Real estate stocks have been decimated in 2022. The S&P/TSX Capped REIT Index is down 27.25% this year versus the broader market S&P/TSX Composite Index, which is only down 13.8%.

As interest rates rise, the future expected return on the purchase price of real estate assets (also called the cap rate) declines. This is because most people, businesses, and real estate investment trusts (REITs) finance their real estate with mortgage or debt financing.

Consequently, as interest rates rise the value of future earnings from real estate assets are discounted at a higher rate. That means valuations also decline.

Real estate stocks are cheaper, and there are bargains for long-term investors

While this is certainly worrisome, the valuation discount has become extreme. Today, you can buy most real estate asset classes at a steep discount to their private market value. That is despite several asset classes (like industrial, multi-family, and storage) enjoying very strong rental rate and cash flow growth this year.

For long-term investors, this might be great news. You can pick up some of the best real estate in the world at valuations not seen since the March 2020 market crash.

StorageVault: A top-performing stock in Canada

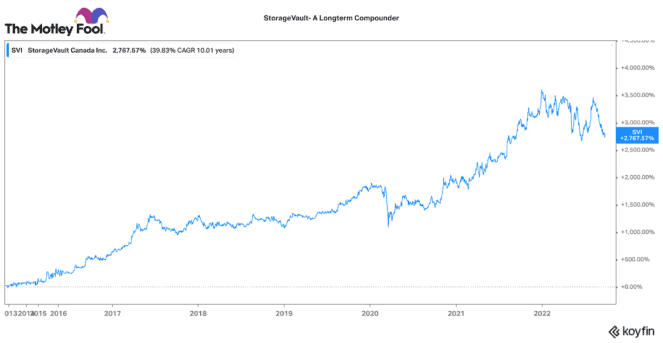

One real estate stock that has massively outperformed the broader TSX market for years is StorageVault (TSX:SVI). Its stock is down 22% this year. Yet its stock is up 154% in the past five years and over 3,144% in the past 10 years. Add in dividends, and it has turned a $10,000 initial investment into nearly $325,000.

StorageVault is a corporation, unlike many other real estate stocks that have real estate investment trust (REIT) structures. It does not have to distribute 90% of its earnings in dividends to shareholders.

Hence, it has been able to build out and acquire/consolidate storage properties across Canada, collect their monthly cash flows, and re-invest that into more properties. Over the past five years, it has successfully compounded adjusted funds from operation (AFFO) per unit by an incredible 25% rate!

Today, it operates 11.2 million square feet of space across 100,500 storage units. It has also expanded into portable storage, self-storage management, and document and data storage/management.

Self-storage is an incredibly resilient asset class. It has consistently high returns on investment (ROI), relatively low capital maintenance, and limited cyclicality, as compared to other real estate assets.

Right now, you can buy StorageVault stock for 24 times its forward AFFO. Compared to other REITs, it is certainly not cheap here today. However, that valuation has pulled back from 32 times AFFO a year ago. This real estate stock has not been this cheap since the pandemic market crash in 2020.

The Foolish takeaway

If you want a real estate stock with a long and astounding track record of compounding capital, StorageVault is one to look at. It is not the cheapest stock, but it is cheaper after its recent stock decline. If it can continue to execute, long-term shareholders could continue to do very well.