as of writing in passive income each year. But hold that for a decade while reinvesting, and your portfolio could be worth $33,494!