Growth stocks have certainly had a phenomenal run over the last few years. But lately, the tide has been turning. The general overvaluation of the market, combined with rising inflation and interest rates has taken down many stocks. Despite this, stocks like Dollarama Inc. (TSX:DOL) are great buys today.

Here are three growth stocks that have a lot in common, not the least of which is their stellar track records of growth and operational excellence.

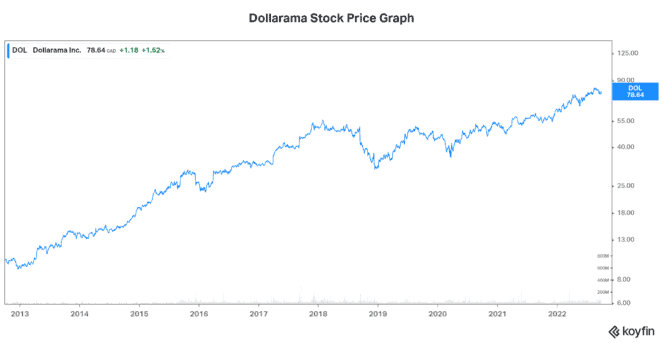

Dollarama: a growth stock with natural price inflation protection

The first growth stock is Dollarama. This is the well-known Canadian retailer that has grown from its first store in 1992 to more than 1,400 stores today. Similarly, Dollarama’s stock price is well known for its outsized growth.

And while some might think that the end of this growth story is nearing, I beg to differ. The last five years illustrate why I feel this way. Since fiscal 2018, Dollarama’s annual revenue has grown 33% to over $4 billion – that’s a compound annual growth rate (CAGR) of 5.8%. Similarly, annual EPS (earnings per share) has grown 30%, for a CAGR of 5.5%.

This doesn’t include the latest quarter which was even stronger – a testament to Dollarama’s value proposition in this rising inflation, rising interest rate environment. In the quarter, same store sales increased 13%, with EPS rising 37.5%.

These consistently strong results are part of what’s driving management’s growth forecast which includes 60 to 70 net new stores this year. Longer term, Dollarama is targeting to grow to 2,000 stores by 2031. There’s clearly an appetite for Dollarama products, which has only intensified in this difficult environment consumers now face.

Accordingly, Dollarama has seen its stock price rise significantly over the last five years, taking its place as one of the most attractive growth stocks on the TSX today.

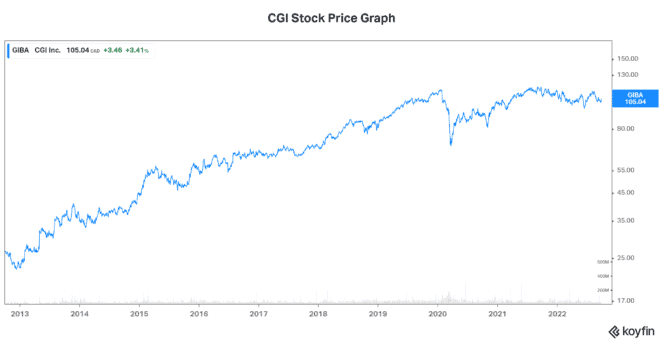

CGI: a tech stock embarking on growth via global consolidation

CGI Inc. (TSX:GIB.A)(NYSE:GIB) is a Canadian tech giant in the information technology consulting business. It too has grown through acquisitions – aggressive, but smart acquisitions. Today, CGI is a $22 billion company with plenty more room to grow.

In fact, CGI’s stated goal is to double the size of the company in the next five to seven years. This may be difficult to fathom, given its size, but let’s look at its growth in the latest ten-year period for some perspective. Since 2012, annual revenue has grown 153% to over $12 billion today, which has been achieved mainly through acquisitions. On the earnings side, EPS has grown 262% to $5.43 in 2021.

Based on this, we can get a sense of the type of growth that we can expect from CGI. Opportunities for the company to continue consolidating the industry remain plentiful. And CGI matches the true definition of a growth company – no dividend payments. All, or virtually all, of its profits are invested back into growth opportunities. This is because these opportunities have proven to be the most profitable for the company and shareholders alike.

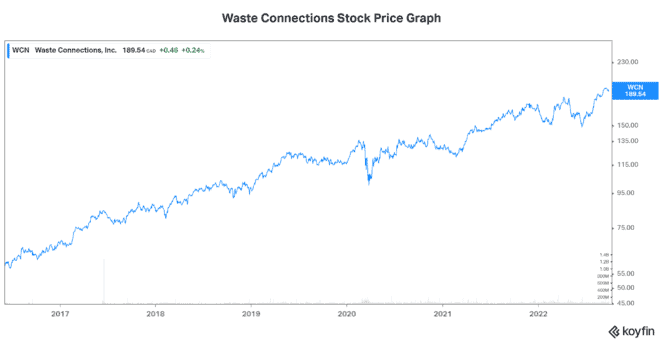

Waste Connections: another consolidator growth stock

Waste Connections Inc. (TSX:WCN)NYSE:WCN) is an integrated solid waste services company. It provides waste collection, disposal, and recycling services in the U.S. and Canada. The company has been on a major growth spurt in the last few years, and this doesn’t look like it’s slowing down any time soon.

Since 2017, Waste Connections has grown its revenue by 12%. In the last ten years, revenue has grown by 539%. Similarly, EPS has grown 149% and 385% in the last five and ten years respectively. This growth path has been consistent and steady throughout the years – and it’s matched by a strong pipeline of acquisition targets. In fact, the company is currently posting above average acquisition activity. In the latest quarter, Waste Connections signed $470 million worth of acquisitions. Looking ahead, the pipeline remains robust.

So, the growth story continues. In fact, it has a lot of upside left. Waste Connections is currently the third largest waste company in North America. It operates in a highly fragmented industry, with thousands of “mom and pop” operations that are acquisition candidates. This is, in large part, how Waste Connections has been growing. And these conditions will persist.