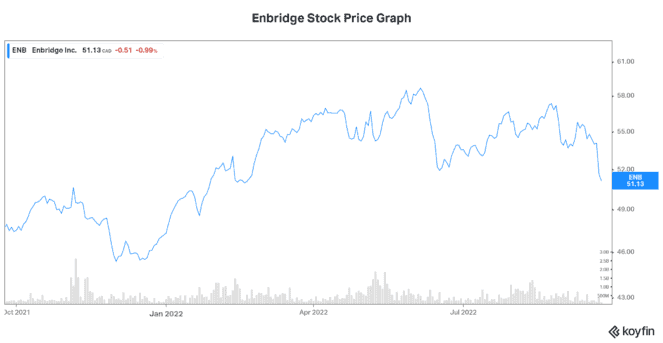

Like it or not, yields are rising. The Bank of Canada is raising interest rates to fight inflation. Stock prices are falling as a result. Ultimately, this latest round of dividend yield increases is due to falling stock prices. The Toronto Stock Exchange as well as global markets, are riskier than they once were. Even top dividend stocks like Enbridge (TSX:ENB)(NYSE:ENB) could not escape this reality.

But in this new environment, there’s opportunity. Let’s talk about Enbridge stock, plus two other dividend stocks that are attractive buys today.

Enbridge: An undervalued stock price with a 6.7% yield

No list of high-yield stocks would be complete without the embattled Enbridge. Coming off of years of negative sentiment and political pressure, Enbridge’s stock price has seen better days. Yet, the fundamentals tell a different story.

For example, Enbridge has years of strong cash flow generation behind it. In fact, since 2017, Enbridge’s cash from operations has grown 39% to $9.3 billion in 2021. Also, in its latest quarter, cash from operations increased over 8% to $5.4 billion. This has been the cornerstone of Enbridge and what makes it a top dividend stock. It’s also what’s driven the company’s strong investment-grade ratings.

Looking to the future, Enbridge’s stock price continues to look promising. The global energy crisis persists, and Enbridge is benefitting as North American oil and gas fundamentals continue to improve. For example, natural gas is benefitting from strong export growth. As Asian demand increases over the next decades, Enbridge’s vast system around the Gulf of Mexico will benefit from this growth.

But it doesn’t stop there. Enbridge is also planning ahead — way ahead. While meeting the demand for energy in the immediate term, Enbridge is also investing in renewables; construction on four offshore wind projects and 10 solar projects is ongoing.

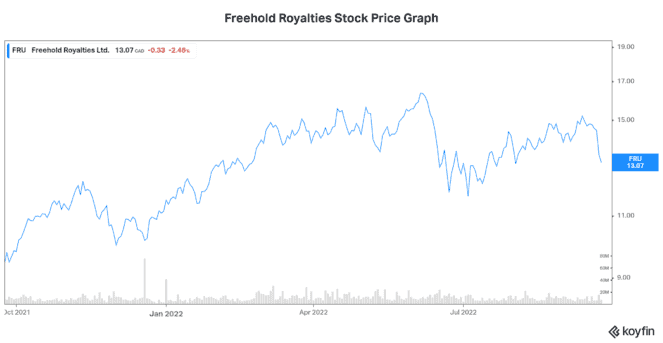

Freehold Royalties: An 8.3% yield with exposure to the booming energy sector

Sticking to the energy theme, I’d like to throw in Freehold Royalties (TSX:FRU) for its 8.3% dividend yield. But that’s not the only thing that Freehold has going for it. We have seen that the North American oil and gas market has improved significantly. Oil prices are down from their highs, but they’re up almost 50% versus five years ago. Also, they’ve been above $70 for the last year. Similarly, the price of natural gas is up 126% versus five years ago.

This has created the biggest oil and gas boom in a long time — almost ever. Freehold Royalties is a lower-risk way to play this boom. And today, with a yield of over 8%, it’s a top dividend stock. Freehold is a Canadian oil and gas company that owns royalties to the production and development of oil and natural gas. It doesn’t bear the operating risk or capital investment requirements. It simply collects royalties off of the revenues of royalty ownership.

In Freehold’s latest quarter, cash flow increased 109%. Furthermore, its quarterly dividend was increased 140% to $0.24 per share.

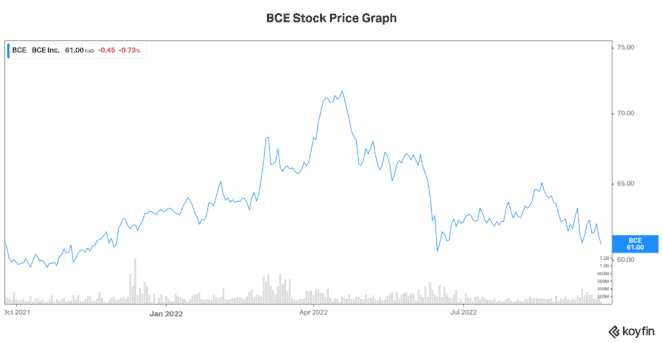

BCE stock: A 6% dividend yield backed by a leading telecom network

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecommunications company. It’s the market leader in internet and TV. Also, it’s one of the largest wireless operators in Canada. In an industry that’s protected by high barriers to entry and regulation, this is a great thing.

With its current rating as a high-yield dividend stock, BCE is providing investors with a great opportunity. While BCE stock is undoubtedly somewhat vulnerable to economic weakness, it’s also very resilient. Like Enbridge’s business, the telecommunications industry is pretty defensive. It’s a key part of society — an essential business. These services would be one of the last that consumers would cut, similar to heating/air conditioning.

In the last quarter, BCE reported solid results once again. Revenue increased 3.8% to $5.9 billion, and earnings per share grew 4.8% to $0.87. Also, free cash flow grew an impressive 7.1% to $1.3 billion. It’s these results that have accumulated over time to make BCE the powerhouse it is today.

This isn’t the type of company that I would expect would have a 6% dividend yield; it’s too predictable and resilient. Yet it’s yielding 6%, and it’s an opportunity of a lifetime, in my view.